Lecture

There are two types of monetary policy: 1) stimulating and 2) restraining.

Stimulating monetary policy is carried out during the recession and aims to “cheer up” the economy, stimulate business growth in order to combat unemployment. The restraining monetary policy is carried out during the boom period and is aimed at reducing business activity in order to combat inflation.

Stimulating monetary policy is to conduct measures by the central bank to increase the money supply. Its instruments are: 1) a reduction in the rate of reserve requirements, 2) a reduction in the discount rate of interest, and 3) the purchase by the central bank of government securities.

A restraining (restrictive) monetary policy is to use measures by the central bank to reduce the money supply. These include: 1) an increase in the rate of reserve requirements, 2) an increase in the discount rate of interest, and 3) a sale by the central bank of government securities.

The mechanism of the impact of a change in the money supply on an economy is called the “money transmission mechanism” or “money transmission mechanism”. The monetary transmission mechanism shows how the change in the money supply (change in the situation on the money market) affects the change in real output (the situation in the real market, ie, the market for goods and services).

This mechanism can be represented by the following logical chain of events. If the economy is in recession, then the central bank buys government securities → lending opportunities of commercial banks increase → banks give out more loans → money supply multiplicatively increases → interest rate (loan price) drops → firms gladly take cheaper loans → investment costs grow → total demand increases → the volume of production multiplies. (It should be borne in mind that not only firms react to a change in interest rates, changing the value of investment expenditures, but also households that use consumer credit and, when it becomes cheaper, increase consumer spending, as well as the foreign sector, which increases the cost of net exports at lower rates percent, since this leads to a decline in the national currency of a given country and makes its products relatively cheaper and more attractive to foreigners).

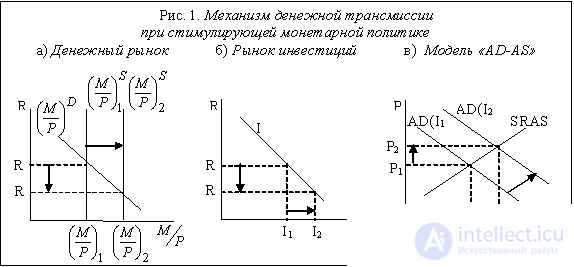

Since the impact of stabilization policy occurs in the short term, then graphically the effect of stimulating monetary policy on the economy can be represented as follows (Fig. 1):

This policy, used during the recession, is called the “cheap money” policy.

Accordingly, the policy pursued by the central bank during the boom period (“overheating”) and aimed at reducing business activity is called the “expensive money policy” and can be represented by the following chain of events:

The central bank sells government securities → lending capacity of commercial banks decreases → money supply multiplies declining → interest rate (loan price) increases → demand for expensive loans from firms falls → investment spending decreases → aggregate demand decreases → production declines.

And in fact, and in another case, the economy stabilizes.

The advantages of monetary policy include:

• Lack of internal lag. Internal lag is the period of time between the moment of awareness of the economic situation in the country and the moment of taking measures to improve it. The decision to buy or sell government securities is made quickly by the central bank, and since these securities in developed countries are highly liquid, highly reliable and risk-free, there are no problems with their sale to the public and banks.

• No wipeout effect. In contrast to stimulating fiscal policy, a stimulating monetary policy (increase in money supply) causes a reduction in the interest rate, which leads not to crowding out, but to stimulating investment and other autonomous costs sensitive to changes in interest rates and to a multiplicative increase in output.

• The effect of the multiplier. Monetary policy, like fiscal policy, has a multiplier effect on the economy, and there are two multipliers. The bank multiplier provides a deposit expansion process, i.e. a multiplicative increase in the money supply, and the growth of autonomous expenditures as a result of a decrease in the interest rate in the face of an increase in the money supply multiplicatively (with a multiplier effect of autonomous expenditures) increases the value of the total output.

The drawbacks of the monetary policy are as follows:

• The possibility of inflation. Stimulating monetary policy, i.e. the growth of the money supply leads to inflation even in the short term, and even more so in the long term. Therefore, representatives of the Keynesian direction argue that monetary policy can be used only in case of overheating (inflationary rupture) of the economy, i.e. consider the possibility of only a restraining monetary policy, and in a recession, in their opinion, stimulating fiscal policy should be used, rather than monetary policy.

• The presence of an external lag due to the complexity and possible failures in the mechanism of monetary transmission. External lag is a period of time from the moment of taking measures to stabilize the economy (the decision of the central bank to change the value of the money supply) until the result of their impact on the economy (which is expressed in the change in the value of output). The purchase and sale by the central bank of government securities is carried out quickly, i.e. credit opportunities of commercial banks are changing rapidly. However, the mechanism of monetary transmission is long and consists of several steps, each of which may fail.

1) The “cheap money” policy pursued by the central bank may provide commercial banks with additional reserves, which expands the lending capabilities of banks, but this possibility may not turn into reality. There is no guarantee that with an increase in reserves, there will be a corresponding increase in the volume of loans issued by commercial banks. In addition, people can decide not to take loans. As a result, the money supply will not increase.

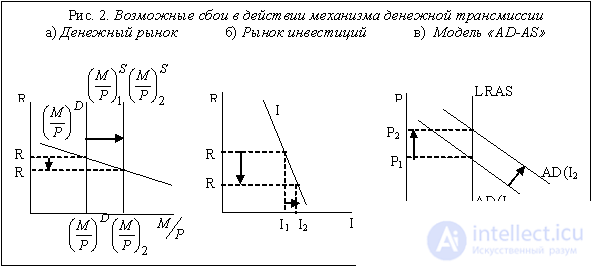

2) The reaction of the money market to the growth of supply depends on the type of demand curve for money. A serious drop in interest rates will occur only if the demand curve for money is steep, i.e. if the sensitivity of the demand for money to a change in the interest rate is small. If the demand for money is very sensitive to a change in the interest rate (flat money demand curve), an increase in the money supply will not lead to a significant decrease in the interest rate (Fig. 2. (a)).

3) A significant reduction in the interest rate as a result of an increase in the money supply may not lead to a serious increase in investment expenditures if their sensitivity to changes in the interest rate is low (the investment curve is steep) (Fig. 2. (b))

1) If the sensitivity of investment demand to interest rate dynamics is high, and investment expenses increased as a result of falling interest rates, the growth in total expenses may not lead to an increase in real output if the economy is in full employment (at the level of potential output), which corresponds to the vertical curve of the aggregate supply (Fig. 2. (c)).

Thus, a violation in any link of the transmission mechanism can negate or substantially weaken the impact of monetary policy on the economy.

Moreover, the monetary policy has a significant external lag, i.e. Delays in the impact of changes in the money supply on the economy, due to the multi-step monetary mechanism (even in the case when there are no failures in its operation) can lead to destabilization of the economy. For example, the decision to increase the money supply, taken during the recession, can give its result when the economy has already reached a boom, which will cause an increase in inflation. Conversely, the sale of government securities by the central bank in order to reduce business activity in an “overheating” economy may affect when the economy is in a deep recession, and this will only aggravate the situation.

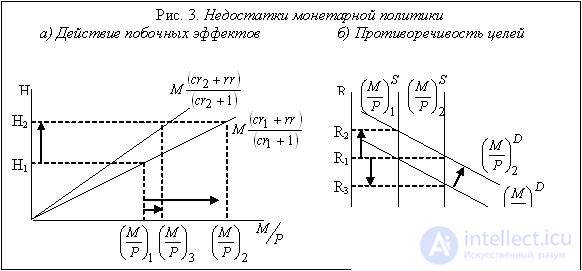

• The presence of side effects caused by a change in the money supply, which also reduces the effectiveness of monetary policy. So, if the central bank increases the money supply, then the interest rate falls, i.e. reduced opportunity costs of storing cash. Under these conditions, the population may prefer to transfer funds from deposits to cash, which will reduce the deposit rate (coefficient cr equal to the ratio of cash to deposits (cr = C / D)). At the same time, the fall in interest rates (loan prices) reduces the interest of commercial banks to lend, increasing their excess reserves (excess reserves), which affects the value of the reserve ratio (coefficient rr equal to the ratio of reserves to deposits (rr = R / D) and represents norms of required reserves (ur) established by the central bank, and norms of excess reserves (er) determined by the commercial banks themselves (rr = ur + er)). An increase in the deposit rate and reserve ratio leads to a decrease in the value of the money multiplier, which significantly weakens the effect of the monetary impulse on the economy (Fig. 3. (a)). The growth of the monetary base from N 1 to H 2 can lead to an increase in the monetary base from M 1 to M 2 if the multiplier value does not change, and only to M 3 if the monetary multiplier value decreases due to an increase in the deposit rate (as in this case) and / or reserve requirements.

• Inconsistency of targets (dilemma of goals) of monetary policy. The fact is that the central bank cannot simultaneously regulate both the money supply and the interest rate, since both these indicators determine the coordinates of the equilibrium point of the money market. If the central bank aims to maintain the interest rate at a constant level, since as the demand for money increases (shift to the right, the demand curve for money from M D 1 to M D 2 ), the interest rate increases from R 1 to R 2 (Fig. 3). (b)), the central bank must increase the money supply to M S 2 , that is, it cannot control the value of the money supply, and it becomes an exogenous value of an endogenous value completely subordinated to the goal of keeping the interest rate unchanged. Conversely, if the central bank aims to maintain a constant value of the money supply, it loses control over the interest rate, since as money supply increases (from M S 1 to M S 2 in Fig. 3 (b)), the interest rate will decrease (from R 1 to R 3 ), while reducing the money supply the interest rate will increase.

As a result, monetary policy can lead to a destabilization of the economy. If the central bank to stabilize the economy does not aim to control the money supply, but to maintain the interest rate at a constant level, then the growth of income (output) in the boom period will lead to an increase in transactional demand for money and, consequently, the overall demand for money, which at a constant money supply will cause an increase in interest rates. To reduce the rate to the original level, the central bank is forced to increase the money supply, which as a result can create additional impetus for economic growth, turning a healthy rise into an inflationary boom. During a downturn, a policy of maintaining a constant interest rate will cause the central bank to reduce the overall demand for money as a result of a decline in business activity, to reduce the money supply, which will result in a further reduction in aggregate demand and an increase recession.

• The loss by the central bank of control over the money supply in the context of the dependence of monetary policy on the fiscal policy of the government. In this case, the money supply also turns from exogenous to endogenous. If the activity of the central bank is aimed at solving budget problems, i.e. providing funding for the growth of public spending (when the government stimulates fiscal policy) or finances the state budget deficit, then monetary policy becomes completely subordinate to solving the problems of fiscal policy. As is known, an increase in government spending and a state budget deficit can be financed by: a) purchases by the central bank of government securities or direct issue of money (the so-called monetization of the state budget deficit); b) purchases of government securities by the population (domestic debt) and c) loans from a foreign sector (external debt). If for some reason debt financing is impossible (as a rule, in the economies of developing countries and in transition economies) or is considered inexpedient, then the government uses an emission method that, on the one hand, provokes inflation, and, on the other, deprives the central bank of its independence in determining the direction of monetary policy. Monetary policy becomes a “hostage” to solving fiscal problems.

In addition, the monetary policy of the central bank cannot be independent, and the money supply is an exogenous value in an open economy under a fixed exchange rate regime, since the change in the supply of the national currency (currency interventions of the Central Bank), especially in conditions of absolute capital mobility, is subordinated to the goal of maintaining the same level exchange rate of the national currency.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics