Lecture

The state budget is the balance of revenues and expenditures of the state for a certain period of time (usually a year), which is the country's main financial plan, which after its adoption by the legislative authority (parliament, the state duma, the congress, etc.) acquires the force of law and is obligatory for execution.

In carrying out its functions, the state incurs numerous expenses. According to the objectives of state spending can be divided into expenses:

• for political purposes: 1) the cost of ensuring national defense and security, i.e. the maintenance of the army, police, courts, etc .; 2) the cost of maintaining the apparatus of government

• for economic purposes: 1) the costs of maintaining and maintaining the public sector, 2) the costs of assistance (subsidies) to the private sector of the economy

• for social purposes: 1) social security costs (payment of pensions, scholarships, benefits); 2) expenses for education, health care, development of basic science, environmental protection.

From a macroeconomic point of view, all government spending is divided into:

The difference between revenues and expenditures of the state is the balance (state) of the state budget. The state budget may be in three different states:

1) when budget revenues exceed expenditures (T> G), the budget balance is positive, which corresponds to an excess (or surplus) of the state budget;

2) when revenues are equal to expenses (G = T), the budget balance is zero, i.e. budget is balanced;

3) when budget revenues are less than expenditures (T <G), the budget balance is negative, i.e. there is a state budget deficit.

At different phases of the economic cycle, the state of the state budget is different. In a recession, budget revenues decrease (as business activity decreases and, consequently, the taxable base), so the budget deficit (if it existed initially) increases, and the surplus (if it was observed) decreases. With a boom, on the contrary, the budget deficit decreases (as tax revenues increase, that is, budget revenues), and the surplus increases.

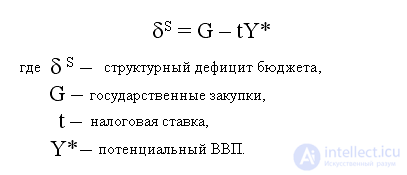

There are structural, cyclical and actual budget deficit. Structural deficit is the difference between government spending and budget revenues that would go to it in conditions of full employment of resources under the existing tax system:

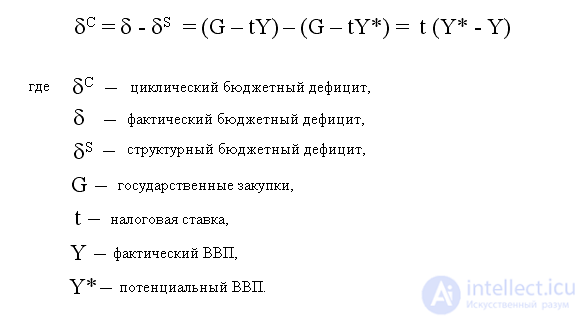

Cyclic deficiency is the difference between the actual deficit and structural deficiency:

During a recession, the actual deficit is greater than the structural one, since a cyclical one is added to the structural deficit, since during a recession Y <Y *. During the boom period, the actual deficit is less than the structural one by the absolute value of the cyclic deficit, since during the boom Y> Y *. Structural deficiency is a consequence of stimulating discretionary fiscal policy, and cyclical deficit is the result of automatic fiscal policy, a consequence of the action of built-in stabilizers.

There are also current budget deficits and primary deficits. The current budget deficit represents the overall state budget deficit. The primary deficit is the difference between the total (current) deficit and the amount of payments for servicing the public debt.

Attitude to the state budget deficit, as a rule, is negative. The most popular is the idea of a balanced budget. Historically, with respect to the state of the state budget, three concepts have been put forward: 1) the idea of an annually balanced budget; 2) the idea of a budget balanced by the phases of the economic cycle (on a cyclical basis); 3) the idea of balancing not the budget, but the economy.

The concept of an annual balanced budget is that, regardless of the phase of the business cycle, each year budget expenditures should be equal to revenues. This means that, for example, during a recession, when budget revenues (tax revenues) are minimal, the state must reduce government spending (government purchases and transfers) to ensure a balanced budget. And since the decline in both government procurement and transfers leads to a decrease in aggregate demand, and, consequently, in output, this measure will lead to an even deeper decline. Conversely, if the economy is booming, i.e. maximum tax revenues, then to balance budget expenditures with revenues, the state should increase government spending, causing even greater overheating of the economy and, consequently, even higher inflation. Thus, the theoretical inconsistency of such an approach to budget regulation is quite obvious.

The concept of a cyclically balanced state budget is that it is not necessary to have a balanced budget each year. It is important that the budget be balanced as a whole during the economic cycle: the budget surplus, which increases during the boom period (the highest business activity), when budget revenues are maximal, should be used to finance the budget deficit that occurs during a recession (minimum business activity), when budget revenues are sharply reduced. This concept also has a significant disadvantage. The fact is that the phases of boom and recession differ in length and depth, so the amounts of budget surplus that can be accumulated during the boom period and the deficit that accumulates during the recession, as a rule, do not coincide, so a balanced budget cannot be ensured.

The most widespread concept is that the goal of the state should not be a balanced budget, but the stability of the economy. This idea was put forward by Keynes in his work "The General Theory of Employment, Interest and Money" (1936) and was actively used in the economies of developed countries until the mid-70s. According to Keynes, the state budget instruments (government purchases, taxes and transfers) should be used as counter-cyclical regulators that stabilize the economy in different phases of the cycle. If the economy is in recession, then the state in order to stimulate business activity and ensure economic growth should increase its spending (government purchases and transfers) and reduce taxes, which will lead to an increase in aggregate demand. And vice versa, if a boom in the economy (overheating), then the state should cut spending and increase taxes (income), which hinders business activity and “cools” the economy, leading to its stabilization. The state of the state budget does not matter. Since Keynes’s theory was aimed at developing recipes for dealing with a recession, with a downturn in the economy, what was proposed to be implemented using, first of all, budget regulation tools (an increase in public procurement and transfers, i.e. budget expenditures and tax cuts, ie budget revenues), this theory is based on the idea of “deficit financing”. As a result of the use of Keynesian recipes to regulate the economy in most developed countries in the 50s-60s, the problem of chronic state budget deficit by the mid-70s became one of the main macroeconomic problems, which was one of the reasons for the increase in inflation processes.

The state budget deficit can be financed in three ways: 1) by issuing money; 2) at the expense of a loan from the population of their country (domestic debt); 3) at the expense of a loan from other countries or international financial organizations (external debt).

The first method is called the emission or monetary method, and the second and third - the debt method of financing the state budget deficit. Consider the advantages and disadvantages of each method.

Emission method of financing the state budget deficit. This method consists in the fact that the state (the Central Bank) increases the money supply, i.e. It puts into circulation additional money, with the help of which it covers the excess of its expenses over income. Advantages of the emission method of financing:

• The growth of the money supply is a factor in increasing aggregate demand and, consequently, in output. An increase in the money supply causes a reduction in the interest rate in the money market (cheaper loan prices), which stimulates investment and ensures the growth of total expenses and total output. This measure, therefore, has a stimulating effect on the economy and can serve as a means of getting out of the recession.

• This is a measure that can be implemented quickly. Growth of money supply occurs either when the Central Bank conducts operations on the open market and buys government securities and, paying sellers (households and firms) the value of these securities, issues additional money into circulation (it can make such a purchase at any time and in any the required amount), either by direct issue of money (for any necessary amount).

Disadvantages:

• The main disadvantage of the emission method of financing the state budget deficit is that in the long run, an increase in the money supply leads to inflation, i.e. This is an inflationary mode of financing.

• This method may have a destabilizing effect on the economy in the period of overheating. The reduction in interest rates as a result of the growth of the money supply stimulates an increase in total expenditures (primarily investment) and leads to even greater growth in business activity, increasing the inflation gap and accelerating inflation.

Financing the state budget deficit through domestic debt. This method consists in the fact that the state issues securities (government bonds and treasury bills), sells them to the population (households and firms) and uses the funds received to finance the excess of government spending over income.

The advantages of this method of financing:

• It does not lead to inflation, since the money supply does not change, i.e. This is a non-inflationary method of financing.

• This is a fairly operational way, since the issuance and placement (sale) of government securities can be achieved quickly. The population in developed countries gladly buys government securities, because they are highly liquid (they can be easily and quickly sold - this is “almost money”), highly reliable (guaranteed by a government that is trusted) and quite profitable (a percentage is paid on them).

Disadvantages:

• Debts must be paid. It is obvious that the population will not buy government bonds if they do not generate income, i.e. if they are not paid interest. The interest payment on government bonds is called “government debt service”. The more government debt (i.e., the more government bonds issued), the greater the amount that must be serviced by the debt. And the payment of interest on government bonds is part of the state budget expenditures, and the more they are, the greater the budget deficit. It turns out a vicious circle: the state issues bonds to finance the state budget deficit, the payment of interest on which provokes an even larger deficit.

• Paradoxically, this method is not non-inflationary in the long run. Two American economists Thomas Sargent (Nobel laureate) and Neil Wallace proved that debt financing of the state budget deficit in the long run could lead to even higher inflation than emission financing. This idea was given the name “Sargent – Wallace Theorem” in economic literature. The fact is that the state, financing the budget deficit at the expense of a domestic loan (issuance of government bonds), as a rule, builds a financial pyramid (refinances debt), i.e. pays for past debts with a loan in the present that will need to be repaid in the future, with the repayment of the debt including both the amount of the debt and interest on the debt. If the state uses only this method of financing the state budget deficit, then there may come a point in the future when the deficit will be so large (that is, so many government bonds will be issued and the cost of servicing the public debt will be so significant) that its debt financing the way will be impossible, and will have to use equity financing. But at the same time, the value of the emission will be much greater than if it is carried out in reasonable sizes (in small portions) each year. This can lead to a surge in inflation and even cause high inflation.

As Sargent and Wallace showed, in order to avoid high inflation, it is wiser not to abandon the issuing method of financing, but to use it in conjunction with the debt one.

• A significant disadvantage of the debt financing method is the “crowding out” of private investment. We have already examined its mechanism in analyzing the shortcomings of fiscal policy in terms of the impact on the economy of an increase in budget expenditures (government procurement and transfers) and a reduction in budget revenues (taxes), which causes a budget deficit. Now consider the economic meaning of the “crowding effect” in terms of financing this deficit. This effect is that the increase in the number of government bonds in the securities market leads to the fact that part of household savings is spent on the purchase of government securities (which provides financing for the state budget deficit, i.e., goes to non-production purposes), and not the purchase of securities of private firms (which ensures the expansion of production and economic growth). This reduces the financial resources of private firms and, therefore, investment. As a result, the volume of production is reduced.

The economic mechanism of the “crowding out” effect is the following: an increase in the number of government bonds leads to an increase in the supply of bonds on the securities market. The increase in the supply of bonds leads to a decrease in their market price, and the price of a bond is inversely related to the interest rate, therefore, the interest rate increases. The increase in interest rates leads to a reduction in private investment and a decrease in output.

• The debt method of financing the state budget deficit can lead to a balance of payments deficit. It is not by chance that in the mid-1980s, the term twin-deficits appeared in the United States. These two types of deficiencies may be interdependent. Recall the identity of injections and withdrawals: I + G + Ex = S + T + Im, where I is investment, G is government procurement, Ex is export, S is savings, T is net taxes, and Im is import.

Rearrange: (G - T) = (S - I) + (Im - Ex)

From this equality it follows that with an increase in the state budget deficit, either savings should increase, investments should be reduced, or the trade balance deficit should increase. The mechanism of the impact of the growth of the state budget deficit on the economy and its financing through domestic debt has already been considered when analyzing the “crowding out” effect of private investment and output as a result of an increase in the interest rate. However, along with the internal displacement, the growth of the interest rate leads to the displacement of net exports, i.e. increases the trade deficit.

The mechanism of external crowding out is the following: the growth of the internal interest rate compared to the world makes the securities of a given country more profitable, which increases the demand for them from foreign investors, which in turn increases the demand for the national currency of the given country and leads to an increase in the national currency exchange rate , making the goods of a given country relatively more expensive for foreigners (foreigners now have to exchange more of their currency in order to buy the same amount of goods from that country as before ), а импортные товары становятся относительно более дешевыми для отечественных покупателей (которые теперь должны обменять меньшее количество национальной валюты, чтобы купить то же количество импортных товаров), что снижает экспорт и увеличивает импорт, вызывая сокращение чистого экспорта, т.е. обусловливает дефицит торгового баланса.

Финансирование дефицита государственного бюджета с помощью внешнего долга. В этом случае дефицит бюджета финансируется за счет займов у других стран или международных финансовых организаций (Международного валютного фонда – МВФ, Мирового банка, Лондонского клуба, Парижского клуба и др.). Those. это также вид долгового финансирования, но за счет внешнего заимствования.

Достоинства подобного метода:

Disadvantages:

Итак, все три способа финансирования дефицита государственного бюджета имеют свои достоинства и недостатки.

Государственный долг представляет собой сумму накопленных бюджетных дефицитов, скорректированную на величину бюджетных излишков (если таковые имели место). Государственный долг, таким образом, это показатель запаса, поскольку рассчитывается на определенный момент времени (например, по состоянию на 1 января 2000 года) в отличие от дефицита государственного бюджета, являющегося показателем потока, поскольку рассчитывается за определенный период времени (за год). Различают два вида государственного долга: 1) внутренний и 2) внешний. Оба вида государственного долга были рассмотрены выше.

По абсолютной величине государственного долга невозможно определить его бремя для экономики. Для этого используется показатель отношения величины государственного долга к величине национального дохода или ВВП, т.е. d = D/Y. Если темпы роста долга меньше, чем темпы роста ВВП (экономики), то долг не страшен. При низких темпах экономического роста государственный долг превращается в серьезную макроэкономическую проблему.

Опасность большого государственного долга связана не с тем, что правительство может обанкротиться. Подобное невозможно, поскольку, как правило, правительство не погашает долг, а рефинансирует, т.е. строит финансовую пирамиду, выпуская новые государственные займы и делая новые долги для погашения старых. Кроме того, правительство для финансирования своих расходов может повысить налоги или выпустить в обращение дополнительные деньги.

Серьезные проблемы и негативные последствия большого государственного долга, заключаются в следующем:

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics