Lecture

2.3. Motivational-volitional components

Economic motives

Economic motives are a special category of motives. Motives related to the accumulation of wealth, competition, selfishness and altruism, the pursuit of profits, risk appetite and transactions, have an economic focus.

The study of economic motives helps in explaining economic behavior as a relatively autonomous, integral area of behavior.

2.3.1. Motives of accumulation

The author of the "basic psychological law" J. Keynes, comparing the driving forces of consumption motives and savings motives, notes that usually the impulse to satisfy the urgent needs of a person and his family is greater than the impulse to accumulate in meeting the urgent needs of a person and his family. 10 They are distinguished by the following reasons for saving or, in its terminology, “abstaining from spending”:

• caution (creating a reserve for contingencies in a competitive environment);

• forethought (taking into account that in the future the ratio between incomes and expenses will change for the worse due to the need to provide old age, to give family members education, to maintain dependents);

• prudence (the desire to secure income in the form of interest or the expected increase in the value of the property in the future, as people often prefer more consumption in the future compared to less consumption in the present);

• striving for the best (the motive is based on the widespread unconscious desire to see in the future a gradual increase in one’s living standards, the possibility of increasing one’s future expenses, even when the very use of benefits can diminish);

• the desire for independence (financial independence provides a person with more personal freedom);

• enterprise, as the provision of freedom for speculative and commercial transactions, as the desire to provide resources for making further investments, without resorting to debts or to the help of the capital market;

• the desire to leave the heirs state;

• sense of stinginess as such, when a person is motivated by an unsubstantiated persistent prejudice against the act of spending itself.

2.3.2. Investment Motives

These are extremely complex and contradictory, according to Keynes, motives. They underwent significant changes after the separation of managerial functions from ownership of capital. If before, the hierarchy of motives was based on the attitude to business as a life vocation, creative self-realization, then after separation of management from ownership, commercial transactions through stock and currency exchanges create the basis for a very dynamic, controversial and ambiguous motivation (income generation, excitement, risk) .

The leading motive is the game motive "outrun the bullet", "outwit the crowd and fade a fake or worn coin to the neighbor." In the course of his reflexive game, each strive earlier to guess not the actual price of future income (this is impossible on the stock exchange), not the opinion of others about it, but “the average opinion as to what the average opinion will be”.

When it comes to private investment of the population, the trust factor comes to the fore. “In economic life,” wrote VM Bekhterev (referring to NN Golovin), “the law of supply and demand is not its only leader. Along with it, in all cases, there is also a trust factor, the significance of which is with particular force during economic shocks. In these cases, trust plays an even bigger role than economic factors. " eleven

The problem of the prospects of private investment in our country is extremely relevant, since the savings of the population are one of the important factors of economic growth. However, private investment is held back by distrust of financial institutions, and the population mainly uses non-investment models of savings behavior.

Modern macroeconomic theory states that within a market economy, decisions about savings and investments are made essentially by different groups of people. Bringing to fit the differences between the subjects of savings and investors is a serious problem of macroeconomic optimization of the economy. One of the main tools for combining the goals of savers and investors is the interest rate on deposits and loans, but this is not the only significant factor. Socioeconomic studies have shown that some families save to make large purchases that exceed the value of mobile income. Savings are also made for future household needs and as a reserve for an emergency. None of the motives discussed above is particularly sensitive to the interest rate on deposits.

Given these circumstances, E.M. Abrahamova and L.N. Ovcharova was offered the following typology of savings motivations of the population. 12

1. Orientation of savings only on current consumption.

2. Creating savings to reserve for an emergency.

3. Formation of savings in order to purchase expensive items (purchase of durable goods: construction, repair or purchase of housing, cottages, garage; purchase of vehicles and their repair).

4. The motives of savings, focused on the future needs of the family and the costs associated with health and leisure activities (education, recreation, sports, rehabilitation, treatment, help for children).

5. The combination of the savings orientation of the third and fourth groups, the desire to have a supply of funds to spend them as needed.

6. Motives to accumulate and use savings for investment purposes (for business, purchase of shares and securities, as a source of additional income).

Savings serving the last group of motives are characterized by higher elasticity relative to investment regulation instruments; serving the third, fourth and fifth groups are sufficiently sensitive to changes in the investment sphere, and the savings of the first two groups practically do not respond to investment policies. In recent years, the propensity to save has become increasingly pronounced, and in donor regions a significant number of families (over 30%) have investment preferences in the use of savings.

However, the propensity to save does not lead to the automatic growth of organized savings, which are an investment resource. Until public confidence in the government and financial institutions is restored, the population will prefer to keep a significant portion of savings in cash and refrain from placing them, or their preferences related to accommodation will be different from the state’s expectations. As shown by our study of attitudes and motives for investing in insurance funds, investors prefer foreign insurance companies to domestic (as well as private ones to state funds) against the background of the government’s constant concern about the lack of investment activity of the population.

2.3.3. Labor and consumption motives

According to A. Marshall, the most stable motive of a person’s work activity is the desire to receive material remuneration for work 13 . The payment received may be spent on a variety of purposes, depending on what the person is (consumption is an exclusively psychologized aspect of economic behavior). The goals of spending can be sublime and selfish, but A. Marshall believes that money will always be the motive. This creates the prerequisites for the aspirations, inclinations, motives or motivating forces of a person, inaccessible to direct measurement, to be measured indirectly through their external manifestations, appearing in monetary form. The amount of money for which a person is ready to perform tedious work somehow characterizes the measure of readiness to overcome the burden of labor. The amount of money that a person is willing to pay for a thing or service is correlated with the force of the motivating forces pushing for their loss.

Without rejecting the polymotivation of work, mentioning also the feeling of enjoying the process of doing a good job, the willingness to sacrifice yourself for the sake of family, neighbors and your country, vanity and carelessness, the desire for a virtuous life for the sake of your own merits, Marshall insists on the most important role the motive of material remuneration for labor.

One of the modern classifications of labor motives 14 includes three types of incentives to engage in labor:

- the motivation of public order (awareness of the need to benefit society, to assist others, unwillingness to pass for a parasite);

- obtaining material benefits to meet the material and spiritual needs;

- satisfaction of the need for self-actualization, self-expression, self-realization.

Describing consumer motivation, A. Marshall identified three basic needs: the desire for diversity, the desire to attract attention and the thirst for recognition as such. A more detailed, recognized by psychologists and widely used in practice is the classification of the needs of Abraham Maslow 15 .

2.3.4. The inefficiency of "economic egoism"

The motives of economic egoism and altruism are of particular interest for the theory and practice of managing the socio-economic side of life. A. Smith focused economic entities on the "selfishness of another." Is it always better to be selfish?

To illustrate the inefficiency of economic egoism, first of all, refer to the classical scheme, taken from game theory. It is called the prisoner's dilemma. Consider a scheme for two participants. Two prisoners are suspected of involvement in a crime, the commission of which they are not recognized. The bailiff speaks to them separately. If they both confess, they will receive 3 years in prison. If none of them is recognized, they will go to prison for 1 year. But if one of them confesses, and the other conceals his guilt, the first will be released, and the second will be in prison for a term of ten years. Interaction between prisoners is prohibited. Each prisoner will understand that confession leads to less severe punishment regardless of the behavior of the other participant. If both of them think so, in the end, both of them will admit that the servants of the law expect it.

Table 1.

Outcome matrix of prisoner's dilemma

|

Prisoner I |

|||

|

not recognized |

recognized |

||

|

Prisoner II |

not recognized |

-1, -1 |

-10,0 |

|

recognized |

0, -10 |

-3, -3 |

Obviously, the cooperation option does not bring the maximum gain, but if each of the criminals acts as an "economic man", both suffer.

On the basis of the prisoner's dilemmas, economic decision-making matrices have been developed regarding the behavior of another actor - competitors, partners, etc. For example, entering the market with a new product involves taking into account the possible actions of competitors. Profit will be greater if the competing side does not enter the market at the same time as your company with a similar product, as a crowded market will lead to losses.

In relation to problems of payment in public transport, maintaining cleanliness, saving resources and the environment, the prisoner's dilemma is often called the road hare dilemma. The right of choice to contribute or not to the structures of public use, to share or not the costs, for example, for public transport, remains with the user. He will win if someone else pays for him, but loses not only if he pays for someone, but above all when no one pays. In this case, oppose individual rationalism and public sanity.

The dilemma of a prisoner or a transport hare can be considered for the situation of several participants. Let's stop on the following example.

Residents of an apartment building want to strengthen the main door for security. The meeting discusses the details. Suppose the entrance includes 20 apartments, and the security system costs $ 120. If all tenants cooperate, each apartment will cost $ 6. The benefit for each tenant is $ 120, which is at least $ 114 of net income (see Table 2). If none of the tenants do not cooperate, they will miss the opportunity to receive benefits from joint activities.

table 2

Outcomes of donations for fixed social needs

|

Number of investors |

Contribution per person (in USD) |

Net profit per person (in dollars) |

|

20 |

6.00 |

114.00 |

|

nineteen |

6.32 |

113.68 |

|

15 |

8.00 |

112.00 |

|

'ten |

12.00 |

108.00 |

|

five |

24.00 |

96.00 |

|

one |

120.00 |

0.00 |

|

0 |

0.00 |

0.00 |

The task

Analyze the table. 2. Present graphically the dependence of the benefit on the number of participants in a collective event and compare it with the benefit of the evaders.

The total benefit per person increases with the number of contributors. This applies to investors as well as road hares. The differences between the results of evaders and collaborators decreases with an increase in the number of collaborators. And while evasion is a more economically rational decision, the less likely it is that the more people will understand the need to cooperate.

2.3.5. Altruism and cooperative behavior

From the point of view of economic psychology, altruism is expressed in behavior-help, gifts, charitable donations, behavior in conditions of social dilemmas and negotiations. From altruistic motives depend preferences in the field of distribution of money (or profit).

There are various attempts to explain altruistic behavior. You can consider altruism as a variant of egoism. For a person, a large number of goals (“benefits”) are relevant at the same time, and irrationality with respect to one turns into rationality with respect to another. Altruistic behavior (the absence of any visible benefit of any type) means only a focus on other values, in the achievement of which the behavior is rational, i.e. takes into account the balance of "cost - result".

In economic activity, purely altruistic behavior is also widely manifested. First, it functionally depends on the amount of income of the subject. From someone who has the material opportunity to be more generous, you should rather expect donations, charity.

Secondly, the individual psychological characteristics of ethical motivation are an important factor in behavior. An attempt to measure the degree of altruism on the basis of how a person divides salary between himself and others or how he evaluates himself and others on his contribution to the activity made it possible to distinguish the following types 16 :

• the cooperative type was presented by the subjects who preferred equal pay for themselves and others;

• competitive type was characterized by the preference of different wages in their favor;

• the individualistic type has distanced itself from the wishes of the salaries of the others.

It turned out that humanitarian students demonstrate more altruistic behavior, and business learners are more concerned with their own benefit.

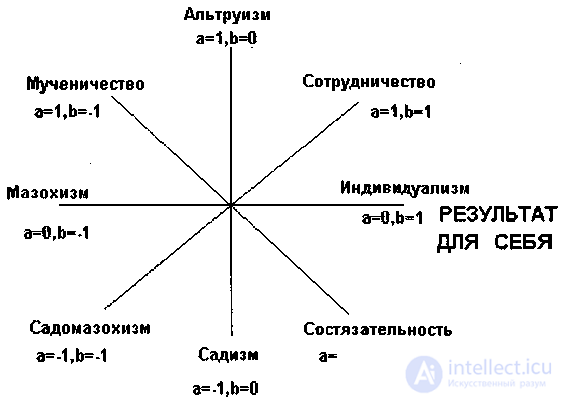

Since the benefit to other people is often associated with the benefit of an individual, a person attaches some importance to what the outcome of the case will be for others. To convey this idea in a simple form, the result of the case for themselves is designated as P and the result of the case for another as O. Altruistic motivation in relation to the other is transmitted by the value a given by O and changes from -1 to +1. The desire of a single person to the overall result is denoted as P + aO. If we assume that P also varies, and these changes are transmitted by the value of b , which also varies from -1 to +1, then the classification of the forms for the ratio of the result for oneself and the result for another will become clear.

RESULT FOR ANOTHER

Figure 5. Classification of preferences regarding the result for yourself and the result for another.

The maturity of economic consciousness presupposes the dominance of cooperation among the many forms of manifestation of the "benefit for oneself - benefit for others" ratio. Cooperation (advantageous to both partners) is more effective, more creative than competition (advantageous to itself to the detriment of another), individualism (beneficial to itself only), altruism (beneficial to the other) and moreover martyrdom (beneficial to the other to the detriment of itself), masochism (only self-harm ), sadism (damage to another) and sadomasochism (damage to oneself and to another). In many economic situations, cooperative, cooperative behavior rather than action aimed at immediate personal gain is required. Even in conditions of active competition, a contract is often more profitable than a struggle. In the field of economics, maximizing efficiency is achieved by incorporating the results of the case for others into one’s own interests, and economic egoism ultimately turns out to be ineffective.

2.3.6. Willful components of economic behavior

The volitional components of economic consciousness and behavior include economic norms, economic interest, economic action, activity.

Экономические нормы не выделялись до недавнего времени в самостоятельный вид социальных норм (стандартов поведения, регламентирующих отношения людей, "правил игры"). Однако в этом возникла необходимость, потому что они могут и стимулировать, и тормозить активное экономическое поведение, предприимчивость.

Одна из особенностей экономических норм заключается в том, что они, как правило, закрепляются юридически, приобретая статус правовых, и наделяются соответствующими средствами контроля (санкциями) за их соблюдением 17 .

Экономический интерес развивается на основе мотива, но под регуляторным воздействием норм. Если рассматривать собственность как определенную форму власти экономических благ над человеком, то экономический интерес — это форма действия власти собственности на волю субъекта хозяйствования и источник хозяйственной активности 18 . Еще Адам Смит подчеркивал разницу трудовой активности на своем и на ничьем поле.

Поскольку изменения в экономике на макроуровне происходят посредством политической воли, ее изучение представляет важнейшую проблему на стыке с политической психологией.

Задание

1. Какие мотивы относятся к экономическим?

2. Какие мотивы накопления (сбережения) Вы знаете?

3. Назовите причины альтруистических мотиваций в экономическом поведении.

Контрольное задание

1. Всегда ли человек поступает рационально? Различается ли рациональность с экономической и психологической точки зрения?

2. В чем сущность закона Йеркса-Додсона и как он может быть применим в Вашей деятельности?

3. Приведите примеры ситуаций, в которых экономический эгоизм неэффективен.

Test questions:

Дайте определение экономического поведения.

Каковы экономические и психологические детерминанты экономического поведения?

В чем состоит отличие экономического и психологического подходов к изучению экономического поведения?

Каковы составляющие научного знания об экономическом поведении?

В чем смысл аксиомы «транзитивности»?

В чем смысл аксиомы «замещения»?

Проиллюстрируйте примерами несостоятельность аксиомы «жадности»?

Перечислите и дайте характеристику основных видов систематических ошибок, допускаемых при оценке вероятностей.

Explain with a specific example how the parameters are related: the difficulty of the task and the level of arousal?

Comments

To leave a comment

Economic psychology

Terms: Economic psychology