Lecture

The main provisions of the model:

• The real sector and the monetary sector are closely interrelated and interdependent.

The principle of money neutrality, which is characteristic of the classical model, is replaced by the principle “money matters” (“money matters”), which means that money influences real indicators. The money market becomes the macroeconomic market, a part (segment) of the financial market along with the securities market (borrowed funds). • Imperfect competition in all markets.

• Since competition is imperfect in all markets, prices are inflexible, they are rigid (sticky), i.e. sticking at a certain level and not changing for a certain period of time.

For example, in the labor market, the rigidity (stickiness) of the price of labor (nominal wage rate) is due to the fact that:

In the commodity market, price rigidity is explained by the fact that monopolies, oligopolies or monopolistic competitors operate on it, which have the ability to fix prices, being price-makers (and not price-takers as in conditions of perfect competition). Therefore, on the graph of the commodity market (Fig. 1. (c)) while reducing the demand for goods, the price level will not drop to P2, but will remain at the level of P1.

The interest rate, according to Keynes, is not formed on the borrowed funds market as a result of the ratio of investments and savings, but on the money market - in terms of the demand for money and the money supply. Therefore, the money market becomes a full-fledged macroeconomic market, a change in the situation in which affects the change in the situation in the commodity market. Keynes justified this position by the fact that, with the same level of interest rates, actual investments and savings may not be equal, since investments and savings are made by different economic agents who have different goals and motives for economic behavior. Investments are made by firms, and savings are made by households. The main factor determining the value of investment expenses, according to Keynes, is not the level of interest rates, but the expected internal rate of return on investment, what Keynes called the marginal efficiency of capital.

An investor makes an investment decision by comparing the value of the marginal efficiency of capital, which, according to Keynes, is the investor’s subjective assessment (in fact, this is the expected internal rate of return on investment) with the interest rate. If the first value exceeds the second, then the investor will finance the investment project, regardless of the absolute value of the interest rate. (So, if the investor equals 100% of the marginal efficiency of capital, the loan will be taken at an interest rate of 90%, and if this estimate is 9%, then he will not take a loan at a rate of 10%). And the factor that determines the amount of savings is also not the interest rate, but the amount of disposable income (Recall that RD = C + S). If the disposable income of a person is small, and it is barely enough for current expenses (C), then a person will not be able to save even at a very high interest rate. (To save, you must at least have something to save). Therefore, Keynes believed that savings did not depend on the interest rate and even noted, using the arguments of the 19th century French economist Sargan, which received the name "Sargan effect" in economic literature, that there can be an inverse relationship between savings and interest rates if a person wants to accumulate a fixed amount over a period of time. So, if a person wants to provide for retirement an amount of 10 thousand dollars, he should set aside 10 thousand dollars annually at the interest rate of 10%, and only 5 thousand dollars at the interest rate of 20%.

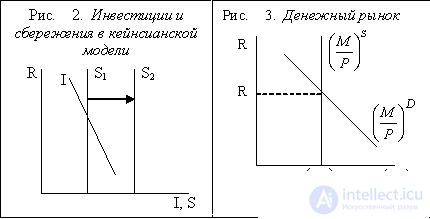

Graphically, the ratio of investment and savings in the Keynesian model is presented in Figure 2. Since savings depend on the interest rate, their graph is a vertical curve, and investments weakly depend on the interest rate, therefore, a curve with a slight negative slope can be represented. If savings increase to S1, then the equilibrium interest rate cannot be determined, since the investment curve I and the new savings curve S2 do not have a point of intersection in the first quadrant. This means that the equilibrium interest rate (Re) should be sought on another, namely, in the money market (in terms of the relation between the demand for money МD and the money supply МS) (Fig. 3.)

Since prices are tight in all markets, the equilibrium of markets is not established at the level of full employment of resources. Thus, in the labor market (Fig. 1. (a)) the nominal wage rate is fixed at the level of W1, at which firms show a demand for the number of workers equal to L2. The difference between LF and L2 is unemployed. Moreover, in this case, the cause of unemployment will not be the refusal of workers to work for a given nominal wage rate, but the rigidity of this rate. Unemployment from voluntary turns into forced. Workers would agree to work at a lower rate, but entrepreneurs do not have the right to reduce it. Unemployment is becoming a serious economic problem.

In the commodity market, prices also stick at a certain level (P1) (Fig. 1. (c)). The decrease in aggregate demand as a result of a decrease in total income due to the presence of the unemployed (note that unemployment benefits were not paid), and therefore a decrease in consumer spending leads to the inability to sell all the products produced (Y2

• Since private sector spending (household consumption expenditures and firms' investment spending) is unable to provide the value of aggregate demand corresponding to the potential output, i.e. such a value of aggregate demand, at which it would be possible to consume the volume of output produced under the condition of full employment of resources. Therefore, an additional macroeconomic agent should appear in the economy, either placing its own demand for goods and services, or stimulating the demand of the private sector and thus increasing aggregate demand. This agent, of course, should be the state. So Keynes justified the need for state intervention and state regulation of the economy (state activism). • The main economic problem (in conditions of under-employment of resources) is the problem of aggregate demand, and not the problem of aggregate supply. The Keynesian model is a demand-side model, i.e. studying economics from the side of aggregate demand.

• Since the stabilization policy of the state, i.e. policy on the regulation of aggregate demand, affects the economy in the short term, the Keynesian model is a model that describes the behavior of the economy in the short term (short-run model). Keynes did not consider it necessary to look far into the future, to study the behavior of the economy in the long run, wittily remarking: “In the long run we are all dead” (“In long run we are all dead”).

Keynesian methods of regulating the economy by influencing aggregate demand (primarily by fiscal policy measures), a high degree of state intervention in the economy were characteristic of developed countries in the period after World War II. However, the increase in inflationary processes in the economy, and especially the consequences of the oil shock of the mid-70s, highlighted the problem of stimulating not aggregate demand (because it provoked inflation even more), but the problem of aggregate supply. In place of the "Keynesian revolution" comes the "neoclassical counter-revolution." The main currents of the neoclassical trend in economic theory are: 1) monetarism (“monetarist theory”); 2) the theory of "supply economy" ("supply-side economics"); 3) the theory of rational expectations ("rational expectations theory"). The focus of neoclassical concepts is on analyzing the microeconomic fundamentals of macroeconomics.

The difference in the views of representatives of the neoclassical direction from the ideas of representatives of the “classical school” is that they use the main provisions of the classical model in relation to modern economic conditions, analyzing the economy from the aggregate supply, but in the short term. Representatives of the neo-Keynesian direction in their concepts also take into account the inflationary nature of the modern economy. Therefore, in modern macroeconomic theory, it’s rather a matter of not contrasting the neoclassical and neo-Keynesian approaches, but the development of a theoretical concept that would most adequately reflect and theoretically explain modern economic processes. This approach is called the "main stream".

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics