Lecture

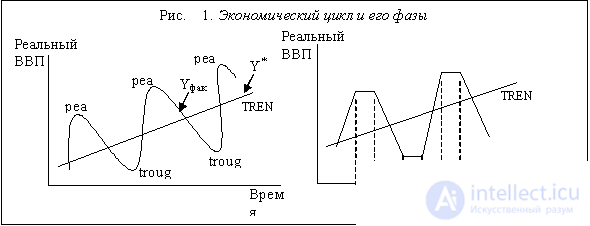

In reality, the economy does not develop in a straight line (trend), which characterizes economic growth, but through constant deviations from the trend, through ups and downs. The economy develops cyclically (Fig. 1.). The economic (or business) cycle (business cycle) is a periodic ups and downs in the economy, fluctuations in business activity. These fluctuations are irregular and unpredictable, therefore the term “cycle” is rather conditional. There are two extreme points of the cycle: 1) the peak point (peak), corresponding to the maximum business activity; 2) the bottom point (trough), which corresponds to the minimum business activity (maximum decline).

The cycle is usually divided into two phases (Fig. 1. (a)): 1) a recession phase or a recession, which lasts from peak to bottom. A particularly long and deep recession is called depression. It is no accident that the crisis of 1929-1933 was called the Great Depression; 2) a recovery or recovery phase (recovery) that continues from bottom to peak.

There is another approach in which four phases are distinguished in the economic cycle (Fig. 1. (b)), but extreme points are not distinguished, since it is assumed that when the economy reaches a maximum or minimum of business activity, then a certain period of time (sometimes long) it is in this state: 1) Phase I - boom (boom), in which the economy reaches its maximum activity. This is a period of over-employment (the economy is above the level of potential output, above the trend) and inflation. (Recall that when actual GDP in the economy is higher than potential, this corresponds to the inflation gap). The economy in this state is called the "overheated economy"; 2) P phase - recession (recession or slump). The economy is gradually returning to the level of the trend (potential GDP), the level of business activity is declining, the actual GDP reaches its potential level, and then begins to fall below the trend, which leads the economy to the next phase - the crisis; 3) phase III - crisis (crisis) or stagnation (stagnation). The economy is in a recessionary gap, as actual GDP is less than potential. This is a period of under-utilization of economic resources, i.e. high unemployment; 4) Phase IV - revitalization or recovery. The economy gradually begins to emerge from the crisis, actual GDP approaches its potential level, and then surpasses it until it reaches its maximum, which again leads to a boom phase.

In economic theory, the causes of economic cycles were declared the most diverse phenomena: sunspots and the level of solar activity; wars, revolutions and military coups; presidential elections; insufficient consumption; high population growth rates; optimism and pessimism of investors; change in money supply; technical and technological innovations; price shocks and others. In fact, all these reasons can be reduced to one. The main cause of economic cycles is the discrepancy between aggregate demand and aggregate supply, between aggregate expenditures and aggregate output. Therefore, the cyclical nature of the development of the economy can be explained: either by a change in aggregate demand with a constant value of aggregate supply (an increase in aggregate spending leads to a rise, their reduction causes a recession); or a change in aggregate supply at a constant value of aggregate demand (a decrease in aggregate supply means a decline in the economy, its growth is a rise).

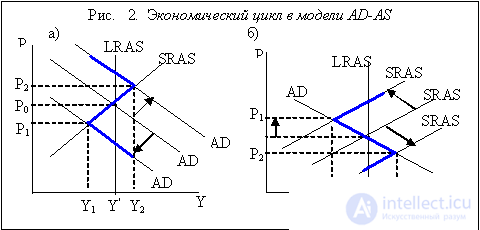

Consider how the indicators behave at different phases of the cycle, provided that the cause of the cycle is a change in aggregate demand (total expenses) (Fig. 2. (a)).

In the boom phase, there comes a time when all the output produced cannot be sold, i.e. total costs less than output. There is a glut, and at first firms are forced to increase stocks. The growth of stocks leads to a collapse of production. The reduction in production leads to the fact that firms lay off workers, i.e. unemployment is rising. As a result, cumulative incomes (consumer - due to unemployment, investment - due to the senselessness of expanding production in the face of falling aggregate demand), and, consequently, cumulative expenses. Households, in the first place, reduce the demand for durable goods. Due to the fall in firms' demand for investment and household demand for durable goods, the short-term interest rate (price for investment and consumer credit) is falling.

The long-term interest rate, as a rule, increases (in the face of declining revenues and a shortage of cash, people start selling bonds, the supply of bonds increases, their price falls, and the lower the price of bonds, the higher the interest rate). Due to the decrease in total income (taxable base), tax revenues to the state budget are reduced. The size of government transfer payments increases (unemployment benefits, poverty benefits). The state budget deficit is growing. By trying to sell their products, firms can lower their prices, which can lead to a decrease in the general price level, i.e. to deflation (in Fig. 2. (a) output is reduced to Y1, and the price level falls from P0 to P1).

Faced with the inability to sell their products even at lower prices, firms (as rational economic agents) can either buy more productive equipment and continue to produce the same type of goods, but with lower costs, which will reduce product prices without reducing profit margins. (it is expedient to do this if the demand for goods produced by firms is not saturated, and a price reduction in the context of low income will provide an opportunity to increase sales); or (if the demand for goods produced by the company is fully saturated and even a reduction in prices does not lead to an increase in sales) switch to the production of a new type of goods, which will require technical re-equipment, i.e. replacing old equipment with fundamentally different new equipment. And in fact, and in another case, the demand for investment goods increases, which serves as an incentive for the expansion of production in industries producing investment goods. There begins a revival, increasing employment, increasing profits of firms, increasing total income. Income growth leads to an increase in demand in the industries producing consumer goods, and to the expansion of production there. Renewal, employment growth (decline in unemployment) and income growth cover the entire economy. In the economy begins to rise. Growing demand for investment and durable goods leads to a rise in the cost of credit, i.e. increase in short-term interest rates. The long-term interest rate decreases as the demand for bonds increases and, as a result, the prices (market rate) of securities increase. The price level is rising. Tax revenues are increasing. Transfer payments are reduced. The state budget deficit is decreasing and there may be a surplus. The rise in the economy, business growth is turning into a boom, into an “overheating” of the economy (Y2 in Fig. 2. (a)), after which another decline begins. So, the basis of the economic cycle is the change in investment costs. Investment is the most volatile part of aggregate demand (total expenditure).

In fig. 2. The cycle is represented graphically using the AD-AS model. In fig. 2. (a) shows the economic cycle due to changes in aggregate demand (total expenditure), and in Fig. 2. (b) - changes in the cumulative offer (cumulative release).

In conditions when a downturn in the economy is caused not by a reduction in aggregate demand (total expenditure), but by a decrease in aggregate supply, most of the indicators behave in the same way as in the first case (real GDP, unemployment, total income, stocks of firms, sales , company profits, tax revenues, transfer payments, etc.) The only exception is an indicator of the general price level, which rises as the recession deepens (fig. 2. (b)). This is a situation of “stagflation” - a simultaneous decline in production (from Y * to Y1) and an increase in the price level (from P0 to P1). Investments also form the basis for a way out of this recession, as they increase the capital stock in the economy and create conditions for the growth of aggregate supply (shift of the SRAS1 curve to the right to SRAS0).

The main indicator of the phases of the cycle is the rate of economic growth (rate of growth - g), which is expressed as a percentage and is calculated using the formula: g = [(Yt - Yt - 1) / Yt - 1] x 100%, where Yt is real GDP current year, and Yt - 1 - real GDP of the previous year. Thus, this indicator characterizes the percentage change in real GDP (total output) in each subsequent year compared with the previous one, i.e. in fact, not the growth rate (growth), but the GDP growth rate. If this value is positive, then this means that the economy is in a phase of recovery, and if it is negative, then it is in a phase of decline. This indicator is calculated for one year and describes the rate of economic development, i.e. short-term (annual) fluctuations of actual GDP, in contrast to the average annual growth rate used in calculating the rate of economic growth, i.e. long-term upward trend in potential GDP.

Depending on the behavior of economic values at different phases of the cycle, indicators are distinguished:

There are different types of cycles in duration:

The allocation of different types of economic cycles is based on the duration of the functioning of various types of physical capital in the economy. Thus, the centenary cycles are associated with the advent of scientific discoveries and inventions that produce a real revolution in the production technology (remember, the “age of steam” was replaced by the “century of electricity” and then the “century of electronics and automation”). The basis of Kondratieff's long-wave cycles is the length of service life of industrial and non-industrial buildings and structures (the passive part of physical capital). After about 10–12 years, physical deterioration of equipment (the active part of physical capital) occurs, which explains the duration of “classical” cycles. In modern conditions, it is not physical, but moral obsolescence that occurs due to the emergence of more efficient, more advanced equipment, and since fundamentally new technical and technological solutions appear with a frequency of 4-6 years, paramount importance for the replacement of equipment, the duration of cycles becomes less . In addition, many economists associate the duration of cycles with mass renewal of durable goods by consumers (some economists even suggest including them as investment goods purchased by households) occurring at intervals of 2–3 years.

In modern economics, the duration of cycle phases and the amplitude of oscillations can be very different. This depends, first of all, on the cause of the crisis, as well as on the characteristics of the economy in different countries: the degree of government intervention, the nature of economic regulation, the share and level of development of the services sector (non-production sector), the conditions for the development and use of the scientific and technological revolution.

It is important to distinguish cyclical vibrations from non-cyclic vibrations. The economic cycle is characterized by the fact that all indicators change, and that the cycle covers all sectors (or sectors). Non-cyclical vibrations are reflected:

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics