Lecture

Fiscal policy is a measure taken by the government to stabilize the economy by changing the amount of revenues and / or expenditures of the state budget. (Therefore, fiscal policy is also called fiscal policy.)

The objectives of fiscal policy as any stabilization (counter-cyclical) policy aimed at smoothing cyclical fluctuations of the economy are to ensure: 1) stable economic growth; 2) full employment of resources (primarily solving the problem of cyclical unemployment); 3) a stable price level (solving the problem of inflation).

Fiscal policy is a policy of regulating the government primarily of aggregate demand. Regulation of the economy in this case occurs through the impact on the value of total costs. However, some fiscal policy instruments can be used to influence aggregate supply through influencing the level of business activity. Fiscal policy is pursued by the government.

The instruments of fiscal policy are the expenditures and revenues of the state budget, namely: 1) government purchases; 2) taxes; 3) transfers.

The impact of fiscal policy instruments on aggregate demand is different. From the formula of aggregate demand: AD = C + I + G + Xn, it follows that government procurement is a component of aggregate demand, so their change has a direct effect on aggregate demand, and taxes and transfers have an indirect effect on aggregate demand by changing the amount of consumer spending ( C) and investment costs (I).

At the same time, the growth of government procurement increases aggregate demand, and their reduction leads to a decrease in aggregate demand, since government procurement is part of total expenditures.

Growth in transfers also increases aggregate demand. On the one hand, since the increase in social transfer payments (social benefits) increases the personal income of households, and, consequently, all other things being equal, disposable income increases, which increases consumer spending. On the other hand, an increase in transfer payments to firms (subsidies) increases the possibilities of domestic financing of firms, the possibility of expanding production, which leads to an increase in investment costs. Reducing transfers reduces aggregate demand.

Tax increases operate in the opposite direction. An increase in taxes leads to a decrease in both consumer (since disposable income is reduced) and investment spending (as retained earnings, which are a source of net investment), and, consequently, to a reduction in aggregate demand. Accordingly, tax cuts increase aggregate demand. Tax cuts lead to a shift in the AD curve to the right, which leads to an increase in real GNP.

Therefore, fiscal policy instruments can be used to stabilize the economy at different phases of the economic cycle.

Moreover, it follows from the simple Keynesian model (the Keynesian cross model) that all instruments of fiscal policy (government procurement, taxes and transfers) have a multiplicative effect on the economy, therefore, according to Keynes and his followers, the economy should be regulated by using the tools of fiscal policy, and above all by changing the size of public procurement, since they have the greatest multiplier effect.

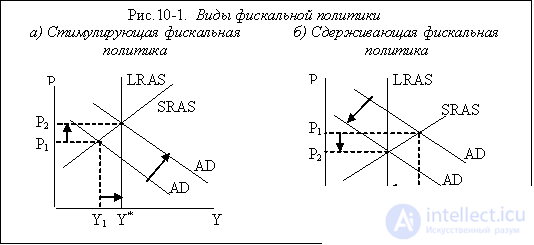

Depending on the phase of the cycle in which the economy is located, the instruments of fiscal policy are used differently. There are two types of fiscal policy: 1) stimulating and 2) restraining.

Stimulating fiscal policy is applied in a recession (Fig. 10.1 (a)), aims to reduce the recessionary output gap and reduce unemployment and is aimed at increasing aggregate demand (total expenditure). Its instruments are: a) an increase in public procurement; b) tax cuts; c) an increase in transfers. Restraining fiscal policy is used in the boom (in case of overheating of the economy) (Fig. 10.1. (B)), aims to reduce the inflationary output gap and reduce inflation and is aimed at reducing the aggregate demand (total expenditures). Its tools are: a) reducing government procurement; b) an increase in taxes; c) reduction of transfers.

In addition, distinguish fiscal policy: 1) discretionary and 2) automatic (non-discretionary). Discretionary fiscal policy is a legislative (official) change by the government of the size of government purchases, taxes and transfers in order to stabilize the economy.

Automatic fiscal policy is associated with the action of built-in (automatic) stabilizers. Built-in (or automatic) stabilizers are instruments whose magnitude does not change, but the very presence of which (embedded in the economic system) automatically stabilizes the economy, stimulating business activity during a recession and restraining it during overheating. The automatic stabilizers include: 1) income tax (which includes both household income tax and corporate income tax); 2) indirect taxes (first of all, value added tax); 3) unemployment benefits; 4) poverty benefits.

Consider the mechanism of the impact of built-in stabilizers on the economy.

Income tax acts as follows: during a decline, the level of business activity (Y) decreases, and since the tax function is: T = tY (where T is the amount of tax revenues, t is the tax rate, and Y is the total income (output)) then the amount of tax revenues decreases, and when the economy overheats, when the actual output is maximum, tax revenues increase. Note that the tax rate remains unchanged. However, taxes are exemptions from the economy, reducing the flow of expenditures and, consequently, revenues (let us recall the model of circulation). It turns out that during a decline, withdrawals are minimal, and when overheated, they are maximum. Thus, due to the presence of taxes (even chord, i.e. autonomous), the economy seems to be automatically “cooled” during overheating and “heated” during a recession. As was shown in Chapter 9, the emergence of income taxes in the economy reduces the multiplier value (the multiplier with no income tax rate is greater than when it is present: [1 / (1-mpc)]> [1 / (1-mpc (1- t )]), which enhances the stabilization effect on the economy of income tax. Obviously, the progressive income tax has the strongest stabilizing effect on the economy.

Value Added Tax (VAT) provides built-in stability as follows. In a recession, sales are reduced, and since VAT is an indirect tax, a part of the price of a product, when sales fall, tax revenues from indirect taxes (exemptions from the economy) are reduced. When overheating, on the contrary, since total revenues grow, sales increase, which increases revenues from indirect taxes. The economy automatically stabilizes.

With regard to unemployment benefits and poverty, the total amount of their payments increases with a recession (as people begin to lose their jobs and become poor) and decrease with a boom, when there is “over-employment” and income growth. (Obviously, in order to receive unemployment benefits, you must be unemployed, and in order to receive poverty benefits, you must be very poor). These benefits are transfers, i.e. injections into the economy. Their payment contributes to the growth of income, and, consequently, costs, which stimulate the rise of the economy during a recession. Reducing the total amount of these payments with a boom has a restraining effect on the economy.

In developed countries, the economy is regulated by 2/3 through discretionary fiscal policy and by 1/3 - due to the effect of the built-in stabilizers.

It should be borne in mind that such fiscal policy instruments as taxes and transfers act not only on aggregate demand, but also on aggregate supply. As already noted, tax cuts and an increase in transfers can be used to stabilize the economy and combat cyclical unemployment during a recession, stimulating growth in total spending, and, consequently, business activity and employment. However, it should be borne in mind that in the Keynesian model, simultaneously with an increase in aggregate output, a decrease in taxes and an increase in transfers causes an increase in the price level (from P1 to P2 in Fig. 10-1 (a)), i.e. is a pro-inflation measure (provokes inflation). Therefore, during the boom period (inflation gap), when the economy is “overheated” (Fig. 10-1 (b)), an increase in taxes can be used as an anti-inflationary measure (price level decreases from P1 to P2) and tools to reduce business activity and stabilize the economy. and reduced transfers.

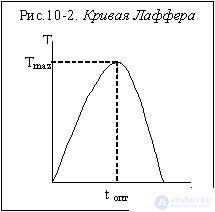

However, since firms view taxes as costs, a tax increase leads to a reduction in aggregate supply, and a tax reduction leads to an increase in business activity and output. A detailed study of the impact of taxes on aggregate supply belongs to the economic adviser to US President R. Reagan, the American economist, one of the founders of the concept of "economic theory of supply" ("supply-side economics") Arthur Laffer. Laffer built a hypothetical curve (Figure 10-2.), Which showed the impact of changes in the tax rate on the total amount of tax revenues to the state budget. (This curve is called hypothetical because Laffer did not draw his conclusions on the basis of an analysis of statistical data, but on the basis of a hypothesis, that is, logical reasoning and theoretical reasoning).

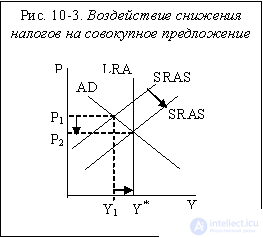

Using the tax function: T = t Y, Laffer showed that there is an optimal tax rate (t opt.) At which tax revenues are maximum (T max.). If you increase the tax rate, the level of business activity (total output) will decrease, and tax revenues will decrease as the taxable base (Y) decreases. Therefore, in order to combat stagflation (simultaneous decline in production and inflation), Laffer in the early 1980s proposed a measure such as a reduction in the tax rate (and income and corporate profits).

The fact is that, unlike the effect of tax cuts on aggregate demand, which increases production, but provokes inflation, the effect of this measure on aggregate supply is anti-inflationary (Fig.10.3), i.e. the increase in production (from Y1 to Y *) is combined in this case with a decrease in the price level (from P1 to P2).

The advantages of fiscal policy include:

Disadvantages of fiscal policy:

1. The effect of crowding out. The economic meaning of this effect is as follows: an increase in budget expenditures during a recession (an increase in government purchases and / or transfers) and / or a reduction in budget revenues (taxes) leads to a multiplicative increase in total income, which increases the demand for money and increases the interest rate on money market (loan price). And since loans, in the first place, are taken by firms, the rise in the cost of loans leads to a reduction in private investment, i.e. to the "crowding out" of the investment costs of firms, which leads to a reduction in the value of output. Thus, part of the total output is “repressed” (not produced) due to a reduction in the value of private investment expenditures as a result of an increase in the interest rate due to the government’s stimulating fiscal policy.

2. The presence of internal lag. Internal lag is the period of time between the need to change a policy and the decision to change it. Decisions on changing fiscal policy instruments are made by the government, but they cannot be put into action without discussion and approval of these decisions by the legislative authority (Parliament, Congress, the State Duma, etc.), i.e. giving them the force of law. These discussions and approvals may require a long period of time. In addition, they come into effect only starting from the next fiscal year, which further increases the lag. During this period of time, the situation in the economy may change. So, if initially there was a recession in the economy, and stimulating fiscal policy measures were developed, then at the moment of their beginning, recovery could already begin in the economy. As a result, additional stimulation can lead the economy to overheating and provoke inflation, i.e. have a destabilizing effect on the economy. Conversely, restraining fiscal policy measures developed during the boom period can exacerbate the recession due to the presence of a prolonged internal lag.

3. Uncertainty. This shortcoming is characteristic not only for fiscal, but also for monetary policy. Uncertainty concerns:

4. The budget deficit. Opponents of Keynesian methods of regulating the economy are monetarists (monetarists), supporters of the supply-side economics theory and rational expectations theory — that is, Representatives of the neoclassical direction in economic theory consider the state budget deficit to be one of the most important shortcomings of fiscal policy. Indeed, the instruments of stimulating fiscal policy pursued in a recession and aimed at increasing aggregate demand are the increase in government purchases and transfers, i.e. budget expenses, and tax cuts, i.e. budget revenues, which leads to an increase in the state budget deficit. It is not by chance that the recipes of state regulation of the economy, which Keynes proposed, were called “deficit financing”.

The problem of budget deficit was particularly acute in most developed countries that used Keynesian methods of economic regulation after World War II in the mid-1970s, and the so-called “double debts” arose in the USA, in which the state deficit budget combined with a balance of payments deficit. In this regard, the problem of financing the state budget deficit has become one of the most important macroeconomic problems.

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics