Lecture

What is LTV?

LTV (Lifetime Value) is the cumulative profit of a company received from one client for the entire period of cooperation with him. There is also a simplified version of the Russian definition, which briefly describes this indicator - the lifetime value of the client. Such a translation is most common. This metric is also called the CLV (Customer Lifetime Value) or CLTV.

Why do I need to know LTV?

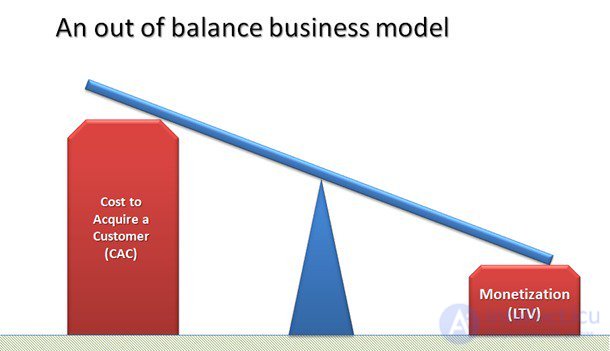

LTV is one of the most important metrics in business (especially E-commerce). David Skok, a well-known venture investor, says in his article that most startups die because the cost of attracting a new customer (CAC) outweighs the customer's lifetime value (LTV), and it looks like this:

As practice shows, most often this advantage is due to the fact that we focus on the implementation of the transaction and often forget about the experience that the client receives after the conversion.

Knowing LTV will help you:

LTV will help you focus on those channels that bring the best customers. After all, it is better to optimize your marketing channels on the basis of the profit that a client brings in all the time, rather than on the income from his initial purchase. Consequently, you can maximize the customer's lifetime value relative to the cost of bringing a new one (CAC). By doing this, you completely change the strategy to attract customers.

Perhaps you realize that you are overpaying for it. And you are not limited to knowing the income from one purchase, but you know how much you get from each client for the entire period of your interaction. Information about your client with a high LTV will also give you an accurate understanding of who you should target. This information in aggregate will allow you to get ahead of competitors who do not possess this data.

The value of a marketing campaign (for example, one that turns a customer once made a purchase into a regular customer) should not be based on current income. It should be assessed in impact on the average LTV in the consumer segment you target. How did this change the LTV trajectory that we get from the average client? To calculate this, you will need accurate analytics and then you can see how LTV is changing under the influence of various marketing activities.

Segment your customers by LTV. This way you can improve the relevance of marketing campaigns with more personalized messages. The important variable used here is the types of products that you sell to customers from different segments.

Using cluster techniques, you can discover new behavioral triggers that stimulated your client to make their first purchase. You can duplicate this behavioral factor with your new potential customers, pushing them to the first acquisition.

Focus your time on special attention to your most valuable customers.

How to count LTV?

There are several approaches for calculating LTV. There are quite complex and confusing, and there are simple, but less accurate. Below are four formulas, each of which has the right to exist.

LTV = income from a client - the cost of attracting and retaining a client.

Example from Topanalytics: 1st purchase - 200 customers, 1500 p. the average check, the cost of attraction - 300 p., The cost of production - 850 p .; 2nd purchase - 90 customers (suppose that the second purchase is made by 45% of customers), the average check is 400 p. (because they buy only consumables), the cost of retention - 60 p., The cost of consumables - 50 p.

Provided that one purchase is made: Profit1 = 200 * (1500 - 850 - 300) = 300,000 - 170,000 - 60,000 = 70,000 rubles. LTV1 = 70,000 / 200 = 350 rub. ROI1 = (70,000–60,000) / 60,000 * 100% = 16.7%

Provided that two purchases are made: Profit common = Profit1 + 90 * (400 - 50 - 60) = 70 000 + 26 200 = 96 200 rub. LTV total = 96,200 p. / 200 = 481 p. ROI total = (96,200 - 69,900) / 69,900 * 100% = 37.6% We calculate the indicators only for the customers who made 2 purchases: LTV2 = LTV1 + 26,200 / 90 = 641 rubles. ROI2 = (641 - 360) / 360 * 100% = 78% Please note that this formula is the simplest and does not take into account many details, for example, the growth of the customer base.

LTV = (average sales price) x (average number of sales per month) x (average customer retention time in months)

Brad .comugars from Entrepreneur.com offers a simple LTV calculation example. A gym member pays for a subscription of $ 20 per month for 3 years. $ 20 x 12 months x 3 years = $ 720 in total revenue, or $ 240 / year. The owner of the gym will be able to use this information to calculate the best cost of attraction and retention.

However, it is worth considering that not all customers will be with the company for 3 years. Note that averages are always inaccurate. If you want to calculate the actual lifetime value of your customers, you need to consider:

a) Purchase of personal training;

b) Payment for additional classes;

c) Purchase of related products (sports bar, equipment, etc.)

You should also analyze the data and the correlation between those gym members who continue to buy season tickets and those who “fall off”.

This is simply the sum of the total revenue for the entire purchase history for each individual customer. Add the sum of all customer purchases (transactions) to transaction N, where transaction N is the last purchase made by the customer in your company. If you have access to all customer transaction data, then you can easily calculate it using Excel.

So, LTV = (transaction 1 + transaction 2 + transaction 3 ... + transaction N) x share of profit in revenue.

The calculation of LTV on the basis of net profit in the long run and shows the actual profit that the client brings to your company. Here is taken into account the cost of customer service, and the cost of retention, and the cost of attracting, etc. The result is a whole set of calculations based on individual data. The total profit earned from one customer for all time will give you a precise understanding of the profitability of your customers today.

Algorithms of the forecast LTV will give you the opportunity to get a more accurate indicator of LTV due to the forecast of the total income that the client will bring you over time. In practice, it can be quite difficult to achieve the necessary conditions, given the ever-changing discounts, etc. There are many ways to calculate a predicted LTV, and many of them are extremely complex and confusing. Below is one of them.

LTV = ((T x AOV) AGM) ALT, where T = average number of orders (sales) per month AOV = average receipt ALT = average duration of customer interaction with the company (in months) AGM = share of profit in revenue.

It is correct to express LTV as the sum of all future revenues minus all costs for attracting and retaining customers brought to today. Because future income is depreciated. However, bear in mind that this formula cannot be completely accurate, as it only gives a forecast.

Conclusion

These formulas should only be used as a starting point for understanding your customers. And, as a rule, they need to be adjusted and tailored to the specifics of your business and other business indicators. It is very important to make such calculations in order to understand how profitable your customers are and to improve marketing campaigns, making them more effective.

Consider well-proven ways to increase LTV:

Distribution is an old and proven tool, and in combination is a great way to improve LTV.

First, regular mailing reminds the customer of your brand. Buyers who systematically see a company in their inbox are more likely to come back and make purchases.

Secondly, you can segment customers, taking into account the history of purchases, and thereby increase the effectiveness of each letter.

Try to create the desired content:

If you want to use email as an LTV growth strategy, your content should be interesting and useful. Create ezines that will be valuable to your customers.

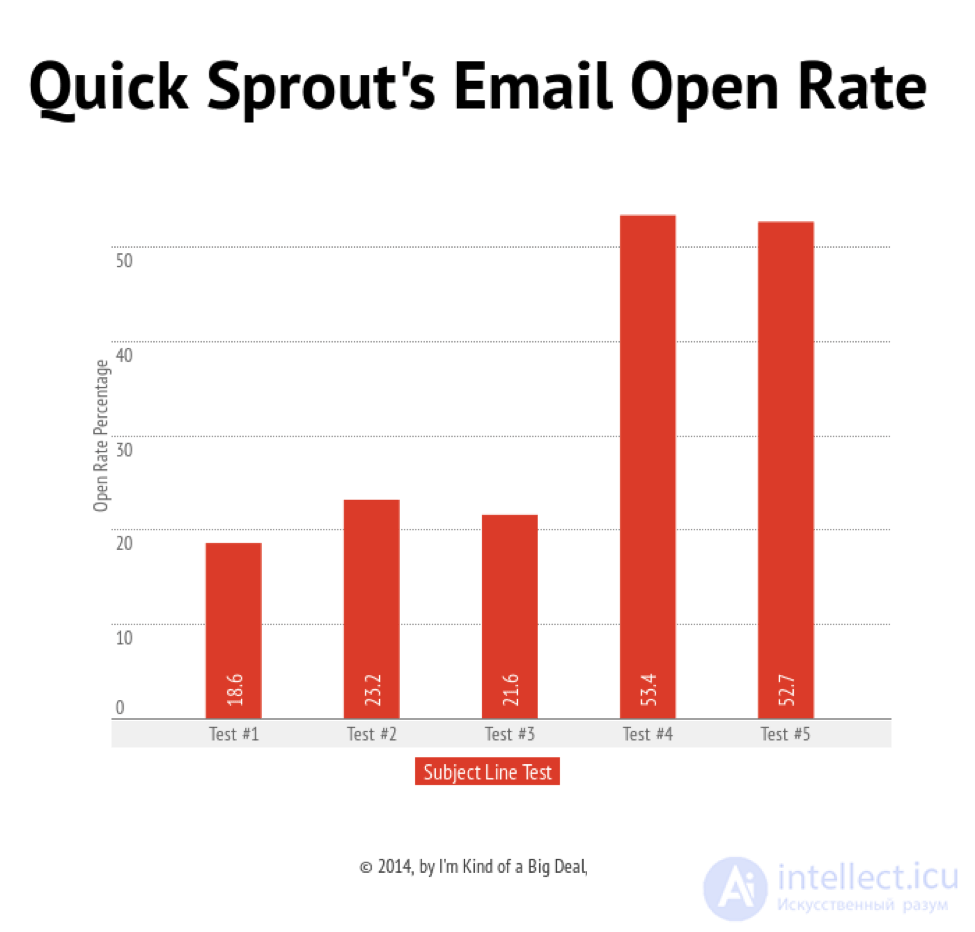

An attractive headline will help to draw attention to your letter. Test different options and increase the percentage of opening of letters. Patel gives an example of his experience, where he increased the open rate of his newsletter by 203% with the help of headline testing.

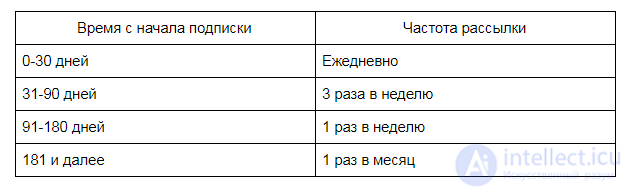

There is no consensus about the frequency with which it is better to send letters. You need to independently determine the frequency that will be suitable for your clients and your business. Distribution may vary depending on the time of subscription of the client from the moment of registration, for example, as indicated in this table:

Create new touch points and invade your customer's information environment. Try to ensure a permanent presence on Facebook, Instagram, Vkontakte, on forums and other communication channels. By interacting with your clients in a variety of places and methods, you increase the value of the “life” of this client. The idea is simple, but its application in practice may be a little more complicated.

Use our recommendations to “enable” new interaction points:

The simplest example of such a touch is the social networking icons on your website:

By turning the product into a subscription service, you naturally increase your LTV. Due to the fact that you change the payment system from a one-time purchase to a multiple purchase, you create an audience of regular customers who create a steady flow of income.

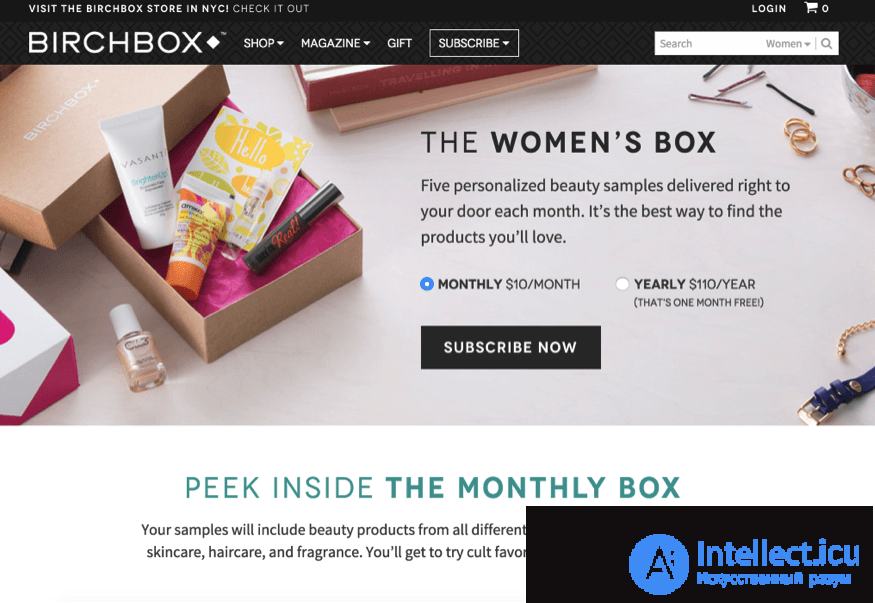

As an example, we present an online cosmetics store, which provides an opportunity to make a subscription to the monthly delivery of probes:

Birchbox specialists transferred the subscription format to their business and did not lose: the company not only provides a profit of $ 110 from the subscriber, but also receives customers who stay with the brand for a long period of time and, as a result, have a higher life cycle value.

It is easier to sell to an existing customer than to attract a new customer. Due to the pre-sale of your product, the vital value of the client for the company increases. By offering accessories, consumables or service to your product, you will not only increase the value of the client, but, more importantly, earn his loyalty.

Upselling and cross selling give you much more profit than you can get from selling to new potential buyers. Remember that the probability of making a purchase from existing customers reaches 60-70%. You only need to motivate users for future purchases.

82% of people stop working with the company due to poor customer service. High-quality customer service is a powerful way to increase LTV.

In the famous Harvard Business School report, researchers found that a mere 5 percent increase in customer retention leads to an increase in profits of 25-95%! Thus, an increase in the retention rate increases the value of the customer's life cycle, since the longer a consumer remains a client of a business, the more profit it brings.

According to Help Scout, Disney Parks revisit 70% of visitors. Believe me, there is no magic here! All the efforts of the park staff are aimed at ensuring that a smile does not descend from the visitor’s face during the entire visit to Disney. It turns out a simple formula for success: satisfied customers = regular customers!

Here are some simple ways to improve customer service:

Working with clients is building a relationship system. A loyal customer with whom you communicate well will, in turn, treat you well.

There are many articles and manuals describing methods of dealing with an abandoned basket, organizing a content strategy and creating additional value for the product for your customers. But very little is said about the methods of influence on LTV.

We have formulated several simple ways by which you can turn ordinary customers into loyal business satellites.

Try to use these recommendations, and you can gradually increase the value of your customers.

Comments

To leave a comment

seo, smo, monetization, basics of internet marketing

Terms: seo, smo, monetization, basics of internet marketing