Lecture

Effective solution of all tasks of financial management is possible only when it is carried out within the framework of an integrated organizational structure of an enterprise, i.e., if there is a sufficient (but not excessive) number of links between organizationally separated divisions of an enterprise. This fundamental position of scientific management requires:

To ensure the position of financial management, corresponding to the importance of the tasks solved by this subsystem of the management system, in the organizational structure of the enterprise, it is necessary first of all to combine them into a single whole within the financial and economic service of the enterprise.

The financial and economic service of an enterprise is an organizational association of all departments of an enterprise that perform the financial functions themselves (related to cash flow), and also form special information support for the performance of these functions .

The place of the financial and economic service in the organizational structure of a modern enterprise is determined by the overall importance of solving the entire complex of financial tasks for its normal functioning: the level of financial indicators is of paramount importance for owners (shareholders) in assessing investment prospects, for lenders as a guideline for the expediency of providing monetary and commercial loan and for company staff - as the basis of the opportunity to receive adequate remuneration for their work. In this regard, it is necessary to bring the financial and economic service to the highest level of management and its subordination directly to the first head.

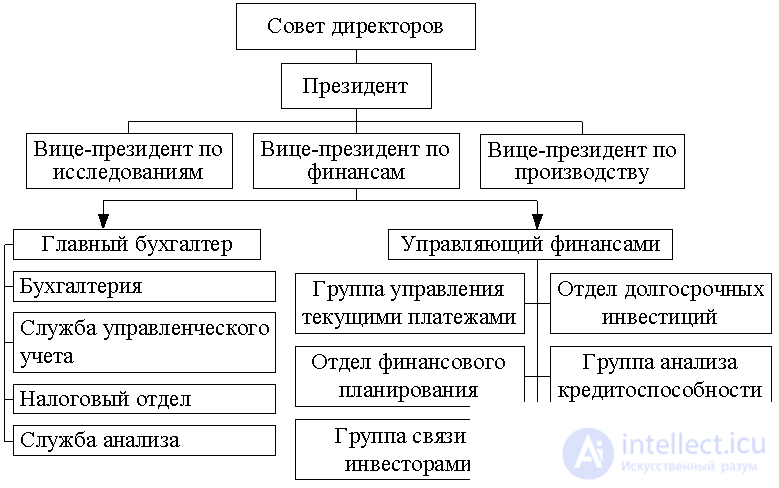

In fig. 5.10. The typical management scheme of the financial and economic service in a large foreign corporation is given. In accordance with this scheme, the company is creating the position of the head of financial service with the rank of vice president of finance, directly subordinate to the president of the corporation. Such an administrative position of the chief financier of an enterprise excludes the predominance of any other (for example, production) interests in its activities, apart from ensuring financial stability and financial development of the enterprise.

Fig. 5.10. The typical scheme of financial management of a large foreign corporation

The maximum autonomy of the financial service allows its manager to develop and put decisions into action without their obligatory agreement with any managers other than the first. In practice, these decisions, after their approval at a higher level, determine the actions of other administrators, despite the fact that they are formally at the same level of management (vice-presidents) as the head of the financial and economic service.

It should be noted that, contrary to common Russian practice, the chief accountant of the enterprise is subordinate to the vice-president for finance, and not the president (in our terminology, more often - the general director). This seems to be quite justified, since the accounting information and reporting, which previously served mainly the goals of state control over the activities of the enterprise, has now become crucial to ensure the effectiveness of the entire enterprise management process. When generating and using this information, it is necessary at the same time to ensure its compliance with the requirements of tax and regulatory authorities, the requirements of enterprise resource management and the requirements of confidentiality - keeping commercial secrets. Only the first requirement was until recently the real function of accounting, which means the need to manage this division of the enterprise by the administrator who has a wider range of tasks than the chief accountant.

In accordance with the above definition of financial and economic services, in general, its membership should include:

Such a composition of divisions of the financial and economic service is not mandatory and is given in order to link the essence of its activities with the organizational forms of ensuring financial and economic work in enterprises that are most common in Russian practice. When designing the financial and economic service as a new structural unit, this composition is clarified and concretized by functional analysis.

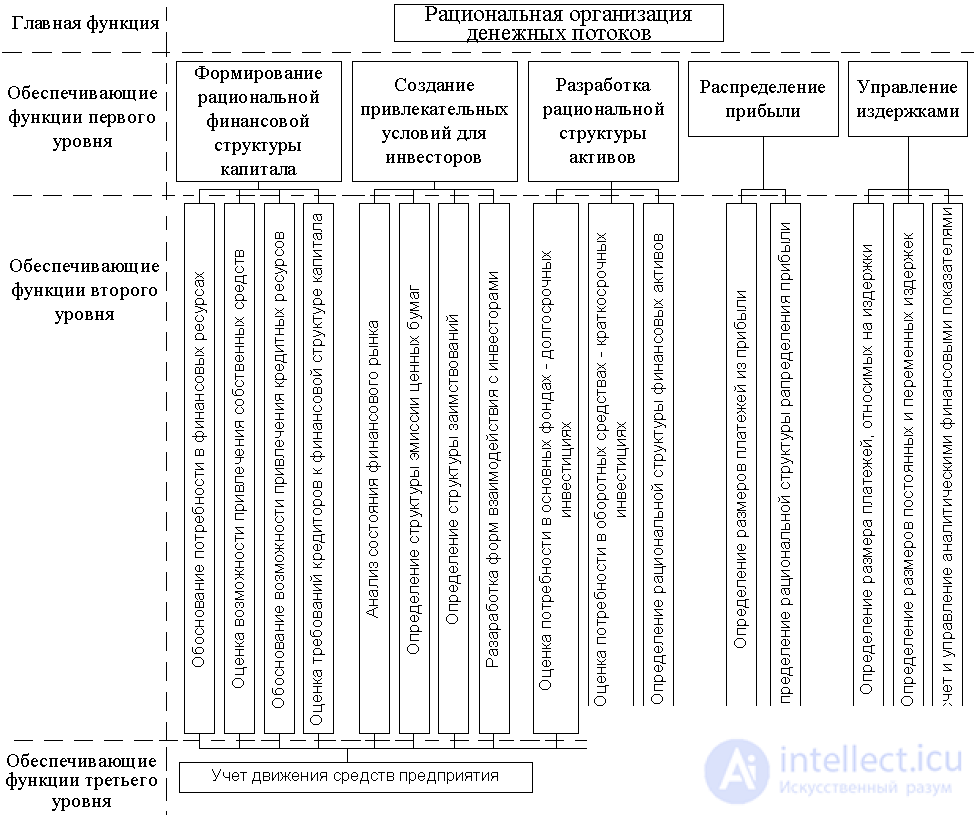

The essence of functional analysis in the design of organizational structures is to build a tree of functions of the organization or that part of it, which is the object of design. The basis of the function tree is the main goal of the enterprise (part of the enterprise), its branches are the functions (work) that must be implemented to achieve this goal. The branches of the function tree consistently form hierarchical levels of their implementation: most of the work in the field of management has a complex structure and can be represented as a complex of more private ones, the interconnected performance of which ensures the implementation of a common one. Thus, in the form of a hierarchy of functions, any specific management task can be represented.

The basis for building a tree of functions of the financial and economic service, the scheme of which is shown in Fig. 5.11, laid the concept of presenting the financial activity of an enterprise in the form of cash flows and determining the financial management tasks (functions) that correspond to their content (. § 5.3.1). In this diagram, there are four functional hierarchical levels: the main and the three supporting levels. However, in the functional analysis of the financial and economic service of a particular enterprise, they can be allocated as much as necessary to adequately reflect the entire complex of that part of the management work that is inherent in this organizational-structural unit; the same applies to the composition of functions. A characteristic feature of the results of functional analysis is that the lower its level, the simpler and technically defined are the selected functions. This property allows you to proceed to the formulation of functions in the form of performing tasks and then to the formation of units (organizational units) of the financial and economic services.

Fig.5.11. Diagram of the financial services function tree

The essence of the process of forming units consists in defining a set of functions-tasks that it will solve in its daily activities. The general approach to the organization of this process is the movement through the tree of functions from the bottom up and the sequential identification of those tasks that the individual worker must solve, then the group of workers, and then the organizational units. So, for example, in accordance with our scheme, we can single out the accounting for the movement of fixed and circulating assets and consolidate the solution of these tasks to individual accountants and combine them into a material accounting group, which, in turn, will form part of a large unit - the company's accounting department. However, due to the above-mentioned principal complexity of financial and economic activity, in some cases, to ensure its effectiveness, it is necessary to use a horizontal combination of functions that ensures the integrity and completeness of the work of departments. For example, when forming a planning-economic or financial department, it is advisable to first combine the functions inherent in it, and then distribute them among the performers.

The distribution and consolidation of tasks produced in this way should be fixed in the internal regulatory documents of the enterprise: in the regulations on the financial and economic service itself, on its divisions and in the job descriptions of the executors. The model regulation on the financial and economic service should include the following sections with appropriate content:

General provisions, which fixes the organizational independence of the service, its subordination and leadership, the main goal in the form of the composition of production tasks (for example, maintaining an effective planned, financial, economic and accounting work), as well as the composition of regulatory documents (general and internal) governing the activities of the service .

The structure of the service in the form of a list of units included in it.

Production tasks of the service, which lists specifically defined functions:

- methodological, informational and organizational support for the development of strategic, tactical and operational plans for the enterprise and its divisions;

- development of economic and financial sections of the plans of the enterprise and its divisions;

- justification of the economic efficiency of the redistribution of financial, material and labor resources of the enterprise;

- ensuring effective financial relations of an enterprise with partners, financial and credit organizations and government bodies;

- ensuring the completeness and timeliness of payments of the enterprise and in favor of the enterprise;

- definition and implementation of the accounting policy of the enterprise;

- accounting of the enterprise and timely, high-quality reporting of the enterprise;

- development of the Regulation on the remuneration of the personnel of the enterprise;

- control and analysis of the implementation of all types of plans of the enterprise and its divisions;

- analysis of the financial results of the enterprise and its divisions.

Organizational tasks of the service , determining its interaction both within the enterprise and outside it; their approximate list:

- organization of receiving from other departments of the enterprise information necessary to achieve the main goal of the service;

- the organization of transfer to other divisions of the enterprise of the information necessary for their effective work;

- The organization of direct relations with credit and financial and regulatory organizations and tax authorities;

- selection, placement, organization of training and advanced training of service staff.

Information and functional communications service, defining the composition and directions of information exchange, for example,

- with the CEO:

- with the deputy director for production:

- with the chief engineer:

- with the head of the supply department:

On the basis of the Regulations on the financial and economic service, the Regulations on its divisions are developed, which, in turn, determine the content of job descriptions of individual employees. Note that in the process of developing these internal regulatory documents of an enterprise, as well as when combining functions, the principle of downward movement from general to more particular is implemented.

When determining the administrative (vertical) internal relations between the units of the financial and economic service, two approaches should be used. To ensure effective management in the course of regular work of the service, it is advisable to apply a linear organizational structure model that allows you to best regulate management * by fixing stable relationships of hierarchy. In cases where a large investment project is being implemented at the enterprise, limited in execution time and representing a unique job, it is necessary to build in the general linear scheme an element of the matrix structure that provides the necessary management flexibility.

Comments

To leave a comment

Management

Terms: Management