Lecture

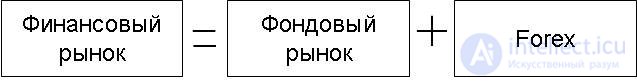

The global financial market can be defined as an institutional structure or a mechanism that provides for the creation and exchange of financial assets [Zhizhilev]. Usually, the structure of the financial market is considered as shown in Figure.

In the money market (Forex) short-term debt obligations (maturity less than a year) and the actual money as a commodity.

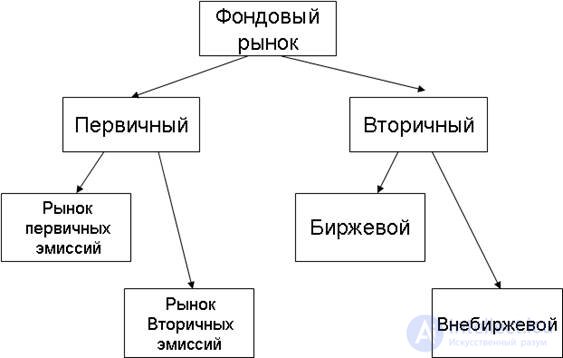

Long-term financial instruments are traded on the stock market with a maturity of more than a year. The structure of the stock market can be represented as shown in Figure.

The world's largest stock exchanges are:

Virtually every country has its own stock exchange (or several) trading in financial assets. In the Russian Federation there are 3 exchanges:

MICEX is the largest stock exchange in the former USSR and is among the 20 largest stock exchanges in the world. MICEX is a member of WFE - World Federation of Exchenges.

Daily stock turnover: NYCE 1.14 billion shares, NASDAQ 2.48 billion shares.

A broker is a legal entity that performs: facilitating transactions between customers and third parties; making transactions for the client; the commission for the client of other legal or factual actions in a particular area of business activity [1].

You must be very scrupulous about choosing your broker. One of the key points is how much this broker is on the market, as well as interest rates for services. For example, Sberbank-broker at the Gals tariff with turnover from 1 to 3 million rubles, the commission is 0.1%, Finam takes 0.3%, VTB 24 takes 0.029% (tariffs include VAT).

According to the MICEX, the number of trading clients was as follows: Sberbank 207 thousand people, VTB 24 153 thousand, Finam 80 thousand.

In the Russian market, for ordinary customers, there are basically only two types of connection: to the Forex market through the MetaTrader terminal and to the stock market through the Quik terminal, there are other options, but they are not so common. Under the usual customers, the author refers those who are not ready to connect with the amount of $ 10,000 or higher. According to the experience of the author and a large number of traders from the Internet community, it is not necessary to connect to the Forex market, the fact is that in such connections, via the Metatrader terminal (currently v.4), there is a very high leverage for Micro accounts, and usually through them, newbies are registered. The shoulder is 50, 100 and higher. The depot (account) is reset in a short period of time. It is very difficult, even impossible, to guess where the currency quotes will go - they are not taken either by statistical methods or technical analysis. Only developed intuition helps to work on the Forex market and knowledge of the fundamentals of the foreign exchange market. According to estimates of the Internet community in the Forex market, 10% of traders win, and lose 90%, respectively. Of the dealing centers, rarely anyone opens data on customer profitability, but for example, the Forex Club in 2007 published data on which for 83.1% of the company's customers was unprofitable and only 16.9% were trading on Forex with a profit. A much more acceptable solution for beginners is connecting via Quik to the stock market, in this case the leverage is 3 for beginners and 10 for experienced ones (that is, here this moment is at least honest!). At the same time, access to the stock market is usually provided by stable banks and investment funds, and access to Forex through Metatrader is usually unknown to anyone. It should also be noted that Metatrader is a “kitchen” [2], which only broadcasts currency quotes and does not issue client bets to real Forex, but crosses orders inside its server. Also, one should not believe demo accounts of Metatrader, on which big money is usually earned in demo mode. In practice, with "live" money is usually the opposite. But we note the following point - Metatrader has a very handy built-in software for programming trading systems, indicators and scripts. The MQL4 language of the Metatrader terminal is very similar to the C language, or rather, this is the C syntax, only expanded with a large number of special functions. The disadvantages include the absence of a debugger, the cost is now by writing to a text file or by displaying messages in a terminal window. QUIK also has a built-in programming language - QPILE, but it is far from perfect. However, all the necessary functions are present. QPILE disadvantages can be solved using a large number of data output options in different environments, such as Excel or Access, and then use the QPILE and PL VBA macros.

We present the parameters for 2009 of one of the largest brokerage companies in Russia (included in the TOP10) of KIT Finance LLC: the total number of client accounts is 17,000; turnover of securities and derivatives 15.1 trillion. rubles; operations with shares at the same time occupied 82% of the turnover, and futures and options 10%; net profit of 145 million rubles; Broker's equity capital is 682 million rubles.

Let us single out among the financial institutions leading activities in the markets Mutual funds . Mutual funds are a portfolio of securities (for example, shares) owned by a group of fund shareholders, and the management company (MC) manages these securities. In principle, mutual funds are the same mutual funds (mutual funds), with some differences. The main difference is the payment of dividends to shareholders. In the conditions of activity of all Russian mutual funds, dividends are reinstated, that is, the investor cannot receive dividends on his account. In mutual funds, the investor has practically no restrictions on operations with dividends, you can get them into the account, including partially, you can reinvest. In Russia, mutual funds are not yet very common, unlike mutual funds (large Russian mutual funds are Troika Dialog, Keith Finance). An explanation of the principle of the fund’s operation is usually added to the name of the mutual fund: income fund (Inc.), if it pays dividends, and accumulation (Acc.). if reinvests. Examples: “Threadneedle European High Yield Bond Retail Gross EUR Acc” and “Allianz RCM BRIC Stars - A - EUR Inc”. Another difference between mutual funds and mutual funds is the ability to acquire units of funds through Internet brokers (for Russia). Funds are divided into the following categories:

In general, in the world there is a huge amount of mutual funds for every taste. Rating of American funds can be viewed at www.smartmoney.com, European ones at www.morningstar.co.uk. There are huge Mutual Funds that can be attributed to market makers and observing the dynamics of changes in their portfolios can give some clue when playing in financial markets. The largest mutual funds include: “American Century Funds”, “Baron Funds”, “Dreyfus”, “Fidelity Funds”, “Janus”, “State Street Global Advisor”, “T.Rowe Price”, “Vanquard Funds” and others.

The Forex market consists of a large number of trading platforms, the backbone are

Almost the entire turnover on Forex goes through the ECN network. The ECN network unites market participants connected to the network, where each participant is not only a client of the network, but essentially a dealer for other market participants. Any transaction in the network is carried out with the real supply of currency. These are the main points of the ECN network, which are fundamentally different from the Forex brokers or dealing centers, in which, in order to fix a position, there must be a reverse operation of a previously completed transaction.

The largest are EBS (ICAP) and D2 (Reuters).

Currenex - the largest currency trading network ECN was established in the USA in 1999 in California, and now its offices are located in Chicago, New York, London and Singapore. Only those who have become members of this exchange are eligible to participate in trading through Currenex. Members of Currenex can be banks, treasury departments of companies, corporate finance managers, government departments, international organizations and central banks. Currently, the members of Currenex include such powerful corporations as Autodesk, Compaq, Ericsson, Intel Corporation, and about 40 of the world's leading banks that play market makers, including ABN Amro, Barclays Capital and Merrill Lynch. Currenex provides bidders with a full electronic range of services, called Straight Through Processing (STP), which means full automation of the trading process - from the placement of the order by the client to its execution and all calculations. It should be noted that the exchange itself does not conduct such calculations, but only ensures their implementation through reliable electronic communication. Currenex conducts trading around the clock in real time, providing their participants with constant access to the foreign exchange market with a daily turnover of over $ 1.5 trillion. That is, almost half of all turnover on Forex passes through the Currenex network.

Atriax was established in the UK in June 2001 and is located in London. Because of this, it is subject to the UK Financial Services Act 1986, and the exchange itself is under the supervision of the state financial services regulatory authority. Atriax is an independent company whose largest shareholders are corporations such as Citibank, Deutsche Bank, JP Morgan and Reuters. To participate in the auction on this exchange, you must go through the registration procedure. Members of the exchange may be corporations, financial institutions and banks from around the world (individuals are not allowed to bid). About 60 leading banks authorized to carry out currency operations have already received membership in this exchange, and their number is constantly increasing. The Atriax system is designed to serve a virtually unlimited number of bidders and their transactions without technical failures. Atriax also provides its members with a range of Straight Through Processing services, that is, full automation of the sales process. Participants can use the automatic entry of applications and the execution of the transaction (using pre-defined conditions), or they can post it manually. (// !!! ATRIAX existed until 2002 - check)

FXall is an electronic organizer of trading on the foreign exchange market, which began its work in May 2001 with the launch of a fully automated trading portal. This exchange has several offices in New York, London, Tokyo and a representative office in Hong Kong. FXall is an independent legal entity formed in the form of a limited liability company (LLC). To manage this exchange, a staff of managers headed by an executive committee has been created. Exchange investors are represented on the FXall board of directors. In order to most effectively take into account the needs of the clients of the exchange, the Advisory Board of Customers (Customer Advisory Board) was created with it, which includes the most active participants in the foreign exchange market - non-banking organizations from around the world. Both corporations and institutional clients take part in the work of the council. FXall services can be used by corporate treasury departments, corporate finance managers, hedge funds, central banks, and other institutional clients. In order to participate in trading on FXall, these organizations must conclude an agreement with members of the exchange - its market makers. About 50 market makers are present on the stock exchange - the world's largest banks providing market liquidity. Among them are the Bank of Tokyo-Mitsubishi, the Dresdner Kleinwort Benson, the Royal Bank of Canada, the Royal Bank of Scotland. The list of market makers is not closed - any large financial institution that has a sufficient number of corporate and institutional clients can apply for membership in the market makers on this exchange. FXall offers its customers the full range of Straight Through Processing services, which allows them to significantly save customers' time and money, reducing manual data entry into the system, and reduce the risk of errors arising in the preparation of an application.

Almost the entire turnover on Forex goes through these three large ECN networks. The rest of the market participants are connected to the networks not directly, but through intermediaries on a hierarchical basis.

Here is the news:

>>>>>>

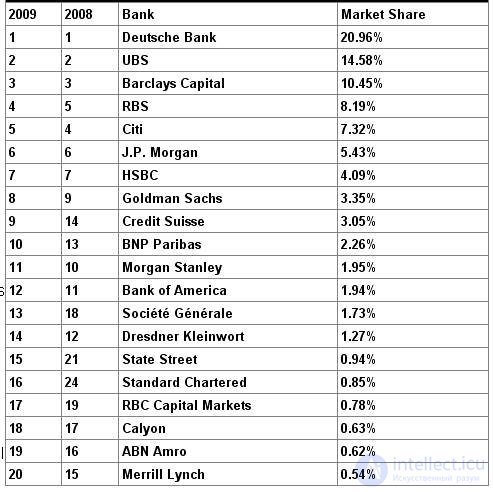

Today, Euromoney presented to the attention of the general public its study of the foreign exchange market, conducted annually since 1979, according to which in 2008 trading volume on FX reached a record $ 175.3 trillion. (note ProFinance.ru: $ 175 trillion in 2007 and $ 125 trillion in 2006), and the main market share this year remained in the hands of Deutsche Bank. This financial institution holds the palm for the fifth year in a row, although it is worth noting that in 2009 its market share declined slightly and amounted to 20.96% after 21.70% in 2008. However, the gap from the closest competitor in the face of UBS last year still slightly increased, given that the share of the Swiss bank in the market declined from 15.80% to 14.58%. Barclays Capital, meanwhile, managed to improve its position as of this year and, remaining in third place, increased its market share from 9.12% to 10.45%, while Citigroup, which dropped from 3 to 4 places in 2007, continued in 2008 take positions and was in 5th place with a market share of 7.32% against 7.49% previously. Meanwhile, RBS returned from 5th to 4th position, which it occupied in early 2007 and its market share reached 8.19% after 7.30% in 2008, while JPMorgan and HSBC in 2009 remained in sixth and seventh places with market shares of 5.43% and 4.09% respectively. Goldman Sachs, meanwhile, ranked eighth (rose from ninth) with a market share of 3.35%. As for the last two positions in the dozens of the largest, there were very drastic changes. The ninth line of the Euromoney rating was taken by the Swiss Credit Suisse, jumped right off from 14th place and took 3.05% of the market, and the tenth position was occupied by BNP Paribas, which previously occupied 13th place and now has 2.26% of the market. If we take a longer list of financial institutions, it is worth noting the breakthrough that State Street and Standard Chartered made, rising from 21 and 24 to 15 and 16 places, respectively [4].

>>>>>>>>>>>

Exchange glass is a table of quotes. A quote is a price position for a financial instrument that has an amount, quantity (lot) and direction (purchase or sale). In the stock exchange, the best buy orders and the best sell orders are displayed.

The glass is arranged in such a way that the bid price in the seller’s queue from the bid to the bid towards the buyers falls in order to comply with the law of the market - “buyers are always interested to buy a better product at a lower price”.

The price of applications in the queue of buyers, from the application to the application in the direction of the sellers is growing in order to comply with the law of the market - "sellers are always interested to sell lower-quality goods at a higher price." Such a device is also dictated by the fact that buyers and sellers should always bargain, which means that buyers should ask for cheaper, and sellers should praise their goods so as not to “sell cheap”.

Moreover, the real bargaining is not that the sellers always ask for more, and the buyers ask for less, but that the buyers agree on the price of the seller with acceptable quality of the goods, and the sellers agree on its price with an acceptable assessment of the goods.

Thus, buyers, sellers can set their price and try to implement the law of “fair transaction” - transactions at a fair price, both for the buyer and for the seller.

If two or more buyers or sellers set the same price, then they are summed up and stand in a glass at the same price - the same price of several buyers or sellers.

If two or more buyers and sellers set a different price, they do not add up and stand in a glass at different prices - prices that differ from buyer to buyer or from seller to seller.

The distance between bids in a queue of buyers or sellers is called a price step, i.e. the minimum difference between the two closest buyers or sellers, exceeding that, buyers or sellers get into a glass at the same price.

Thus, bargaining is conducted between the best bid for the sale (the cheapest for buyers) and the best bid for the purchase (the most expensive for sellers).

The gap between them is called the spread - the difference between the best bid to buy and the best bid to sell. If the buyer has agreed to the seller's price, then the transaction was at the seller's price and his application was partially or fully satisfied. If she was partially satisfied, she remained in the queue in the amount of the balance, and if she was fully satisfied, then this “vacant place” immediately got another seller. If the next buyer agrees to the price of the seller who has taken the vacant place, the transaction again occurs at the price of the seller and the market price of the paper increases each time by the value of the spread.

Сделками покупателей называются сделки, которые произошли по их активной инициативе, при проявлении которой они уступали более высоким ценам продавцов, сокращали спред между собственным станом и станом продавцов, тем самым, увеличивая рыночную цену конкретной ценной бумаги. Сделки покупателей приводят к «сокращению спреда вверх».

Сделками продавцов называются сделки, которые произошли по их активной инициативе, при проявлении которой они соглашались на более низкие цены продаж, сокращали спред между собственным станом и станом покупателей, тем самым, снижая рыночную цену конкретной ценной бумаги. Сделки продавцов приводят к «сокращению спреда вниз».

Эффективность использования спреда на покупку состоит в том, чтобы выставить в очередь покупателей заявку и не снимать ее до тех пор, пока она не будет удовлетворена. Когда удовлетворят все предыдущие “покупающие” заявки, путем продажи по их цене, нужно, чтобы продали и вам. Это значит, что вы будете непреклонны в цене заявки на покупку, а продавец вам уступит, т.е. продаст вам дешевле, чем хочет.

Эффективность использования спреда на продажу состоит в том, чтобы выставить в очередь продавцов заявку и не снимать ее до тех пор, пока она не будет удовлетворена. Когда удовлетворят все, стоящие перед вами “продающие” заявки, путем покупки по их цене, нужно, чтобы купили и у вас. Это значит, что вы будете непреклонны в цене заявки на продажу, а покупатель вам уступит, т.е. купил у вас дороже, чем хочет.

Рыночная сделка – это сделка, прошедшая по цене покупателей, либо по цене продавцов, т.е. по рыночной цене.

Продавцы в собственном стане конкурируют между собой за спрос покупателей, как по времени выставления заявки, так и по цене. Если два продавца встали в очередь по одной цене, то когда рыночная цена доходит до них (спред сокращается вверх), первым продает тот, кто встал в очередь раньше, затем, если спроса остается достаточно, продает и второй продавец, вставший в очередь позже. Если спред между продавцами и покупателями больше шага цены, то он позволяет продавцам вставать в самое начало очереди, а значит предлагать покупателям более низкую цену продажи (более привлекательную для покупателей).

Покупатели в собственном стане конкурируют между собой за предложение продавцов, также по времени выставления заявки и по цене. Если два покупателя встали в встали в очередь по одной цене, то когда рыночная цена доходит до них (спред сокращается вниз), первым покупает тот, кто встал в очередь раньше, затем, если объема предложения остается достаточно, покупает и второй покупатель, вставший в очередь позже. Если спред между покупателями и продавцами больше шага цены, то он позволяет покупателям вставать в самое начало очереди, а значит предлагать продавцам более высокую цену покупки (более привлекательную для продавцов).

На рынке Форекс понятие стакана отсутствует, так как на нем нет единого центра образования котировок, т.е. биржи. Из-за этого вычислить реальный объём и глубину рынка не представляется возможным. Однако, если торговать валютными фьючерсами, то там стакан увидеть можно, т.к. сделки проходят через биржу.

Теория арбитража – один краеугольных вопросов формирования рынка. Определение: « Арбитраж – это несколько логически связанных сделок, направленных на извлечение прибыли из разницы в ценах на одинаковые или связанные активы в одно и то же время на разных рынках ( пространственный арбитраж ), либо на одном и том же рынке в разные моменты времени ( временной арбитраж )».

Арбитражер – торговец, совершающий арбитражные сделки.

Пример арбитража:

«Пусть обменные курсы RUR, USD, EUR:

а) В Нью-Йорке 1$ = 30RUR = 0.8EUR;

б) во Франкфурте – на Майне 0.8EUR = 1$ = 31RUR;

тогда покупка 2$ в Нью-Йорке за 60 рублей и продажа их в Франкфурте даст прибыль в 2 рубля на ровном месте, за вычетом комиссионных в несколько центов». Это был двухзвенный арбитраж, а реально работающие схемы гораздо сложнее, в них задействовано от 3 и более цепочек. При этом теория арбитража, по сути система с отрицательной обратной связью, как только появляется где - то разрыв в ценах, сразу совершается несколько сделок и цены выравниваются.

Как пример можно привести – курс обменов валют в коммерческих банках, в первой половине 90-х годов прошлого века можно было оббежав центр Москвы на арбитраже заработать до 10% прибыли за час (из передачи по ТВ «Эксперт»). Другой пример арбитража – цены в магазинах, где – то дешевле, где – то дороже, но обычная торговля официально арбитражем не является.

Две главные операции (рыночные ордера) – это покупка (“Buy”) и продажа (“Sell”). Первая операция делается в расчете, что курс вырастет и соответственно продав, мы получим прибыль. Вторая делается в расчете, что курс снизится. Покупка происходит по цене Ask (цена спроса), продажа по цене Bid (цена предложения). Разница между Ask и Bid называется спредом (Spred).

Также существуют отложенные ордера:

Sell Stop - продать при равенстве будущей цены "Bid" установленному значению. При этом текущий уровень цен больше значения установленного ордера. Обычно ордера этого типа выставляются в расчете на то, что цена инструмента достигнет определенного уровня и продолжит снижаться

Sell Limit - продать при равенстве будущей цены "Bid" установленному значению. При этом текущий уровень цен меньше значения установленного ордера. Обычно ордера этого типа выставляются в расчете на то, что цена инструмента, поднявшись до определенного уровня, начнет снижаться;

Buy Stop - купить при равенстве будущей цены "Ask" установленному значению. При этом текущий уровень цен меньше значения установленного ордера. Обычно ордера этого типа выставляются в расчете на то, что цена инструмента преодолеет некий уровень и продолжит свой рост;

Buy Limit - купить при равенстве будущей цены "Ask" установленному значению. При этом текущий уровень цен больше значения установленного ордера. Обычно ордера этого типа выставляются в расчете на то, что цена инструмента, опустившись до определенного уровня, начнет расти.

К отложенному ордеру можно прикрепить ордера Стоп Лосс и Тейк Профит. После срабатывания отложенного ордера его Стоп Лосс и Тейк Профит автоматически прикрепляются к открытой позиции.

При этом обратим внимание, что цена исполнения всех торговых операций определяется брокером. Стоп Лосс и Тейк Профит исполняется только для открытых ордеров.

Стоп Лосс предназначен для минимизации потерь в том случае, если цена финансового инструмента начала двигаться в убыточном направлении. Когда же открытая позиция становится прибыльной, Стоп Лосс можно перемещать вручную на безубыточный уровень. Для автоматизации этого процесса используется Трейлинг Стоп (Trailing Stop). Данный инструмент особенно полезен при сильном однонаправленном движении цены, а также в тех случаях, когда нет возможности внимательно следить за изменением состояния рынков.

To date, thousands of indicators have been developed []. The value of the indicators can be used to judge the strength of the trend and its duration. But the indicators have one big drawback - the inability to predict the future behavior of a series, that is, they show what was and what is now. The Appendix contains a table of the most common indicators and basic values of advisers for them. Note the following indicators, which are used independently, and also are part of other indicators.

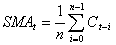

A) Simple Moving Average - SMA (Simple Moving Average). This is the average arithmetic value:

where C is one of the OLHC prices, n is the smoothing period.

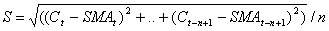

B) Bollinger bands. The essence of the indicator is that if you add or subtract the double market volatility in the standard deviation dimensions to the current market price of a financial instrument, you get a price corridor within which the price will be 95% of the time. The formula for calculating:

where ct is the closing price at time t. The top bar is equal to  , bottom equals

, bottom equals  .

.

...

Thus, we see that in most indicators the basic element is the moving average. For a moving average, it is important to determine the smoothing period, a short period is sensitive to small “outliers”, and a long one, on the contrary, smoothes them out. Often, combinations of the short (n = 7) and long (n = 21) smoothing periods are used, and the intersections of these means act as buy / sell signals.

OPTION is the right to buy or sell a property at a set price, called the exercise price, which is provided in exchange for paying a certain agreed amount of money. If the owner of the option does not exercise his right before the specified date, the option expires and the holder simply loses the money that he paid for the option. Options with very long periods of validity are issued directly by corporations in conjunction with a new issue of securities and are called warrants. There are also:

There is an American type of option and European , in American it can be executed on any date before and at, and in European only on the date of expiration of the option.

An example of a “Call Option”: let a player make an option to buy 100 shares of Sberbank at 3 rubles at 3 months. Then, if after 3 months the Sberbank share began to cost 104 rubles, then the player can exercise the option and sell the shares at 104 rubles for a profit of (104 - 100) * 100 = 400 rubles [5] (respectively, if the shares began to cost 108 rubles, then the profit (108-100) * 100 = 800 rubles). In this case, if the action suddenly became less than 100 rubles, then the player may not exercise the option! True, while paying for the registration of the option itself.

A futures contract (futures contract) is an agreement on fixing the conditions for buying or selling a standard quantity of a certain asset at a specified time in the future, at a price fixed today. Initially, futures were made in respect of goods, such as grain or oil, now futures are made for stocks and indices and other financial instruments. The futures price is fixed on the day of the transaction and no longer changes. That is, if a farmer signed a futures contract for 100 tons of grain with grain buyer, after three months at a price of $ 55 per ton, and at the time of execution the price of grain in the market is $ 45 per ton, all the same, futures are executed at $ 55 per ton ( there is a farmer in good profit). That is, in futures contracts one of the main points is the price forecast, respectively, according to these contracts are very high risks. Why is there a need for such contracts? Such contracts are necessary, for example, in cases where a drought is expected - that is, the buyer (for example, a flour mill) hedges against the risk of being left without grain. Or in the oil market amid instability in the Middle East.

[1] The following can also be singled out: customs brokerage and brokerage of ship chartering.

[2] Slang Network.

[3] Collected from various sources. May differ from the actual structure.

[4] Taken from http://www.forexpf.ru/_newses_/newsprint.php?news=332736

[5] There is still the cost (interest) of the cost of exercising and concluding an option in favor of the representative of the option and the exchange, but we will not consider it.

Comments

To leave a comment

Networked Economy (E-Commerce)

Terms: Networked Economy (E-Commerce)