Lecture

The circuit diagram is an example of a macroeconomic model. Modeling and abstraction are the main method of macroeconomic analysis. All macroeconomic processes are studied on the basis of model building. Macroeconomic models are a formalized (graphical or algebraic) description of economic processes and phenomena in order to identify the main relationships between them. To build a model, it is necessary to single out the essential, most important characteristics for each phenomenon studied and to distract (abstract) from insignificant phenomena and factors. Thus, the model is a certain simplified reflection of reality, which allows to identify the main patterns of development of economic processes and to develop options for solving complex macroeconomic problems such as economic growth, inflation, unemployment, etc.

Macroeconomic models can be in the form of: functions, graphs, charts and tables, which allows you to understand the interdependencies between macroeconomic quantities, cause-effect relationships between economic phenomena. In macroeconomics, there are various types of functions:

a) behavioral, characterizing the behavior of economic agents (for example, the function of consumption:

C = Co + mpyd,

where Co is autonomous consumption, independent of income level; Yd - disposable income; mpс - behavioral coefficient, which is called the marginal propensity to consume and shows how the amount of consumption changes when the value of disposable income changes by one);

b) technological, describing the production technology (for example, production function:

Y = F (K, L),

where Y is the total output, which is determined by the capital stock (K) and labor margin (L), i.e. the number of major economic resources;

c) institutional, showing the impact of institutional factors (government parameters) on macroeconomic values (for example, the function of taxes:

T = T + tY,

where T is the amount of tax revenue, T is autonomous (lump sum) taxes that do not depend on the level of income, t is the tax rate, Y is the level of total income (output);

d) definitional, reflecting the definition of a macroeconomic value (for example, the aggregate demand function, which by definition is the sum of the demands of all macroeconomic agents, has the form:

AD = C + I + G + Xn,

where C is household demand (consumer spending), I is firm demand (investment spending), G is government demand (government purchases of goods and services) and Xn is foreign demand (net exports)

All these functions can be represented in the form of graphs and tables.

Models include two types of indicators: exogenous and endogenous.

Exogenous values - these are indicators that are set from the outside, are formed outside the model. Exogenous values are autonomous (independent). Endogenous values are indicators that are formed within the model.

The model allows us to show how the change in exogenous values (external impulse) affects the change in endogenous (Fig. 1). For example, if the consumption function is: C = C (Yd, W), where C is the value of total consumer spending, Yd is disposable income and W is wealth, Yd and W are exogenous values, and C is endogenous. This model allows you to explore how changes in disposable income and / or wealth change the amount of consumer spending. Consumption, therefore, acts as a dependent quantity (function), and disposable income and wealth value - as independent values (function argument). In different models, the same value can be both exogenous and endogenous. Thus, in the consumption model, consumer spending (C) acts as an endogenous (dependent) quantity, and in the aggregate demand model: AD = C + I + G + Xn, consumer spending (C) is an exogenous (independent) quantity, i.e. variable determining the value of total output and total income. The exceptions are government variables, which, as a rule, are exogenous, such as government purchases of goods and services, lump sum taxes, tax rates, transfers, interest rates, required reserves, and the monetary base.

In addition to variables, models include parameters and constants. These include all behavioral factors, such as marginal propensity to consume, marginal propensity to save, deposit rate, excess reserves rate, as well as elasticity (sensitivity) indicators, such as the sensitivity of investments to changes in interest rates, the sensitivity of money demand to changes in income degree of capital mobility, etc.

An important feature of macroeconomic variables is that they are divided into two groups: flow indicators and inventory indicators. Flow is the quantity for a certain period of time. In macroeconomics, as a rule, the unit of time is the year. Flow indicators include: total output, total income, consumption, investment, state budget deficit (surplus), number of unemployed, export, import, etc., since all of them are calculated every year, i.e. for one year. All indicators displayed in the circuit diagram are streams. (Not by chance this scheme is called the circular flow model - model of circular flows). The stock is the quantity at a certain point in time, i.e. on a specific date (for example, January 1, 2000). Reserves indicators include national wealth, personal wealth, capital stock, number of unemployed, production potential, national debt, etc.

Macroeconomic indicators can also be divided into: absolute and relative. Absolute indicators are measured in monetary (monetary) terms (the exceptions are indicators of the number of employees and the number of unemployed, which are measured in terms of the number of people), and relative indicators in percentage or relative values. Relative indicators include the unemployment rate, deflator (general price level), inflation rate, economic growth rate, interest rate, tax rate, etc.

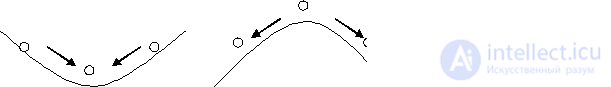

Stable equilibrium Unstable equilibrium Neutral

Important in macroeconomics is the study of equilibrium states. In this case, there are three types of equilibrium: stable, unstable and neutral (Fig. 2). An equilibrium in a system is considered stable if, being taken out of equilibrium, the system returns to it independently; unstable, if not returned, and neutral, if you can not definitely say whether the system will return to its original state or not.

In macroeconomic models, the time factor is of great importance. Depending on how this factor is taken into account in the analysis, three types of macroeconomic models are distinguished: static, comparative statics and dynamic (in this case, studies can be carried out both in discrete and in continuous time). Static models describe the economic situation at a particular point in time. Models of comparative statics show the result of the transition of the economic system from one equilibrium state to another, but do not investigate how this transition occurs. The mechanism of this transition process is studied in dynamic models.

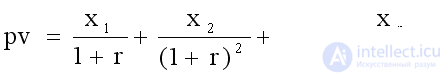

In dynamic models, the principle of discounting plays an important role, i.e. bring the value of future income to the present period (present value - PV). The discounting method is used in determining the effectiveness of investing funds in financing investment projects (financing an investment project makes sense if the amount of future revenues cited for this period is no less than the cost of financing it) when buying securities (which is reasonable only if , if the reduced total income from this security is not less than the amount spent on its purchase), with intertemporal choice of consumption (when deciding on preference, I will present consumption). Discounted value is calculated by the formula:

where x1, x2, ... xn are the revenues that the economic agent intends to receive in each of the future periods (from the first to the nth), r is the discount rate, which in macroeconomic models, as a rule, is set equal to the interest rate. The macroeconomic meaning of interest rates is that it represents the opportunity cost of using money in a different way.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics