Lecture

Identifying the most typical behavioral traits of economic agents (aggregation of agents) and the most significant regularities in the functioning of economic markets (market aggregation) allows to aggregate macroeconomic interrelations, that is, to investigate the regularities of the behavior of macroeconomic agents in macroeconomic markets. This is done by constructing a product’s flow, cost, and revenue (or circular flows) model.

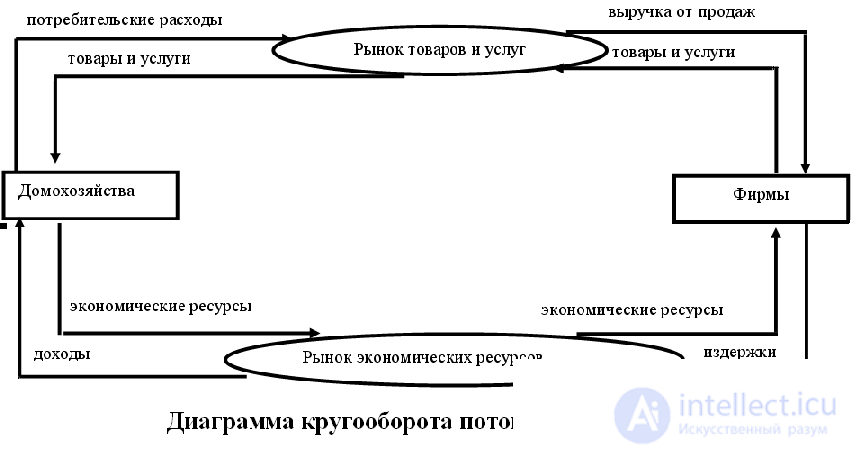

First, we consider a two-sector model of the economy, consisting only of two macroeconomic agents — households and firms — and two markets — the goods and services market and the economic resources market (Fig. 1).

Households buy (demand for) goods and services that firms produce (provide supply) and supply goods and services to the market. To produce goods and services, firms buy (demand) economic resources — labor, land, capital, and entrepreneurial abilities — that is, demand for economic resources — owned by households (ensure supply of economic resources). Material flows must be mediated by cash flows. Buying goods and services, households pay for them. Household spending on the purchase of goods and services is called consumption spending. Firms, selling their products to households, receive revenue from sales (revenue), from which households are paid a fee for economic resources, which for firms represents costs, and for households factorial incomes (wages) (for labor factor ), rent (for the factor of land), interest (for the factor of capital) and profit (for the factor of entrepreneurial ability), the amount of which is the national income.

Household incomes spent on the purchase of goods and services (consumer spending). Revenues and expenses are moving in a circle. The income of each economic agent is spent, creating income for another economic agent, which, in turn, serves as the basis for its expenses. An increase in expenses leads to an increase in income, and an increase in income is a prerequisite for a further increase in expenses. That is why the scheme is called the circuit model or circular flow model. Material flows are moving counterclockwise, and cash - clockwise. Demand is moving clockwise, and supply is against.

From the scheme it follows that: 1) the cost of each material flow is equal to the value of the cash flow; 2) the national product is equal to the national income; 3) aggregate demand is equal to aggregate supply; 4) total revenues are equal to total expenses.

When analyzing the complete scheme of the circuit (Fig. 2), we will examine only cash flows. Since households act rationally, they do not spend all their income on consumption. Part of the income they save, and savings (savings) should generate income. Firms, on the other hand, need additional funds to secure and expand production (in loanable funds). This determines the need for the emergence of a financial market in which household savings are transformed into investment resources of firms. This happens in two ways: 1) either households provide their savings to financial intermediaries (first of all, banks) from which firms take loans; 2) either households spend their savings on the purchase of securities issued by firms, directly providing them with investment resources.

In the first case, the relationship between households and firms is established indirectly - through the money market, in the second - directly - through the securities market. The funds received in the financial market of the company spend on the purchase of investment goods, primarily equipment. Household consumer spending (consumption spending - C) is complemented by investment spending by firms (investment spending - I). At the same time, the equality of the national income to the national product is preserved; therefore, in macroeconomics, the national income and the national product are denoted by one letter, Y (yield). The value of the national product in equilibrium is equal to the sum of the total expenditures (expenditures):

Y = E

The total expenditures (national product) in the two-sector economic model consist of household consumption expenditures (C) and investment expenditures of firms (I):

E = C + I,

and national income from consumption (C) and savings (S):

Y = C + S.

It follows that

C + I = C + S,

which means that total expenses are equal to total income, and

I = s,

those. investments are equal to savings. Investments represent injections into the economy, and savings imply leakages from the economy. Injections are understood to mean anything that increases the flow of expenditures and, consequently, revenues (with the exception of consumer spending, which does not apply to either injections or withdrawals). Withdrawals are all that reduce the flow of expenditures and, therefore, revenue. Growth of investments increases total expenses (aggregate demand), provides additional incomes for producers, serves as a stimulus for increasing the national product (output). Higher savings reduce total costs and may lead to a reduction in production. In an equilibrium economy, injections are equal to exemptions.

The emergence of the state leads to the emergence of new types of macroeconomic interrelations and the transformation of the two-sector model of the economy into a three-sector one.

1) First, the state makes purchases of goods and services (government spending - G), which is associated with the need to maintain the public sector, ensure the production of public goods, perform the functions of regulating the economy and managing the country. At the same time, the wages of civil servants are not viewed as a payment for an economic resource in the resource market, but as payment for services in the market for goods and services, since this payment is made from the state budget and is the result of income redistribution. Government purchases of goods and services increase the aggregate demand for the national product, i.e. total expenses.

2) Secondly, the state obliges everyone to pay taxes (taxes - Tx), which are the main source of state budget revenues. However, acting as a redistributor of national income, the state not only collects taxes, but also pays transfers (transfers - Tr). Transfers are payments that households and firms donated (not in exchange for goods and services) receive from the state. The transfer payments of the state to households are various kinds of social benefits (social benefits), such as pensions, scholarships, unemployment benefits, disability benefits, poverty benefits, etc. Transfer payments by the state to firms are called subsidies.

3) Thirdly, depending on the state of the state budget, the state can act either as a lender or as a borrower in the financial market. If state expenses (government purchases + transfers) exceed state revenues (taxes), which corresponds to the state budget deficit, the state should borrow money on the financial market by acting as a borrower. For this, the state issues government bonds (makes an internal loan) and sells them on the securities market to households. Households spend part of their savings on the purchase of government bonds, ensuring that the state can pay part of its expenses that exceed the incomes of the treasury, i.e. financing the state budget deficit. At the same time, the state pays households a percentage of their bonds, making them attractive for purchases. Interest payments on government bonds increase household incomes, but are expenditures of the state budget and are called “public debt service costs”. If state revenues exceed expenses (there is a surplus (surplus) of the state budget), then the state can act as a creditor in the financial market by buying securities of private firms.

For the three-sector model of the economy, all conclusions made for the two-sector model are valid, i.e. national product is equal to national income, total expenditures are equal to total income, injections are equal to withdrawals. However, total costs now consist of three components: consumption (C), investment (I) and government procurement (G):

E = C + I + G,

and total income is distributed to consumption (C), savings (S) and taxes (T):

Y = C + S + T

Taxes here are net taxes, which are the difference between taxes (Tx) and transfers (Tr):

T = Tx - Tr

(Note that, as a rule, when analyzing the circulation model, interest payments on public debt are not specifically distinguished and are taken into account in the value of transfers, since, like transfers, they are not paid in exchange for a product or service)

Government purchases of goods and services are injections, and (net) taxes are exemptions from the flow of expenditures and incomes, so the equation of equality of injections and withdrawals takes the form:

I + G = S + T

(It should be borne in mind that transfers and interest payments on government bonds are injections, as they increase the flow of income and, consequently, the cost).

Analysis of the three-sector model of the economy (model of a closed economy) shows that the national income (national income - Y), which is the sum of the factor income, i.e. income earned by owners of economic resources (households) is different from the income that households can manage and spend at their own discretion, i.e. disposable income (Yd). In accordance with the circulation scheme, disposable income differs from national income by the amount of taxes that households pay to the state and the amount of transfers that the state pays to households, therefore, to get the amount of disposable income, you need to subtract taxes (Tx) from the national income and add transfers ( Tr) (as well as interest payments on government bonds, if any), i.e. deduct net taxes

T = Tx - Tr

In general, you can write:

Yd = Y - Tx + Tr

or

Yd = Y - T

Household disposable income is used for consumption (consumer spending) and savings:

Yd = C + S

The inclusion of a foreign sector in the circulation scheme gives a four-sector economic model (open economy model) and means the need to take into account the relationship of the national economy with the economies of other countries, which primarily manifest through international trade in goods and services - through exports and imports of goods and services. Since only cash flows are reflected in the flow chart, export (export - Ex) refers to revenue (revenues) from exports (arrow from the foreign sector), and import (import - Im) refers to expenditures on imports (arrow to the foreign sector).

The ratio of exports and imports is reflected in the trade balance. If import expenses exceed export earnings (Im> Ex), this corresponds to the state of the trade deficit. The financing of the trade deficit (the difference between expenditures on imports and export revenues) can be carried out:

a) at the expense of foreign (foreign) loans from other countries or from international financial organizations, such as the International Monetary Fund, the World Bank, etc. (note that an external loan can also be used to finance the state budget deficit)

b) due to the sale to foreigners of financial assets (private and government securities) and the receipt of funds in the country to pay for them.

And in fact, and in another case in the country (on the financial market) there is an inflow of funds from the foreign sector, which is called the capital inflow. This allows you to finance the trade deficit. If export revenues exceed the costs of imports (Ex> Im), which means a surplus (surplus) of the trade balance, then a capital outflow occurs from the country, since in this case foreigners sell their financial assets to the country and receive the necessary payment export cash.

In the four-sector model (open economy model), the principle of equality of income and expenses is also preserved. Taking into account the costs of the foreign sector, which are called “net exports” (net export - Xn) and represent the difference between exports and imports:

Xn = Ex - Im,

You can write the formula for total expenses, which are equal to the sum of expenses of all macroeconomic agents: households, firms, government and foreign sector:

E = C + I + G + Xn.

The formula for total income:

Y = C + S + T

(This means that income is used for consumption, savings and payment of taxes). Since in equilibrium state E = Y, it follows that:

C + I + G + Xn = C + S + T.

This equality is called the macroeconomic identity. The value of total expenditures is equal to the value of the total (gross) domestic product (GDP):

Y = E = C + I + G + Xn

To derive from the macroeconomic identity the formula of equality of injections and withdrawals, it should be borne in mind that in the net export indicator there is also an injection (i.e., exports representing expenditures (demand) of the foreign sector for the products of a given country, and, therefore, part of total expenses , increasing the flow of expenditures and incomes) and withdrawal (i.e. imports, which are the “leakage” of a part of the country's total income to the foreign sector and, consequently, reduce domestic expenses and, accordingly, incomes), therefore the formula CTBA injection and seizures should be written as:

I + G + Ex = S + T + Im

The circuit diagram shows all kinds of interconnections and interdependencies in the economy. Now the subject of macroeconomics can be determined more accurately. Macroeconomics studies the patterns of behavior of macroeconomic agents in macroeconomic markets.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics