Lecture

The balance of payments reflects the entire spectrum of international trade and financial operations of a country with other countries and is a summary record of all economic transactions (transactions) between a given country and other countries during the year. It characterizes the relationship between foreign exchange earnings into the country and payments that this country makes to other countries.

The principle of double entry is used in the balance of payments, since any transaction has two sides - debit and credit. The debit reflects the inflow of values (real and financial assets) into the country for which the country has to pay in foreign currency, so debit operations are recorded with a minus sign, since they increase the supply of the national currency and create demand for foreign currency (these are import-like operations). Transactions that reflect the outflow of values (real and financial assets) from the country for which foreigners must pay are reflected with a plus sign and are export-like. They create a demand for national currency and increase the supply of foreign currency.

The balance of payments is the basis for the development of monetary, fiscal, monetary and foreign trade policies of the country and the management of public foreign debt.

The balance of payments includes three sections:

• the current account, which reflects the sum of all operations of a given country with other countries related to trade in goods, services and transfers and therefore includes:

a) export and import of goods (visibles)

Exports of goods are reflected with a “+” sign, i.e. loan because it increases foreign exchange reserves. Import is recorded with a “-” sign, i.e. debit, as it reduces foreign exchange reserves. Export and import of goods is a trade balance.

b) export and import of services (invisibles), for example, international tourism. This section however excludes credit services.

c) net income from investments (otherwise called net factor income or net income from credit services), which is the difference between the interest and dividends received by citizens of the country from foreign investments, and the interest and dividends received by foreigners from investments in a given country.

d) net transfers, which include foreign aid, pensions, gifts, grants, remittances

The current account balance in macroeconomic models is reflected as net exports:

Ex - Im = Xn = Y - (C + I + G)

where Ex is the export, Im is the import, Xn is the net export, Y is the country's GDP, and the sum of consumer spending, investment spending and government procurement (C + I + G) is called absorption and is part of the GDP sold to domestic macroeconomic agents - households, firms and the state.

The current account balance can be both positive, which corresponds to the current account surplus, and negative, which corresponds to the current account deficit. If there is a deficit, it is financed either by using foreign loans or by selling financial assets, which is reflected in the second section of the balance of payments, the capital account.

• capital account, which reflects all international transactions with assets, i.e. inflows and outflows of capital (capital inflows and outflows) both in long-term and short-term operations (sale and purchase of securities, purchase of real estate, direct investments, current accounts of foreigners in a given country, loans from foreigners and foreigners, treasury bills, etc. P.).

The balance of the capital account can be either positive (net capital inflow into the country) or negative (net capital outflow from the country).

• the official reserves account, which includes reserves of foreign currency, gold, and international settlement funds, such as SDRs (special drawing rights –special drawing drawing rights). SDRs (called paper gold) are reserves in the form of accounts with the IMF (International Monetary Fund). In the event of a deficit in the balance of payments, a country can take reserves from an account with the IMF, and if it is in surplus, increase its reserves with the IMF.

If the balance of payments is negative, i.e. there is a shortage, it should be financed. In this case, the central bank reduces official reserves, i.e. there is intervention (intervention) of the central bank. Intervention is the purchase and sale by a central bank of foreign currency in exchange for a national one. With a balance of payments deficit as a result of central bank intervention, the supply of foreign currency in the domestic market increases, and the supply of national currency decreases. This operation is export-like and is taken into account with a “+” sign, i.e. this is a loan. Since the amount of the national currency in the domestic market has decreased, its exchange rate rises, and this has a restraining effect on the economy.

If the balance of payments is positive, i.e. there is a surplus, there is an increase in official reserves in the central bank. This is reflected with a “-” sign, i.e. it is a debit (import-like operation), since the supply of foreign currency in the domestic market is reduced, and the supply of national currency increases, consequently, its exchange rate falls, and this has a stimulating effect on the economy.

As a result of these operations, the balance of payments becomes zero.

BP = Xn + CF - ΔR = 0

or

BP = Xn + CF = ΔR

Transactions with official reserves are used with a fixed exchange rate system so that the exchange rate remains unchanged. If the exchange rate is floating, then the balance of payments deficit is compensated by the inflow of capital into the country (and vice versa), and the balance of payments is evened out (without intervention, i.e. central bank interventions).

We prove this from a macroeconomic identity.

Y = C + I + G + Xn

Subtract from both parts of the identity value (C + G), we obtain:

Y - С - G = С + I + G + Xn - (С + G)

In the left part of the equation we obtained the value of national savings, hence: S = I + Xn or regrouping, we get: (I - S) + Xn = 0

The value (I - S) represents the excess of domestic investment over domestic savings and is nothing more than a capital account balance, and Xn is a current account balance. Rewrite the last equation:

Xn = S - I

This means that a current account surplus corresponds to a capital outflow (a negative capital account), since national savings exceed domestic investments, they are sent abroad, and the country acts as a lender. If the current account balance is negative, then national savings are not enough to secure domestic investment, so capital inflows from abroad are needed, and the country acts as a borrower. If capital flows into the country, the national currency becomes more expensive, and if capital outflows from the country, the national currency becomes cheaper. Intervention by the central bank in a floating exchange rate regime is not required.

To derive the balance of payments curve (BP curve), it is necessary to consider all the factors that influence the component sections of the balance of payments: 1) net exports (i.e., current account balance) and 2) capital flows (balance of capital account).

Factors affecting net exports. Net exports represent the difference between exports and imports (Xn = Ex - Im) and are a component of aggregate demand. Net exports can be either a positive value (if exports exceed imports, that is, Ex> Im), or negative values (if imports exceed exports, that is, Ex <Im). In macroeconomic models under "net exports" corresponds to the current account balance. If net exports are> 0, this means a current account deficit; if net exports <0, then this is the current account surplus.

Consider the factors affecting net exports. According to the IS-LM model, the net export formula is:

Xn = Ex (R) - Im (Y)

which means export:

- negatively depends on the interest rate (R),

- does not depend on the income level of the given country (Y) (i.e., it is an autonomous value, since it depends on the income level in other countries, and not on the domestic income level).

Recall that the change in the interest rate affects the value of exports through the exchange rate. The growth of interest rates in the country means that its financial assets (for example, bonds) become more profitable (that is, they are paid a higher interest income). Foreigners wanting to buy securities of a given country (for which they will receive a higher interest income than on securities in their own country), increase the demand for its national currency, which leads to an increase in the exchange rate of the national currency. The growth of the exchange rate makes the export of a given country more expensive for foreigners, since foreigners must exchange a greater amount of their currency in order to receive the previous amount of units of the currency of a given country and accordingly buy the same amount as before. Consequently, an increase in interest rates means an increase in the exchange rate and a reduction in exports.

Import is not an autonomous value because it:

- positively depends on the level of income in the country (Y)

besides import:

- positively depends on the interest rate (R) and, therefore, since the relationship between the interest rate and the exchange rate is direct:

- positively depends on the exchange rate (the higher the exchange rate of the national monetary unit, the more foreign currency units citizens of this country can receive in exchange for 1 unit of their currency and, consequently, the more imported goods they can buy, that is, imported goods they become relatively cheaper for the citizens of the country - they receive more units of foreign currency for the same number of units of their currency than before and therefore can buy more imported goods than before).

In addition to internal factors (the value of domestic income Y and the exchange rate e), the external factor also affects the net export (its ups and downs) - the amount of income in other countries. The higher it is, i.e. the richer other countries, the greater the demand for goods of a given country they impose, export is higher, and therefore net exports are higher.

Therefore, the net export formula can be written as:

Xn = Xn (Y, YF, e)

Net exports are affected by 2 effects:

1) income effect

Since the value of the income of a given country has an impact on imports, the net export formula can be written as: Xn = Xn - mpm Y, where Xn is the autonomous net export (the difference between exports and autonomous imports), i.e. which does not depend on income within the country, mpm is the marginal propensity to import, showing how much import will increase (decrease) while income grows (decreases) by one, i.e. mpm = ΔIm / ΔY, Y - the value of total income within the country. When Y grows (for example, during a cyclic rise), then Xn decreases, as imports increase, i.e. demand for imported goods. When Y falls (for example, during a cyclical decline), Xn increases, as imports decrease.

2) exchange rate effect

As already noted, changes in exchange rates affect exports and autonomous imports. If the national currency becomes more expensive, i.e. increasing its value in relation to other currencies, the export is reduced, and the import increases. And vice versa.

When considering factors affecting net exports, it is important to distinguish between nominal and real exchange rates.

Nominal and real exchange rate. All our previous arguments concerned the nominal exchange rate. The nominal exchange rate is the price of a national monetary unit expressed in a certain number of units of foreign currency, i.e. this is the ratio of the prices of two currencies, the relative price of the currencies of the two countries. The nominal exchange rate is set in the foreign exchange market, which consists of bank employees around the world who sell and buy foreign currency by telephone. When the demand for a country's currency rises in relation to its supply, these bank employees (foreign exchange traders) raise the price and the currency rises. And vice versa. If foreigners want to buy goods of a given country, the demand for its national currency rises, and these bank employees provide it in exchange for currencies of other countries, therefore the exchange rate rises (and vice versa).

In order to obtain a real exchange rate, as for obtaining any real value (real GDP, real wages, real interest rate), it is necessary to “clear” the corresponding nominal value from the impact of price level changes on it, i.e. from the effect of inflation.

Therefore, the real exchange rate is the nominal exchange rate adjusted for the ratio of price levels in a given country and in other countries (countries - trading partners), i.e. this is the relative price of a unit of goods and services produced in two countries: ε = e x P / PF,

where ε is the real exchange rate, e is the nominal exchange rate, P is the price level in the country, РF is the price level abroad.

The percentage change in the real exchange rate (rate of change) can be calculated by the formula: Δε = Δе (%) + (π - πF),

where Δε is the percentage change in the real exchange rate, Δe is the percentage change in the nominal exchange rate, π is the rate of inflation in the country, πF is the rate of inflation abroad. Thus, the real exchange rate is the nominal exchange rate adjusted for the ratio of inflation rates in the two countries.

The real exchange rate ε is also called terms of trade (terms of trade), as it determines the competitiveness of goods in a given country in international trade. The lower the real exchange rate (that is, the lower the nominal exchange rate, the lower the inflation rate in a given country and the higher the rate of inflation abroad), the better the terms of trade.

It is obvious that net exports are determined not by the value of the nominal exchange rate, but by the value of the real exchange rate, i.e. terms of trade, therefore, the formula of net exports: Xn = Xn - mpm Y - ηε,

where η is a parameter that shows how much net exports change when the real exchange rate changes by one and characterizes the sensitivity of net exports to changes in the real exchange rate, i.e. ΔXn / Δ.

The competitiveness of goods in a given country is increasing, i.e. the demand for goods of a given country will be greater and, consequently, net exports are higher if:

Therefore, the net export function:

Xn = Xn (Y, YF, ε)

Factors affecting the movement of capital.

The second section of the balance of payments is the capital account.

Consider what factors affect international capital flows - СF (capital flows). Since capital flows between countries as a result of the purchase and sale of financial assets by countries from each other, they also affect the exchange rate. If the demand for securities of this country is great, then the demand for national currency increases, and the exchange rate rises. The demand for securities is determined by their yield, i.e. interest rate. The higher the interest rate (that is, the higher the interest income on securities) in the country, the more attractive for investors are its financial assets. It does not matter to the investor in which country to buy financial assets, to invest in the country or in other countries. The main motive for the purchase of securities for the investor is their profitability. Thus, the main factor determining the demand for financial assets is the difference in the yield levels of securities in a given country and in other countries, i.e. the difference between the value of the interest rate in a given country (R) and the value of the interest rate abroad (RF), which is called the differential interest rate (interest rate). Therefore, the formula for capital flows is: CF = CF + s (R - RF),

where CF is autonomous capital flows, R is the interest rate in a given country, RF is the interest rate abroad, с is the sensitivity of the change in the amount of capital flow to changes in the difference between the internal interest rate and the interest rate abroad, i.e. to changes in the differential interest rates.

So, since under the floating exchange rate regime, the balance of payments formula is: BP = Xn + CF = 0,

then taking into account the factors affecting net exports (current account balance) and capital flows (capital account balance), we get:

BP = Ex - Im - mpm Y + CF + s (R - RF) = 0

We derive the balance of payments curve - BP curve. Since, in equilibrium, BP = 0, all points on the BP curve show such pairwise combinations (combinations) of income Y and interest rates R, which ensure a zero balance of payments.

Construction of the balance of payments curve

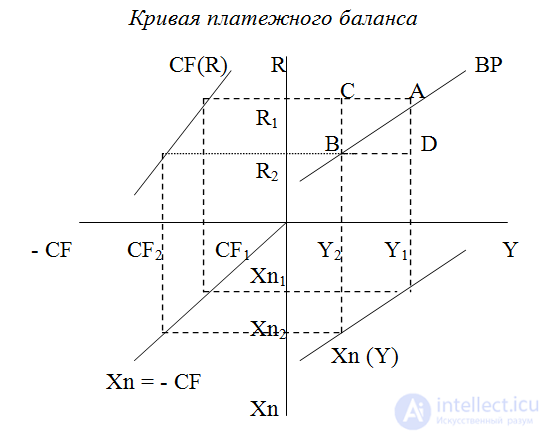

The graph of the BP curve in Y and R coordinates (first quadrant) can be obtained by plotting the net export curve Xn and the capital flow curve CF.

Во втором квадранте изображен график кривой потоков капитала. Кривая CF (кривая чистого экспорта капитала, т.е. чистого оттока капитала) имеет отрицательный наклон, поскольку чем выше ставка процента в стране, тем больше приток капитала (сapital inflow) в страну, т.е. импорт капитала, так как финансовые активы страны высокодоходны и привлекательны для инвесторов, то спрос на ценные бумаги страны повышается, и в страну притекает капитал. И наоборот, если ставка процента в стране уменьшается, ее финансовые активы становятся менее доходными, менее привлекательными для инвесторов, в том числе и для отечественных инвесторов, они предпочитают покупать ценные бумаги за рубежом, в результате из страны происходит отток капитала (capital outflow). Таким образом, чем внутренняя ставка процента ниже, тем больше отток капитала. Очевидно, что наклон кривой CF определяется коэффициентом с – чувствительностью потоков капитала к изменению дифференциала процентных ставок (разницы между внутренней и зарубежной ставкой процента). Тангенс угла наклона кривой CF равен с. Чем больше величина коэффициента с, тем более крутая кривая CF. А чем более крутая кривая CF, тем менее чувствительны потоки капитала к изменению дифференциала процентных ставок. Это означает, что увеличение дифференциала процентных ставок должно быть очень большим, чтобы это привело к изменению величины притока или оттока капитала. Таким образом, если величина с большая, и кривая CF крутая, то мобильность капитала низкая. Следовательно, коэффициент с характеризует степень мобильности капитала. Чем он больше, тем степень мобильности капитала меньше.

В третьем квадранте изображена кривая равновесия платежного баланса (ВР=Хn + CF = 0). Это биссектриса (линия под углом 450), поскольку для того, чтобы сальдо платежного баланса было равно 0, необходимо, чтобы сальдо счета текущих операций (Хn) было равно сальдо счета движения капитала с противоположным знаком (- CF).

В четвертом квадранте представлен график кривой чистого экспорта (товаров). Кривая Xn имеет отрицательный наклон, поскольку чем выше величина совокупного дохода страны (Y), тем больше импорт товаров и, следовательно, тем меньше чистый экспорт. Наклон кривой Xn определяется коэффициентом mpm – предельной склонности к импорту (тангенс угла наклона кривой Xn равен mpm). Чем больше mpm , тем кривая Xn более крутая. Это означает, что если чувствительность чистого экспорта к изменению ставки процента велика, то даже незначительное изменение величины дохода ведет к существенному изменению величины импорта и, следовательно, чистого экспорта.

Выведем кривую ВР (первый квадрант). При ставке процента R1 отток капитала (отрицательное сальдо счета движения капитала) составит CF1. Чтобы сальдо платежного баланса было нулевым, необходимо, чтобы чистый экспорт (положительное сальдо счета текущих операций) был равен Xn1, что соответствует величине дохода Y1. Получаем точку А, в которой величина дохода равна Y1, а ставка процента R1,. При ставке процента R2 отток капитала равен CF2, следовательно, чистый экспорт должен быть равен Xn2, что соответствует уровню дохода Y2. Получаем точку В, в которой величина дохода равна Y2, а ставка процента R2. Обе точки соответствуют нулевому сальдо платежного баланса. Соединив эти точки, мы получим кривую ВР, в каждой точке которой парные сочетания величины внутреннего дохода (Y) и внутренней ставки процента (R) дают нулевое сальдо платежного баланса.

The slope of the BP curve is determined by the slopes of the CF and Xn curves and depends on the values of the coefficients c and mpm. The more they are, i.e. the steeper the CF and Xn curves, the steeper the BP curve.

If the value of the internal income Y or the internal interest rate R changes, we get from one point of the BP curve to another point, i.e. moving along the curve.

The BP curve is shifted if the CF and / or Xn curves are shifted, and in the same direction.

Сдвиг кривой CF происходит при изменении: 1) валютного курса и 2) ставки процента в других странах. Рост валютного курса ведет к относительному удорожанию финансовых активов данной страны, поскольку иностранцам нужно поменять большее количество своей валюты, чтобы купить то же количество ценных бумаг, как раньше, и к относительному удешевлению иностранных финансовых активов, так как инвесторы данной страны должны будут обменять меньшее количество своей валюты, чтобы купить то же количество иностранных ценных бумаг, как раньше, и поэтому увеличивается отток капитала при каждом значении внутренней ставки процента, поэтому кривая CF сдвигается влево. Аналогично, рост ставки процента за рубежом ведет к росту доходности иностранных ценных бумаг, что увеличивает спрос на них и также приводит к оттоку капитала из страны, сдвигая влево кривую CF.

Кривая Xn сдвигается при изменении: 1) величины дохода в других странах и 2) реального обменного курса. Рост величины дохода в других странах увеличивает спрос на товары данной страны со стороны иностранцев и ведет к росту экспорта, что увеличивает чистый экспорт и сдвигает кривую Xn вправо. Рост реального обменного курса снижает конкурентоспособность товаров данной страны и ухудшает условия торговли, поэтому ее чистый экспорт сокращается, в результате кривая Xn сдвигается влево.

Таким образом, кривая ВР сдвигается влево, если:

Точки вне кривой ВР. Поскольку каждая точка на кривой ВР соответствует нулевому сальдо платежного баланса, то, очевидно, что точки вне кривой ВР (выше или ниже кривой) соответствуют неравновесию платежного баланса, т.е. либо отрицательному сальдо (дефициту), либо положительному сальдо (профициту) платежного баланса.

Возьмем точку, которая находится выше кривой ВР, например, точку С. В этой точке величина дохода равна Y2, что соответствует величине чистого экспорта Xn2, а ставка процента равна R1, что соответствует величине оттока капитала CF1. Величина Xn2 (положительное сальдо счета текущих операций) больше, чем CF1 (отрицательное сальдо счета движения капитала), следовательно, сальдо платежного баланса положительное, т.е. имеет место профицит платежного баланса. Таким образом, все точки, которые лежат выше кривой ВР соответствуют профициту платежного баланса.

Рассмотрим точку, которая находится ниже кривой ВР, например, точку D. В этой точке величина дохода равна Y1, что соответствует величине чистого экспорта Xn1, а ставка процента равна R2, что соответствует величине оттока капитала CF2. Величина Xn1 (положительное сальдо счета текущих операций) меньше, чем CF2 (отрицательное сальдо счета движения капитала), следовательно, сальдо платежного баланса отрицательное, т.е. имеет место дефицит платежного баланса. Таким образом, все точки, которые лежат ниже кривой ВР соответствуют дефициту платежного баланса.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics