Lecture

A payment system is a set of necessary software tools that ensure the use of certain money carriers (bank plastic cards and / or digital money) as a means of payment. The term "electronic money" is new in the economic literature and this is the reason for the difficulty in interpreting its economic content. In the literature, this term is usually likened to payment systems using plastic cards or electronic money transfers. In reality, e-money systems are characterized by an extremely complex information component and an economic nature, in terms of cost, banking properties, etc.

The main criteria for evaluating electronic payment systems:

Basic payment systems:

In the e-commerce system, payments are made subject to a number of conditions:

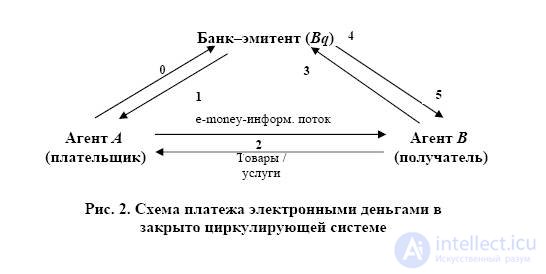

Distinguish open circulating and closed circulating electronic money systems. Circulating circuits are the most common, the basic scheme of functioning of which is shown in fig.

Figure 5. Payment scheme with electronic money in a closed circulating system

The basic principle of such systems is that after each payment transaction electronic money must be returned to the issuer for verification and destruction. Electronic money is emitted in a closed circulating system at the expense of the prepaid payer to the issuer a sum of money either by bank tickets (cash) or by bank transfer (deposit money) (Fig. 2, stream 0). This prepayment is the basis for recording on the technical device of the payer the monetary claim on the issuer (stream 1) in the form of an electronic file (squeak) 1. This obligation is used by consumers to purchase goods or services from outlets (stream 2), after which the outlets return it to the acquirer or directly to the issuer (stream 3), which destroys it (stream 4) and pays compensation to the outlet in the form of traditional money (stream five).

The scheme of the open circulating system is shown in fig.

Figure 6. Open Circulating System

In openly circulating systems, electronic money functions as a monetary asset that can circulate within the monetary system. Three streams of electronic money should be considered as three different operations causing the movement of value: stream 1 - issuance of electronic money, stream 2 - payment by electronic money, stream 3 - return of electronic money to the issuer (Fig. 1).

As can be seen in Figure 1, in openly circulating systems, electronic money based on the sale by the issuer of its own debt obligations for cash or deposit money is issued in favor of Agent A (stream 1). Next, there is a series of consecutive payments between agents A, B, C, and so on up to agent Z (stream 2). It should be noted that the direction of payments may change, especially in the case when the payers-recipients of electronic money are individual consumers and not outlets. Agent Z (the last recipient of electronic money) places electronic money in the issuer's agent bank (stream 3), which sends them to the issuer for clearing (stream 4). Technical clearing (confirmation and destruction of electronic money) carried out by the issuing bank (stream 5) makes it possible to carry out banking clearing between the issuing bank B1 and agent bank B2 (stream 6) through the participation of the Central Bank. The payment operation is completed by crediting the agent's Z account (stream 7).

Valuable note: in addition to cash, the use of electronic money can also affect the reserve balances of commercial banks stored in the central bank. Reserve balances may decrease if electronic money is issued outside the banking system, or if banks reduce their required or free reserves due to lower demand for deposit money.

Literature:

Questions for self-study:

1. What is an issuer?

2. What are the risks of internet bank?

3. What is “technical clearing”?

4. What guarantees do internet banks have for digital money?

Comments

To leave a comment

Networked Economy (E-Commerce)

Terms: Networked Economy (E-Commerce)