Lecture

In Russia, the following key performance indicators of an innovative project are established:

For large-scale (significantly affecting the interests of the city, the region or the whole of Russia), it is recommended to evaluate the national economic efficiency.

Commercial efficiency (financial justification) of the project is determined by the ratio of financial costs and results that provide the required rate of return. Commercial efficiency can be calculated both for the project as a whole and for individual participants, taking into account their contributions according to the rules. At the same time, the flow of real money acts as an effect at the tth step ( E t ).

Within each activity, there is an inflow P i (t) and outflow O i (t) of funds. Denote the difference between them by Ф i (t):

Ф i (t) = П i (t) - О i (t)

where i = 1, 2, 3.

The inflow of real money f (t) is the difference between the inflow and outflow of funds from investment and operating activities in each project period (at each calculation step):

Ф (t) = [П 1 (t) - О 1 (t)] + [П 2 (t) - О 2 (t)] = Ф 1 (t) + Ф 2 (t).

Budget performance indicators reflect the impact of project results on revenues and expenditures of the relevant (federal, regional or local) budget. The main indicator of budgetary efficiency used to substantiate the measures of federal and regional financial support provided for in the draft is the budgetary effect.

The budgetary effect (B t ) for the project’s implementation step is defined as the excess of the revenues of the relevant budget (D t ) over the costs (P t ) in connection with the implementation of this project.

In t = D t - P t .

The indicators of national economic efficiency reflect the effectiveness of the project in terms of the interests of the national economy as a whole, as well as for the regions (subjects of the Federation) involved in the project, industries, organizations.

When calculating indicators of economic efficiency at the level of the national economy, the following are included in the project results (in terms of value):

final production results (revenue from sales on the domestic and foreign markets of all manufactured products, except for products consumed by Russian member organizations), this also includes proceeds from the sale of property and intellectual property (licenses for the right to use the invention, know-how, programs for Computers, etc.) created by the participants in the course of the project;

social and environmental results, calculated on the basis of the joint impact of all project participants on public health, social and environmental situation in the regions;

It is also necessary to take into account indirect financial results caused by the implementation of the project of changing incomes of outside organizations and citizens, the market value of land, buildings and other property, as well as the costs of conservation or liquidation of production facilities, loss of natural resources and property from possible accidents and other emergencies .

Social, environmental, political and other results that are not measurable are considered as additional indicators of national economic efficiency and are taken into account when deciding on the implementation and (or) on state support for projects.

The project costs include current and one-time costs envisaged in the project and necessary for its implementation by all participants in the project, calculated without re-counting the same costs of some participants as part of the results of other participants. Therefore are not included in the calculation:

Fixed assets temporarily used by a participant in the process of implementing an investment project are taken into account in the calculation in one of the following ways:

In this case, the costs include only the costs of the organizations participating in the project, which relate to the relevant region (branch) also without re-counting the same costs and excluding the costs of some participants as part of the results of other participants.

When calculating the economic efficiency indicators at the organization level, the project results include:

In this case, only one-time and current expenses of an organization are included in the costs without re-invoicing (in particular, it is not allowed to simultaneously account for one-time costs for the creation of fixed assets and current expenses for their depreciation).

When evaluating the effectiveness of an investment project, the comparison of multi-temporal indicators is carried out by reducing (discounting) them to the value in the initial period. To bring different costs, results and effects at different times, the discount rate ( E ) is used, which is equal to the investor's rate of return on capital acceptable to the investor.

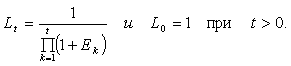

Technically, bringing to the base moment of time the costs, results and effects occurring at the t- th step of the project implementation calculation, it is convenient to produce by multiplying them by the discount factor, defined for the constant discount rate E as

where t is the number of the calculation step ( t = 0, 1, 2, ..., T ), T is the calculation horizon, equal to the number of the calculation step at which the object is liquidated.

If the discount rate changes in time and at the t- th calculation step is equal to E 1 , then the discount factor

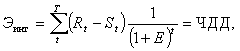

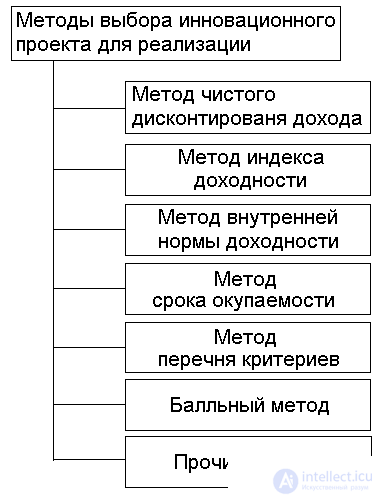

Comparison of various investment projects (or project options) and the selection of the best one is recommended using various indicators, which include net present value * (NPV), or an integral effect; yield index (ID); internal rate of return (TYPE); payback period, other indicators reflecting the interests of the participants or the specifics of the project (see Figure 5.8). When using indicators to compare different investment projects (project options), they should be given a comparable form.

Net present value (NPV) is defined as the sum of the current effects for the entire billing period, reduced to the initial step, or the excess of the integral results over the integral costs. If during the billing period there is no inflationary change in prices or the calculation is made in base prices, then the NPV value for the constant discount rate is calculated by the formula

where R is the results achieved at the t- th calculation step; S - costs incurred in the same step; T is the horizon of calculation.

Figure 5.8 Methods for selecting an innovative project for implementation

If the NPV of an investment project is positive, the project is effective (at a given discount rate) and the question of its acceptance may be considered. The greater the NPV, the more effective the project. If the investment project is implemented on a negative NPT, the investor will suffer losses, i.e. the project is ineffective.

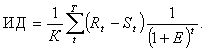

The profitability index (ID) is the ratio of the sum of the reduced effects to the value of the reduced investment

The profitability index is closely related to the NPV. It is built from the same elements and its value is related to the NPV value: if the NPV is positive, then the ID is> 1 and vice versa. If ID> 1, the project is effective, if ID <1 - ineffective.

The internal rate of return (GNI) is the discount rate ( E NR ) at which the magnitude of the cited effects is equal to the magnitude of the cited investment. If the calculation of the NPV of an investment project gives an answer to the question whether it is effective or not at some given discount rate ( E ), then the project's IRR is determined in the calculation process and then compared with the investor's required rate of return on invested capital. An investment in an investment project is justified, and the issue of its adoption may be considered when the GNI is equal to or greater than the rate of return on capital required by the investor. Otherwise, investment in this project is not appropriate. If the comparison of alternative (mutually exclusive) investment projects (project options) on the NPV and GNI lead to opposite results, the NPV should be preferred.

Payback period * - the minimum time interval (from the start of the project), beyond which the integral effect becomes and remains positive in the future. In other words, this is the period (measured in months, quarters or years), starting from which the initial investments and other costs associated with the investment project are covered by the total results of its implementation.

The results and costs associated with the implementation of the project can be calculated with or without discounting. Accordingly, you get two different payback periods. However, the payback period is recommended to be determined using discounting.

Comments

To leave a comment

Management

Terms: Management