Lecture

To ensure the implementation of trade and financial transactions between countries establishes a certain ratio between their national monetary units. The currency of the country is called the national currency. The ratio of national currencies is called the exchange rate (exchange rate). The exchange rate is the price of the national currency of one country, expressed in the national currency of another country. (For example, 1 pound = 2 dollars, which means that the price of 1 pound is equal to 2 dollars).

There are two types of exchange rates: 1) a slogan, which shows how many units of foreign currency can be obtained for one unit of domestic currency, i.e. this is the price of domestic currency, expressed in units of foreign currency (this is the so-called direct quotation that exists, for example, in the UK); 2) exchange, which is the inverse of the exchange rate and which shows how many units of domestic currency can be obtained in exchange for a unit of foreign currency, i.e. This is the price of a unit of foreign currency expressed in units of domestic currency (the so-called reverse quotation used in the USA, in Russia and in most European countries). So, the ratio of 1 pound = 2 dollars is the slogan exchange rate for Great Britain and the exchange rate for the USA.

(In our analysis, under the exchange rate, we will understand the slogan exchange rate, ie, direct quotation of currencies).

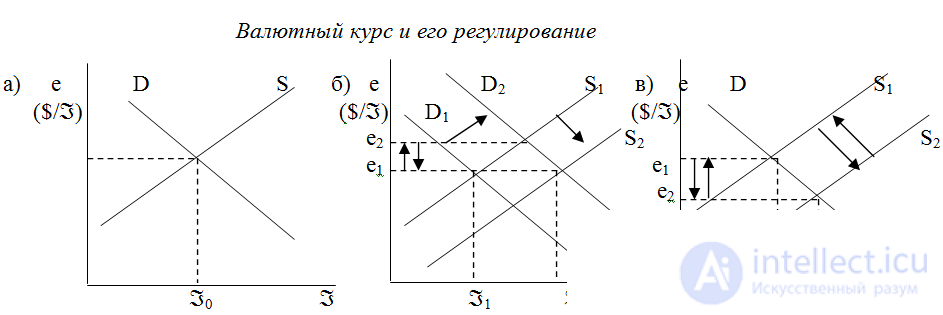

The exchange rate is set depending on the ratio of the demand for the national currency and the supply of the national currency in the foreign exchange market Forex (foreign exchange market) and is graphically presented in Figure 14-1 (a), where e is the exchange rate of the pound, i.e. the price of 1 pound, expressed in dollars, D is the demand curve for pounds, S is the supply curve for pounds. The demand curve for currency (pounds) has a negative slope, because the higher the exchange rate of the pound, i.e. the higher the price of a pound in dollars, the more dollars Americans have to pay in order to receive 1 pound in exchange, therefore, the less will be the demand for pounds on the part of Americans. The currency supply curve (pounds) has a positive slope, since the higher the exchange rate of the pound, the more dollars the British will receive in exchange for 1 pound, and therefore the higher the pound offer will be. The equilibrium exchange rate e0 is set at the intersection of the pound demand curve and the pound supply curve.

The demand for the national currency (pound) is determined by:

1) the demand of other countries for goods produced in a given country (in the UK) and 2) the demand of other countries for financial assets (stocks and bonds) of a given country (UK), because in order to pay for this purchase of goods and financial assets, foreign States (for example, the United States) must exchange their currency (dollar) for the currency of the country from which they buy (pound).

Therefore, the demand for a national monetary unit (pound) will be higher, the greater the desire of foreigners (for example, Americans) to buy goods produced in a given country (Great Britain) (that is, the greater the export of British goods) and acquire its financial assets (export (?) capital). The growth in demand for currency (a shift to the right in the demand curve for pounds from D1 to D2 in Fig. 20. 1. (b)) leads to an increase in its “price”, i.e. exchange rate (from e1 to e2). The growth of the exchange rate means that foreigners (Americans) must exchange (pay) more than their currency units (dollars) per unit of currency of a given country (pound). If initially we assumed that the exchange rate of a pound is $ 2 per pound, then its growth means that the ratio of currencies was, for example, $ 2.5 per pound.

The offer of the national currency (pound) is determined by:

1) the demand of a given country (UK) for goods produced in other countries (USA), i.e. for imported goods

2) the demand of a given country for the financial assets of other countries, because in order to pay for the purchase by a given country (UK) of goods and financial assets of other countries (USA), it must exchange its national currency (pounds) for the national currency of the country where she buys (ie for dollars).

The supply of the national currency (pounds) will be the greater, the greater the desire of the country (Great Britain) to buy goods and financial assets of other countries (USA). The growth in the supply of the national currency (pounds) (the shift to the right of the supply curve of pounds from S1 to S2 in Fig. 20. (c)) reduces its exchange rate (from e1 to e2). Exchange rate decline, i.e. The prices of the national currency mean that for 1 unit of the national currency (pound) it is possible in exchange to receive a smaller amount of foreign currency (dollars), for example, not 2 dollars for 1 pound, but only 1.5 dollars for 1 pound.

There are 2 exchange rate regimes: fixed and floating.

Fixed exchange rate. In the fixed exchange rate regime, the exchange rate is set by the central bank in a certain hard ratio, for example, $ 2 per pound and maintained by central bank interventions. Interventions of the central bank are the operations of buying and selling foreign currency in exchange for the national currency in order to maintain the exchange rate of the national currency at a constant level. So, if the demand for national currency increases, then its rate rises from e1 to e2 (Fig. 16-1 (b)). Meanwhile, the central bank must maintain a fixed exchange rate at the e1 level. Consequently, in order to lower the rate and return it from the e2 level to the e1 level, the central bank must intervene (intervene) and increase the supply of pounds by buying up dollars (i.e. presenting a demand for dollars).

As a result, the pound supply curve will shift to the right from S1 to S2 and the original pound rate of e1 will be restored. If the supply of the national currency increases (Fig. 20.1. (C)) as a result of an increase in demand for imported goods and foreign financial assets, the rate of the national currency (pound) will decrease (from e1 to e2), then the central bank, which is obliged to maintain a fixed rate at the level of e1, conducts intervention in order to increase the exchange rate. In this case, he should reduce the supply of the national currency (shift to the left of the supply curve of pounds from S2 to S1), presenting demand for foreign currency (dollar), i.e. exchanging for her national currency (pound). Central bank interventions are based on operations with foreign exchange reserves (foreign exchange reserves account is an integral part of the balance of payments under the fixed exchange rate regime). Intervention central bank related to the state of the balance of payments.

If the national currency rate rises, then foreign exchange reserves increase. The fact is that the currency rate increases, if the demand for goods of a given country increases, i.e. exports increase, which leads to the inflow of foreign currency into the country and the current account surplus and if the demand for financial assets of this country increases, which leads to capital inflows and a positive capital account balance. This causes a balance of payments surplus. To lower the exchange rate, the central bank increases the supply of the national currency by buying foreign currency. As a result, there is a replenishment of foreign exchange reserves.

Conversely, the depreciation of the national currency occurs when a given country increases the demand for imported goods and foreign financial assets. As a result of the growth in imports, there is a deficit in the current account, and because of the growth in demand for foreign financial assets, capital outflows occur, and the balance of the capital account also becomes negative. There is a balance of payments deficit. To finance this deficit and increase the rate of the national currency, the central bank reduces the supply of the national currency, i.e. buys it by selling foreign currency. As a result, foreign exchange reserves of the central bank are reduced.

Thus, under the regime of fixed exchange rates, the balance of payments equation (BP - balance of payments) is:

BP = Xn + СF - ΔR = 0

those.

Xn + CF = ΔR

where Хn is the current account balance, СF is the capital account balance, ΔR is the change in the value of foreign exchange reserves. If the sum of the balance of the current account and the capital account is positive, i.e. there is a surplus of the balance of payments, then foreign exchange reserves increase, and if negative, which corresponds to the deficit of the balance of payments, then foreign exchange reserves decrease. The balance of payments is balanced by changing the value of foreign exchange reserves by the central bank, i.e. by intervening (intervening) the central bank.

Under the regime of fixed exchange rates, both a chronic surplus in the balance of payments and a chronic deficit are dangerous. With a chronic balance of payments surplus, the possibility of over-accumulation of official reserves arises, which is fraught with inflation (since the central bank will have to constantly increase the money supply, that is, the national currency) in order to maintain a fixed exchange rate in the face of its growth. With a chronic surplus in the balance of payments, there is a threat of a complete depletion of official reserves (since the central bank will have to constantly increase the supply of foreign currency to maintain a fixed rate in the face of a decline in the balance of payments deficit), and its reserves are gradually depleted. This leads to the fact that fearing either inflation or the exhaustion of foreign exchange reserves, the central bank may be forced to officially change the exchange rate of the national currency, i.e. its price (value) relative to other currencies. The official increase in the exchange rate of the national monetary unit by the central bank under the fixed exchange rate regime is called revaluation (revaluation, that is, value increase).

The official decline in the exchange rate of the national monetary unit by the central bank in the fixed exchange rate regime is called devaluation (devaluation, ie, a decrease in value).

The system of fixed rates was developed and adopted in 1944 in the American city of Bratton Woods and therefore received the name of the Bratton Woods monetary system. According to this system:

- The reserve currency for international payments was the American dollar.

- the US Treasury undertook to exchange dollars for gold at the first presentation in the ratio of 35 dollars for 1 troy ounce (31.1 grams) of gold

- all national currencies were rigidly (in a certain fixed ratio) “tied” to the dollar and through the dollar to gold.

The American dollar replaced gold in international payments, because at that time the United States was the richest country in the world. They provided 57% of industrial production in the capitalist world, 30% of world exports and concentrated 75% of the gold reserves of capitalist countries.

The national currency of the United States — the dollar — was the strongest and most trusted. Gradually, however, the balance of forces in the world changed. An “economic miracle” occurred in Japan and Germany, the growth rates of their industrial production began to outpace the growth rates of the American economy. In 1954, the European Economic Community (EEC or Common Market) arose, which initially included 6 countries (Germany, France, Italy, Belgium, the Netherlands and Luxembourg), and now includes almost all the countries of Western Europe. The competitiveness of American products has fallen. Countries that have accumulated a large number of dollars (green paper), which Americans paid for the real values they purchased (goods and services), began to present dollars to the US Treasury for exchange for gold. US gold reserves began to melt rapidly. The United States was forced to announce the cessation of the exchange of dollars for gold, and in 1969 and 1971 to devalue the dollar, i.e. reduce the exchange rate of the dollar against other currencies. Even earlier, in 1967, due to the economic difficulties experienced by Great Britain in the aftermath of World War II, the central bank of this country (Bank of England) was forced to report the devaluation (ie, depreciation) of the pound against the dollar. Germany in 1969 conducted a revaluation (i.e. an increase in the exchange rate) of the mark against the dollar. The Bratton Woods Fixed Exchange Rate Crisis began. March 19, 1973 was introduced a system of flexible exchange rates.

Flexible exchange rate. The system of flexible (flexible) or floating (floating) exchange rates suggests that exchange rates are regulated by the market mechanism and are set by the ratio of demand and supply of currency in the foreign exchange market. Therefore, the balance of payments is balanced without intervention (interventions) of the central bank and is carried out through the inflow or outflow of capital. The balance of payments equation is:

BP = Xn + CF = 0

those.

Xn = - CF

If there is a deficit in the balance of payments, it is financed by capital inflows into the country. The fact is that the balance of payments deficit means that the demand for goods and financial assets of a given country is less than the demand of a given country for goods and financial assets of other countries. This leads to a decrease in the exchange rate of the national currency, as its supply increases (citizens of a given country offer the national currency in exchange for foreign currency in order to buy foreign goods and financial assets).

A depreciation of the exchange rate under a floating exchange rate regime is called currency depreciation (depreciation). The depreciation of currency makes national goods cheaper and favors the export of goods and capital inflows, since foreigners can receive in exchange for their currency more than a given country’s currency per unit of their currency.

If there is a surplus in the balance of payments, it is financed by capital outflows. A surplus means that the goods and financial assets of a given country are more in demand than foreign goods and financial assets. This increases the demand for national currency and increases its exchange rate. The growth of the exchange rate under the regime of floating exchange rates is called the appreciation of currency. The appreciation of the currency leads to the fact that foreigners must change more of their currency in order to receive a unit of currency of a given country. This makes national goods more expensive and reduces exports, stimulating imports, i.e. increased demand for imported goods and foreign securities, since now they can be bought more. As a result, the exchange rate of the national currency decreases.

However, the modern monetary system is not a system of absolutely flexible exchange rates, because the US Federal Reserve and a consortium of European banks do not allow the dollar to fluctuate completely freely in order to prevent its sharp fall (as in 1985), i.e. The US Fed seems to be artificially backing the dollar, buying it and artificially increasing the demand for the dollar and maintaining its higher exchange rate .. If the central bank does not interfere in setting the exchange rate, then this is a clean floating system. If the central bank intervenes, then it is “dirty” (dirty) or “managed floating”. The modern monetary system is a “dirty swimming” system, since the central banks of Europe fear the collapse of the dollar, which will make American exports more competitive and reduce American demand for European and Japanese goods. This can lead to bankruptcies and the closure of enterprises in other countries and an increase in unemployment.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics