Lecture

The importance of studying the problem of economic growth is that economic growth is the basis for increasing welfare, and analyzing the factors that determine it allows us to explain the differences in the level and pace of development in different countries (inter-country differences) in the same period of time and in one and the same same country at different times (intertemporal differences).

How to ensure economic growth; what factors determine it; why some countries are developing faster and others are slower; what needs to be done to maintain a high level of well-being, if it has already been achieved, and what measures should be used by underdeveloped countries to achieve this level, what are the costs of economic growth - this is not a complete list of issues that the macroeconomic theory of economic growth deals with.

Economic growth is a long-term upward trend in real GDP. In this definition, the key words are:

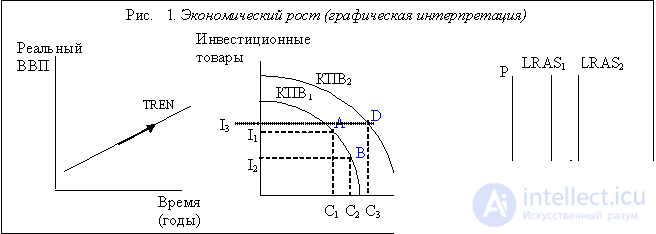

Graphically, economic growth can be represented in three ways:

In Fig. 1. (a), the curve (trend) reflects the long-term upward trend in real GDP. In Figure 1. (b) economic growth is shown using the production potential curve.

The main types of goods produced in the economy are investment goods (industrial use) and consumer goods. The production capacity curve (CPV) reflects the limited resources in the economy in a certain period of time. Each point of the curve corresponds to a certain combination of quantities of consumer goods and investment goods that can be produced using the available economic resources. For example, at point A on CPV1, using the amount of resources that corresponds to this curve, one can produce the number of consumer goods C1 and investment goods I1. If the goal is to increase the number of consumer goods to C2, then being on the same production potential curve (moving from t. A to t. C), this problem can be solved only by reducing the production of investment goods to I2, i.e. have opportunity costs.

If the economy moves to a new production capacity curve (KPV2), i.e. From t. A to t. D, the production of both consumer goods (up to C3) and investment goods (up to I3) is increasing, and without the opportunity costs. And this is economic growth, i.e. transition to a new level of production capabilities, solving the problem of limited resources and opportunity costs. Thus, economic growth can be represented as a shift (not necessarily parallel) to the production potential curve. Figure 5.1. (C) economic growth is depicted using the AD-AS model. Since economic growth is a growth in potential GDP, i.e. real GDP in the long run, it can be graphically represented as a shift to the right of the long-term aggregate supply curve (LRAS) and output growth from Y * 1 to Y * 2.

Although the indicator of real GDP is widely used to assess the level of a country's economic development, its economic potential, it should be borne in mind that this is an absolute indicator that cannot accurately reflect the standard of living. A more accurate indicator of a country's welfare, welfare level is the value of real GDP per capita, i.e. a relative indicator reflecting the cost of the quantity of goods and services, which is not generally produced in the economy, but on average per person. The fact is that the standard of living to a large extent depends on the rate of population growth. On the one hand, the population of the country determines the size of the labor force, i.e. labor resources. It is not surprising that countries with a large population (USA, Japan) have much higher GDP than Luxembourg and the Netherlands. However, on the other hand, population growth reduces the average per capita GDP, i.e. leads to lower living standards. Economic growth can only be talked about if there is an increase in the level of well-being, i.e. if economic development is accompanied by faster growth in real GDP compared with population growth. In terms of real GDP per capita between countries, there is a huge difference. Thus, at present, the level of real GDP per capita of the United States is about 50 times higher than in Bangladesh, 30 times more than in India, 10 times more than in China, and about the same as in Canada and Japan . The growth in GDP per capita means that per capita of the country accounts for more and more goods and services, and that wealth increases.

However, over time, the ranking (ratio) of countries in terms of real GDP per capita changes. This is due to the fact that different countries have different rates of economic growth. The rate of growth is an indicator of the dynamics of economic growth, which allows you to determine which country is developing faster. The rate of economic growth is expressed in average annual growth rates of GDP or average annual growth rates of GDP per capita (this is a more accurate indicator) over a certain period of time. Differences in real GDP growth per capita are very large. Thanks to high average economic growth over the past 100 years, for example, Japan was able to drastically advance, while due to low growth rates, the United Kingdom and Argentina lost their positions.

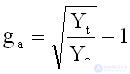

Moreover, even small differences in growth rates can lead to huge differences in income and output between countries after a number of years. This is due to the accumulated growth (сompound growth), i.e. cumulative effect. The cumulative effect is calculated by the formula of "compound interest", when the percentage of the previously received percentage is taken into account. So, if the value of GDP in the country is 100 billion dollars. and the average annual growth rate of GDP is 10%, then the GNP at the end of the first year will be 110 billion dollars. (100 + 100 x 0.1 = 110), at the end of the second year 121 billion dollars. (100 + 100 x 0.1+ (100 + 100 x 0.1) x 0.1 = 121), at the end of the third year 133.1 billion dollars. (100 + 100 x 0.1 + (100 + 100 x 0.1) x 0.1 + [(100 + 100 x 0.1) x 0.1] x 0.1) = 133.1), etc. So, if you know the average annual growth rate of GNP (ga - annual growth rate), then, knowing the initial level of GDP (Y0) and using the compound percentage formula, you can calculate the GDP value in t years (Yt):

Y t = Y 0 (1 + g a ) t ,

which means that the average annual GDP growth rate is:

So, the average annual GDP growth rate is the geometric average growth rate for a certain number of years.

To facilitate the calculations, the “rule 70” is usually used, which states that if a variable grows at a rate of x% a year, then its value will double in about 70 / x years. If the per capita GNP grows annually by 1%, then its value will double in 70 years (70/1). If GDP per capita grows by 4% per year, then its value will double in about 17.5 years (70/4). Thus, each generation of Americans considers it their goal to leave behind double the GDP for the next generation. To do this, the economy should have an average growth rate of approximately 3% per year.

However, it follows from the “rule 70” that after a number of years, a rapidly growing economy applies a percentage of the economic growth rate to a larger initial GDP, and total output increases faster in more slowly growing economies. As we have seen, an economy that grows at a rate of 1% will double its GDP in about 70 years, and in an economy with a 4% growth rate, GDP will double every 17.5 years. After 70 years, an economy with 4% growth will increase its GDP by 16 times compared with the initial level (24), while an economy with a 1% growth will only double the initial GDP value (21). If both economies initially have the same level of GDP, then an economy with a 4% growth rate in 70 years will have a GDP 8 times greater, due to a cumulative effect than an economy with a 1% growth. This phenomenon, when a poorer country begins to develop at a faster rate than a richer country, because it initially has a lower production potential and a level of GDP, has been called the “catch-up effect”.

The economic policy of the state has a significant impact on the growth of labor productivity and the standard of living of the population. First of all, with the help of economic policy, the state can influence the amount of physical and human capital. If the stock of capital in the economy grows, then the economic potential of the country increases, and the economy can produce more goods and services in the future. Therefore, if the government wants to increase productivity, accelerate economic growth and raise the standard of living of its citizens, it should pursue the following policy:

• Stimulate domestic investment and savings. The growth of the stock of capital in an economy occurs through investment. The higher the share of investment in the economy (for example, in Japan, South Korea), the higher the rate of economic growth. Since the growth of capital stock directly affects the growth of labor productivity, the main condition for economic growth is an increase in investment. The basis of investment is savings. If society consumes less and saves more, it has more resources to invest.

• Stimulate investment from abroad, removing restrictions on the receipt of capital in the ownership of the country. It is obvious that an increase in capital can occur not only at the expense of domestic, but also at the expense of foreign investment. There are two types of foreign investment: direct and portfolio. Foreign direct investment is an investment in capital owned and managed by foreigners. Portfolio foreign investments are investments in capital that are financed with the help of foreigners, for example, income from the sale to foreigners of stocks and bonds of firms in a given country, but which are managed by producers (residents) of a given country. Foreign investment ensures the growth of the country's economy. Despite the fact that part of the income of firms created with the participation of foreign capital goes abroad (foreign firms ’profit from direct investment and dividends received and interest on portfolio investment), foreign sources of financing increase the country's economic potential, increase the level of productivity and wages. In addition, foreign investment allows developing countries to master the most advanced technologies developed and used in developed countries.

• Stimulate education. Education is an investment in human capital. In the United States, according to statistics, every year spent on study, increases the salary of an employee by an average of 10%. Education not only increases the recipient's productivity (i.e. the person who received it), it can provide a positive external effect (externalities). An external effect occurs when the action of one person affects the well-being of another person or other people. An educated person can put forward ideas that become useful to others, the public domain, they have the opportunity to use everyone who fell within the scope of the positive external effect of education. This is an argument in favor of public education. In this regard, the phenomenon called “brain drain”, that is, the emigration of the most educated and qualified specialists from poor countries and countries with economies in transition to rich countries with a high standard of living, has especially negative consequences.

• Stimulate research and development. Most of the growth in living standards comes from the growth of technological knowledge that comes from research and development. Over time, knowledge becomes a public good, so that we can all use it at the same time, without reducing the gain (well-being) of others. Research and development can be stimulated by grants, tax cuts and patents to establish temporary ownership of inventions.

• Protect property rights and ensure political stability. Ownership is understood as the ability of people to freely dispose of their resources. In order for people to want to work, save, invest, trade, invent, they must be sure that the results of their work and their property will not be stolen, and that all agreements will be fulfilled. Even the slightest possibility of political instability creates uncertainty about property rights, because a revolutionary government can confiscate property, especially capital. This policy direction is important:

• Stimulate free trade. Free trade is like technological achievement. It allows the country not to produce all the products itself, but to buy from other countries those types of products that they produce more efficiently. Often for developing countries there is an argument about the need to protect young industries from foreign competition and, therefore, to carry out protectionist policies that restrict or even ban international trade. This argument is untenable, because the expansion of trade with developed countries not only allows developing countries to save on costs and not to produce products, the production of which is inefficient, but also to use the latest global technical and technological advances.

• Control population growth. To ensure the growth of prosperity, the growth rate of production must be higher than the rate of population growth. Meanwhile, high population growth rates make other factors of production “more subtle” (that is, per worker) and reduce opportunities for economic growth. Thus, the rapid growth of the population reduces the capital-labor ratio, i.e. the amount of capital per worker, which leads to lower productivity and welfare. The problem of population growth rates is particularly acute when analyzing changes in human capital. High population growth rates, that is, an increase in the proportion of children and young people, create serious difficulties for the education system, especially in developing countries.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics