Lecture

All major indicators in the system of national accounts reflect the results of economic activity for the year, i.e. are expressed in prices of a given year (at current prices) and therefore are nominal. Nominal indicators do not allow for both cross-country comparisons and comparisons of the level of economic development of the same country in different periods of time. Such comparisons can be made only with the help of real indicators (indicators of real output and real income), which are expressed in constant (comparable) prices. Therefore, it is important to distinguish between nominal and real (cleared from the influence of price level changes) indicators.

Nominal GDP is GDP calculated in current prices, in prices of a given year. The value of nominal GDP is influenced by two factors:

To measure real GDP, it is necessary to “clear” nominal GNP from the effects of price level changes on it. Real GDP is GDP measured in comparable (unchanged) prices, in prices of the base year. In this case, the base year can be chosen any year, chronologically, both earlier and later than the current one. The latter is used for historical comparisons (for example, for calculating real GDP in 1980 at 1999 prices. In this case, 1999 will be the base year, and 1980 will be the current year).

Real GDP = Nominal GDP / General Price Level

The overall price level is calculated using a price index. Obviously, in the base year, nominal GDP is equal to real GDP, and the price index is 100% or 1.

The nominal GDP of any year, since it is calculated in current prices, is p t q t , and real GDP, calculated in prices of the base year, is p 0 q t . Both nominal and real GDP are calculated in monetary units (in rubles, dollars, etc.).

If the percentage changes in nominal GDP, real GDP and the general price level are known (and this is the rate of inflation), then the ratio between these indicators is as follows:

change in real GDP (in%) = change in nominal GDP (in%) - change in the general price level (in%)

For example, if nominal GDP grew by 15%, and the inflation rate was 10%, then real GDP grew by 5%. (However, it should be borne in mind that this formula is applicable only at low rates of change and, first of all, at very small changes in the general price level, that is, at low inflation. When solving problems, it is more correct to use the formula for the ratio of nominal to real GDP in general as.)

There are several types of price indices: 1) consumer price index; 2) producer price index; 3) deflator GNP and others.

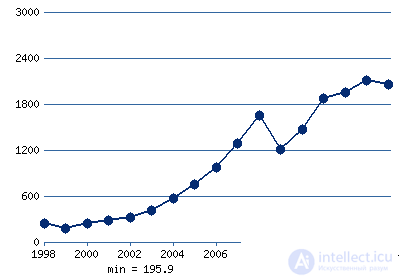

Real Russian GDP, billion US dollars

Source - CIA World Factbook

View data in the form of a table for 1991-2011

View real world GDP data

The consumer price index (CPI) is calculated based on the value of the market consumer basket, which includes a set of goods and services consumed by a typical urban family during the year. (In developed countries, the consumer basket includes 300-400 types of consumer goods and services).

The producer price index (PPI) is calculated as the value of the basket of industrial goods (intermediate products) and includes, for example, in the USA 3,200 items. Both CPI and PPI are statistically calculated as indices with weights (volumes) of the base year, i.e. as Laspeyres index:

CPI = IL = (∑p 0i q ti / ∑p ti q ti ) * 100%

where p i - prices for individual products; q i - the number of goods of each type; superscripts t and 0 mean that the data refer to the studied and base periods respectively.

GDP deflator, calculated on the basis of the value of the basket of final goods and services produced in the economy during the year. Statistically, the GDP deflator acts as the Paasche index, i.e. index with weights (volumes) of the current year:

def GDP = (∑p ti q ti / ∑p 0i q ti ) * 100%

where p ti , p oi - prices of goods for the studied (t) and basic (0) periods, respectively; qi1 - the number of goods sold in the study period.

As a rule, the CPI (if the set of goods included in the consumer market basket is large enough) and the GDP deflator are used to determine the general level of prices and the rate of inflation.

The differences between the CPI and the GDP deflator, besides the fact that they are calculated using different weights (the base year for the CPI and the current year for the GDP deflator), are as follows:

The inflation rate (equal to the ratio of the price level difference (for example, the GDP deflator) of the current (t) and previous year (t - 1) to the price level of the previous year, expressed as a percentage:

Inflation rate = deflator of current year GDP - deflator of GDP prev. years * 100%;

The rate of change in the cost of living is calculated similarly, but through the CPI is equal to:

Tempus CPI = CPI of the current year - CPI of the previous year * 100%

a) The CPI underestimates the structural shifts in consumption (the substitution effect relative to more expensive goods is relatively cheaper), since it is calculated on the basis of the structure of the consumer basket of the base year, i.e. attributes the base year's consumption structure to the current year (for example, if oranges are relatively expensive by this year, consumers will increase the demand for tangerines, and the structure of the consumer basket will change - the share (weight) of oranges in it will decrease, and the share (weight) of tangerines will increase. , this change will not be taken into account when calculating the CPI, and the current year will be attributed to the weight (the number of kilograms relative to the rising price of oranges and relatively cheap mandarins consumed per year) of the base year, and the cost of sweat ebitelskoy basket is artificially inflated GDP deflator is overestimating the structural changes in consumption (substitution effect), attributing the weight of this year, the base year.;

b) The CPI ignores changes in the prices of goods due to changes in their quality (a rise in prices for goods is considered as if by itself, and does not take into account that a higher price for a product may be associated with a change in its quality. Obviously, the price of an iron with a vertical ironing higher than the price of conventional iron, but in the composition of the consumer basket, this product appears as a simple "iron"). Meanwhile, the GDP deflator overestimates this fact and underestimates the level of inflation.

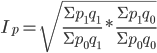

Due to the fact that both indices have flaws and cannot accurately reflect the change in the general price level, the so-called “ideal” Fisher index can be used, which removes these flaws and represents the geometric average of the Paasche index and the Laspeyres index:

The Fisher index is used to more accurately calculate the growth rate of the general price level, i.e. inflation rate. Depending on whether the overall price level (P - price level) (usually determined with the help of a deflator) has increased or decreased over a period of time that has passed from the base year to the current year, nominal GDP can be either larger or smaller than real GDP. If during this period the general price level has increased, i.e. GDP deflator> 1, then real GNP will be less than nominal. If for the period from the base year to the current price level has decreased, i.e. GDP deflator <1, then real GDP will be more than nominal.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics