Lecture

Content:

1. The concept, essence and content of Startup.

2. Goals and objectives of the Startup.

3. Key principles for the functioning of Startup Activities.

4. Possible areas of startups.

5. Infrastructure Startups.

6. Stages of development of startups.

7 Startup Financing

8 Motivations, pushing forces of the stupa participants

nine . Flexibility of a startup or bend (pivot start-up)

As Bill Bishop wrote in the book How to Sell Lobster and Make a Customer Buy Highly How to Sell a Lobster. The money-making secrets of a streetwise entrepreneur:

The term “startup” first appeared in the United States in 1939. Then, near the city of San Francisco, in the Santa Clare Valley (California), almost all enterprises and firms involved in high-tech development concentrated. In those days, Stanford University students David Packard and William Hewlett, creating their own small project here, called this business a startup (from the English. Start-up - to start, start). Over time, this startup has grown into such a huge and successful company as Hewlett-Packard.

Startup (from the English startup company, startup, lit. “start”) is a company with a short history of operating activities [1]. The term was first used in Forbes magazine in August 1973 and Business Week in September 1977. The concept was fixed in the language in the 1990s and became widespread during the emergence of the dotcom economic bubble.

Today, startups mistakenly characterize all Internet projects (sites) that differ from the others in some “highlight”. This opinion arose from the observation of the most successful startups on the World Wide Web.

Such as:

Social networks Facebook, VKontakte, Odnoklassniki.ru. However, based on the classic concept

startup (where the main characteristic features are the presence of an original idea and a free niche not occupied by anyone), then only the first one (Facebook)

can be considered as such. Two other sites are successful copies that are successful only on RuNet.

-Largest Internet Wikipedia Encyclopedia. The number of articles on this resource cannot be calculated, since their number is growing daily.

-YouTube - (founders - Chad Hurley, Steve Chen, Javed Karim).

-Flickr is one of the most popular photo storage services.

-Twitter is a platform created by Jack Dorsey for short messaging.

Each of the above startups is a website on the Internet.

Other classic examples of successful startups are Microsoft (founders Bill Gates and Paul Allen), Apple Computer inc. (founders Steve Jobs and Steve Wozniak) and Google (founders Larry Page and Sergey Brin). So in our country, in Kazakhstan, the opinion appeared that a startup is a social network, an Internet service, or some unusual site, because most people, citing examples of successful startups, refer to them. An English-speaking person invests much more in the concept of “startup” and includes a definition of a company that meets a number of certain conditions. It’s correct to call a startup a company that carries out this development and releases this product (provides services).

Start-up (Start-up) is a newly created company that may not yet be officially registered, has not yet entered the market, or has just begun to enter it and has a limited set of resources.

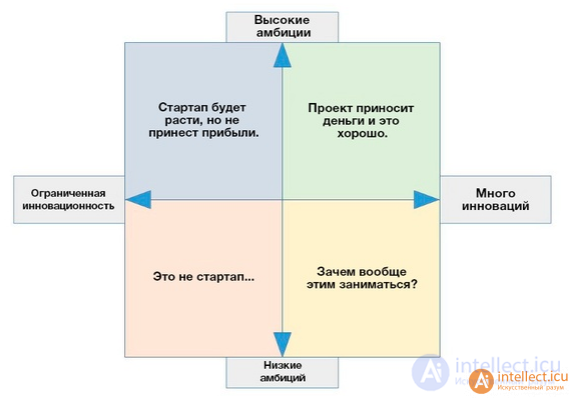

The main goal of a startup is to earn money.

At the initial stage of building your company, you need to decide which business you want to build.

The second main goal of a startup is to recruit a professional team. Which will continue to earn you money.

At first, the task of a startup is the idea of creating a product.

13 Startup principles:

1. Choose good co-founders.

2. Take action immediately.

3. Let your ideas grow.

4. Be sympathetic to your consumers.

5. Only a few consumers are better off than most do not.

6. Offer amazing customer service.

7. Correct assessment is the key to success.

8. Keep costs to a minimum.

9. Adhere to the principle "that enough for a doshirak."

10. Avoid distractions.

11. Work in an organized manner.

12. Do not give up.

13. Failures happen.

8 promising areas for Startups:

1. "Internet of things" for industrial needs.

2. Online education.

3. Mobile application development.

4. Wearable devices and accessories.

5. Business software development.

6. Cybersecurity.

7. Targeted ecommerce.

8. Green technologies.

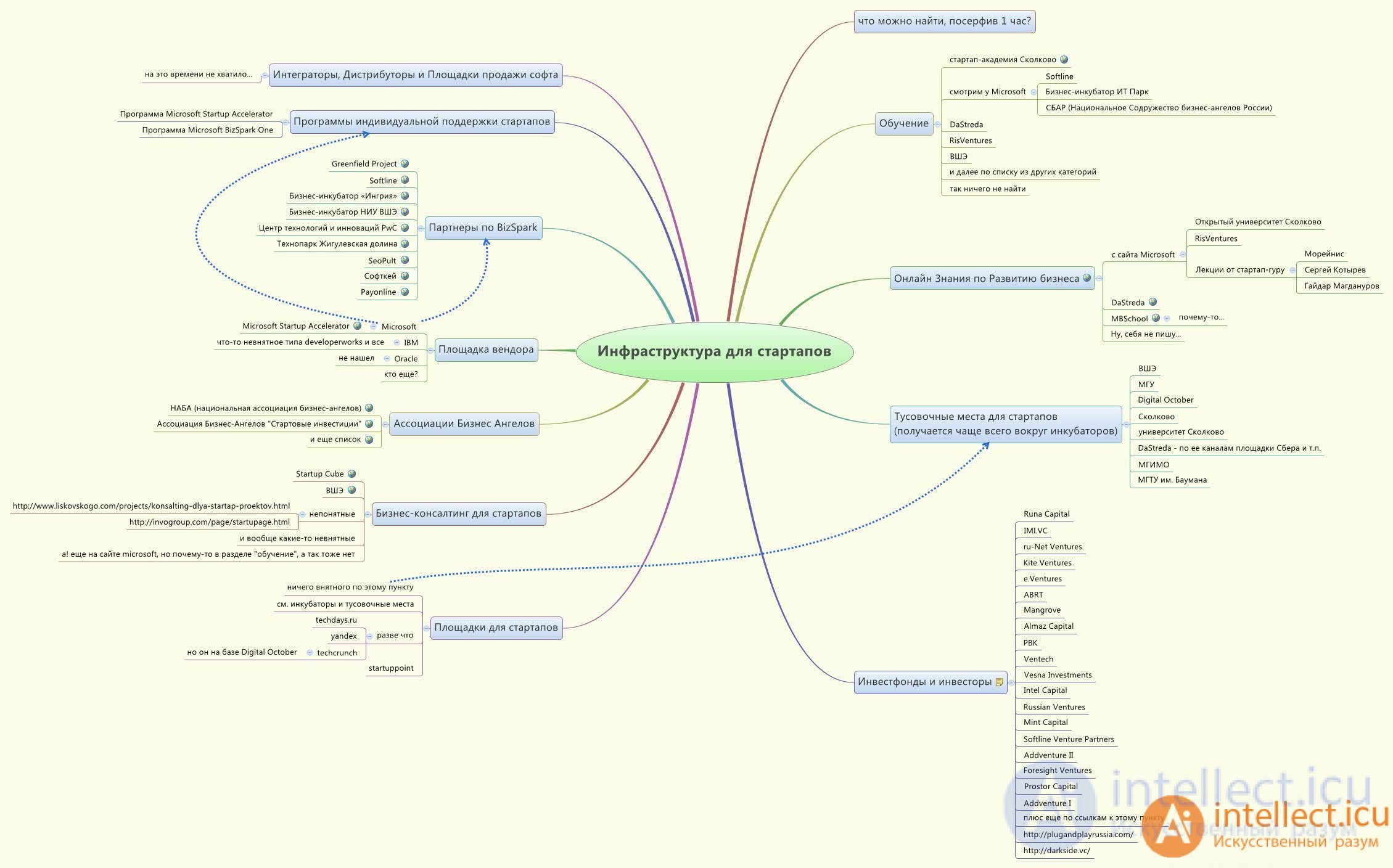

As you know, two main problems: personnel and infrastructure.

At the same time, if you can still somehow fight one misfortune with a shovel and ice rink, then what to do with the infrastructure is not at all clear.

Each country has its own system of basic institutions and programs, thanks to which investments in startups can be carried out.

For example, in Russia - startup support programs - UMNIK up to 28 years old and up to 400,000 rubles for two years. , “START” Amount of financing: up to 6,000,000 rubles for 3 years., “DEVELOPMENT”, “INTERNATIONALIZATION”

State venture companies - RVC (Russian Venture Company) - up to 25,000,000 rubles.

State Accelerators (InCube Business Incubators, Technological Parks Strogino, Business Accelerators)

Private foundations and investors

1. Successful copies. It consists of ordinary clones of famous international services, for example Viber, Watsup, in fact, Skype, or social networks like VKontakte and classmates full copies of Facebook, Yandex - a full copy of Google search engine. however, due to certain specifics, they are more popular in local markets (under certain circumstances).

2. Aggressive aliens. Such startups can be projects aimed at capturing a certain segment of the market and crowding out competitors from it, for example, at a lower price for use. or the provision of certain bonuses or additional services, etc.

3. Dark horses. these are startups that at first are not understandable to the public, the essence of their work. monetization, etc., however, over time, everything becomes clear. at the same time such horses bring big dividends to their owners

4. Startups based on high technology. Projects using the most recent (or vice versa forgotten) scientific discoveries can be very profitable. But for its launch, solid funding is required, for example, the use of smart contracts on the state scale instead of the sonnets of thousands of notaries, banks and credit unions.

5. Traditional startups. It is quite possible to implement a common idea, and it’s excellent to make money on it.

1 PowerPoint startups (i.e. those that consist of one presentation) (NOT yet MVP), often nobody owns anything in such startups

2. The seed stage, or Pre-Seed stage. (NOT yet MVP) at this moment, the search and refinement of the idea and the development of technical methods for its implementation are carried out. The initiative group analyzes the market, writes a business plan, formulates the terms of reference. This is the creation of a prototype of the product, testing of its versions, the study of demand and the search for funding sources.

3. Seed stage. the product is already available, however, entrepreneurs turn to investors, including friends, relatives and angel investors, to find financial support for their concept or product

4 pitching . Presentation of a startup at a meeting with investors

5. Startup, or Startup Stage. When an investor is found and the project is implemented, it can be released to the market. Startup creators should be persistent, demonstrate creative thinking and business acumen to break into the market, as almost all niches are already occupied by analogues. At this stage, the project is at greatest risk.

6. Growth, or Growth Stage. at this moment, there is an increase in profit and exit at the breakeven point

7. Expansion, or Expansion Stage . the startup has reached its goals. however, it doesn’t have to stop there, it should reasonably expand its functionality and consumers (users) there, thereby increasing profit even further

8. Exit, or Exit Stage . the way out of their startup of the initial investor is the sale of their share, or vice versa, obtaining constant profit

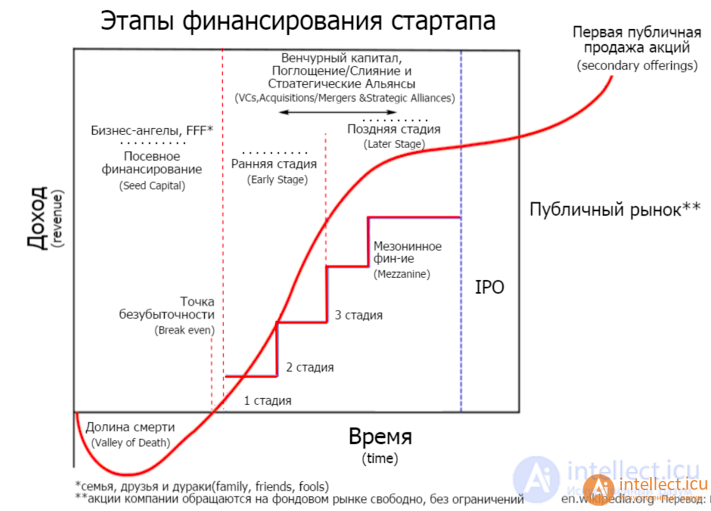

The current practice of venture investments involves several stages of financing startups, at each of which the company attracts enough funds to maintain growth and achieve the next round of investments. Since the investor receives income from the increase in the value of his share in the capital of the company, a multiple growth of the company between investment rounds is expected, making the startup attractive to a new investor

Most approaches to describing the stages of financing, with some variations, are similar to those presented in Paul Graham 's essay “How to Finance a Startup”

Startup Financing Stages

The sequence described in Paul Graham's essay is arbitrary and serves as an example. The works of other authors complement this model. For example, a professor of finance in entrepreneurship. Westmont College of California and writer David Newton separately notes the stage of borrowing, including an interim loan (also called a bridge loan) to pay off a startup’s current obligations. Another step in attracting financing is the initial public offering, IPO - the placement of company shares on the stock exchange. Entering an IPO usually becomes the main goal of a startup in the late stages of development

The interest of developers. the developer seeks to realize his ideas, achieve success and recognition, and also simply does his favorite work and hopes that his efforts will be rewarded. In some cases this happens.

Investor interest. For an investor, the main thing is to make more capital. in the future, he can choose one of two things - invest in a developing business, and then sell his share, which will already be expensive and will allow you to repay investments, or leave it to yourself and receive passive income from it constantly.

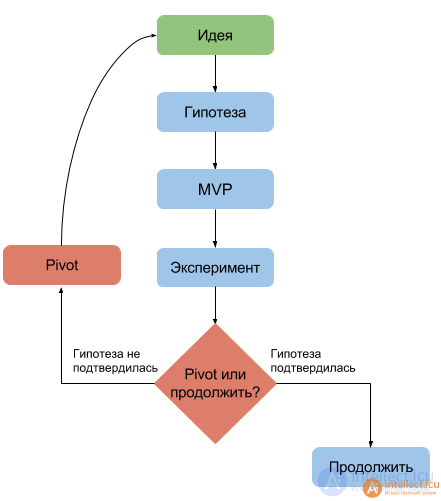

Pivot (pivot, turn) is a change in the direction of a startup to test a new direction of development. Pivot can test the basic hypothesis of a product, business model, or growth mechanism. For example, Flickr was conceived as a tool for saving images for the online game Game Neverending, but in the end the creators closed its development and focused only on the functions of the photo gallery. The startup lineup is part of the startup development phase proposed by the economical startup methodology Eric Rice.

How to determine when you need to make a turn?

1. The project does not solve the problem of users . The target audience you are targeting is not interested in your proposal, as it solves a problem that is not important to him. You need to appeal to an audience for which your decision will have value, or to identify the problem of the current audience and solve it (see Core of the consumer segment and customer needs). Read our article on overseas startups that solve problems to learn more about creating winning solutions.

Successful startups do not hide the fact that they had to go through a strong point. For example, the initial startup company Instagram was called Burbn and offered too many features (registration, scheduling and creating photos from meetings with friends). It turned out that the component with user checks is not interesting, but they are happy to use the ability to quickly share photos. Its creators used this information to launch a startup. After the turn, Burbn became Instagram.

2. Startup is not able to attract the right users . This situation may occur if you missed the opportunity to create an MVP or simply because the target audience was less than expected. In this case, you will need to expand your audience or reorient to a new one (see Consumer segment core and business architecture).

3. The strategy of attracting or retaining users does not provide sufficient startup growth . Your online launch solves the problem of users, but the channel you use to attract does not work effectively. Or the cost of attracting one user or CAC (cost of attracting customers) is too high. Then you should think about the core of the monetization method, growth mechanism or distribution channel.

4. Customers are not willing to pay startups . You offer a solution to an important problem to users, but they are in no hurry to pay you. Perhaps the price is too high or does not correspond to their ideas about the value of the goods? You can reduce the price by reducing the number of unused functions and focusing only on 1-2 important functions (see Summary increase). And in order to find solvent customers, you need to expand the capabilities of the product or reorient it to a completely new audience (see Summary reduction and architecture of a consolidated business).

5. Production is too expensive. This problem often arises in startups that produce physical products such as home electronics, but IT startups have also heard about it. In this case, you need to look for ways to reduce the cost: perhaps you should refuse to support a large website and provide your services only through the application (see. Pivot Platform)? Or turn the technology around and move on to a less expensive solution?

After you have decided that you need to use pivot, you need to choose one of its types, we will consider these types in the next article

Comments

To leave a comment

Project idea

Terms: Project idea